Michigan Form 3966 Instructions

Understanding the Michigan Form 3966

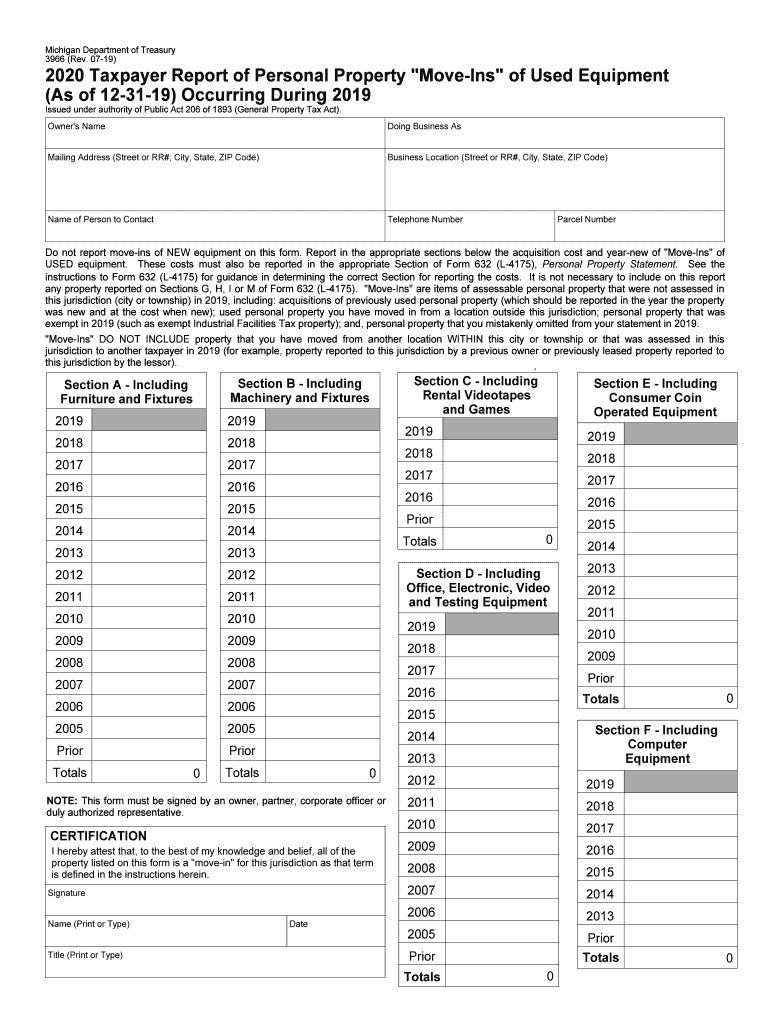

The Michigan Form 3966, also known as the taxpayer report form, is essential for reporting personal property move-ins. This form is primarily used by taxpayers to declare their personal property to the local tax authority. Understanding its purpose and requirements is crucial for compliance with state regulations. The form is designed to ensure that all personal property is accurately reported, which helps in determining property taxes.

Steps to Complete the Michigan Form 3966

Filling out the Michigan Form 3966 involves several straightforward steps:

- Gather necessary information, including details about the property being reported.

- Enter your personal information, such as name, address, and contact details.

- Provide a detailed description of the personal property, including its location and value.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your submission.

Completing these steps carefully can help prevent issues with local tax authorities and ensure compliance.

Legal Use of the Michigan Form 3966

The Michigan Form 3966 is legally binding when filled out correctly and submitted on time. It complies with state regulations regarding property tax reporting. To ensure its legal standing, it is important to follow the guidelines set forth by the Michigan Department of Treasury. This includes accurate reporting of all personal property and adherence to submission deadlines.

Filing Deadlines for the Michigan Form 3966

Timely submission of the Michigan Form 3966 is critical. Typically, the form must be filed by February first of each year. Missing this deadline can result in penalties or additional taxes. It is advisable to check for any specific local deadlines that may apply, as these can vary by municipality.

Required Documents for the Michigan Form 3966

When completing the Michigan Form 3966, certain documents may be required to support your claims. These can include:

- Proof of purchase or ownership of the reported property.

- Previous tax assessments or property valuations.

- Any relevant correspondence from local tax authorities.

Having these documents ready can facilitate a smoother filing process and help ensure that all reported information is accurate.

Form Submission Methods for the Michigan Form 3966

The Michigan Form 3966 can be submitted through various methods, including:

- Online submission via the Michigan Department of Treasury's website.

- Mailing a completed paper form to your local tax assessor's office.

- In-person submission at local government offices.

Choosing the right submission method can depend on personal preference and local requirements.

Quick guide on how to complete 3966 taxpayer report of personal property quotmove insquot of

Complete Michigan Form 3966 Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without holdups. Handle Michigan Form 3966 Instructions on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The most efficient way to modify and eSign Michigan Form 3966 Instructions with ease

- Acquire Michigan Form 3966 Instructions and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your device of choice. Edit and eSign Michigan Form 3966 Instructions to guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3966 taxpayer report of personal property quotmove insquot of

How to generate an electronic signature for the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of in the online mode

How to generate an eSignature for the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of in Chrome

How to make an eSignature for putting it on the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of in Gmail

How to create an electronic signature for the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of straight from your mobile device

How to make an electronic signature for the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of on iOS devices

How to create an electronic signature for the 3966 Taxpayer Report Of Personal Property Quotmove Insquot Of on Android OS

People also ask

-

What is the Michigan form 3966?

The Michigan form 3966 is a legal document used for registering a vehicle in Michigan. It is essential for vehicle owners to complete this form for proper registration and titling of their vehicles. Utilizing airSlate SignNow can simplify the process of signing and sending the Michigan form 3966 securely.

-

How can airSlate SignNow help with the Michigan form 3966?

airSlate SignNow streamlines the process of completing and eSigning the Michigan form 3966. With our platform, you can easily send your form for signatures and manage document workflows efficiently. This saves time and ensures a hassle-free experience for vehicle registration.

-

Is there a fee to use airSlate SignNow for the Michigan form 3966?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. While there is a cost associated with using our services to manage the Michigan form 3966, the investment pays off in improved efficiency and reduced paperwork hassles. You can choose a plan that aligns best with your usage.

-

Can I integrate airSlate SignNow with other applications for handling the Michigan form 3966?

Absolutely! airSlate SignNow supports seamless integrations with various applications, enabling you to manage your workflow related to the Michigan form 3966 easily. Whether it's linking with CRM systems or other document management tools, our platform ensures a connected experience.

-

What features does airSlate SignNow offer for processing the Michigan form 3966?

airSlate SignNow offers features such as eSigning, document templates, and automated workflows specifically tailored for forms like the Michigan form 3966. These features help reduce the time spent on paperwork and improve the overall efficiency of processing documents.

-

Is airSlate SignNow secure for handling sensitive documents like the Michigan form 3966?

Yes, security is a top priority for airSlate SignNow. We use advanced encryption methods to ensure that all documents, including the Michigan form 3966, are securely transmitted and stored. You can trust our platform to safeguard your sensitive information.

-

How does airSlate SignNow enhance the signing experience for the Michigan form 3966?

The signing experience with airSlate SignNow is incredibly user-friendly, allowing signers to complete the Michigan form 3966 quickly and easily. Our platform is intuitive and accessible on multiple devices, ensuring that users can sign documents anytime, anywhere.

Get more for Michigan Form 3966 Instructions

- Parties mrs form

- Chspe transcript order form testing ca dept of education form to request transcripts for the the california high school

- Unified family court of yolo superior court of california county of bb yolo courts ca form

- Family information form and urgent concerns yolo courts ca

- Radio sale contract template form

- Radio station contract template form

- Rap artist management contract template form

- Ratification ballot contract template form

Find out other Michigan Form 3966 Instructions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors