Michigan Uc 1019 Form

What is the Michigan UC 1019?

The Michigan UC 1019 is a tax form used by individuals to report unemployment compensation received during a tax year. This form is essential for accurately declaring unemployment benefits when filing state and federal income taxes. Understanding the purpose of the 1019 tax form is crucial for taxpayers who have received unemployment benefits, as it helps ensure compliance with tax regulations.

Steps to Complete the Michigan UC 1019

Completing the Michigan UC 1019 involves several key steps:

- Gather necessary information, including your Social Security number, the total amount of unemployment compensation received, and any federal taxes withheld.

- Fill out the form accurately, ensuring all personal details are correct and that the unemployment compensation amount matches the records provided by the Michigan Unemployment Insurance Agency.

- Review the completed form for any errors or omissions before submission.

- Submit the form as part of your tax return to the appropriate tax authorities.

Legal Use of the Michigan UC 1019

The Michigan UC 1019 is legally binding when completed correctly and submitted according to state tax laws. It is important to ensure that the information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. Utilizing a reliable digital platform for completing and submitting the form can enhance its legal validity by ensuring compliance with eSignature laws.

How to Obtain the Michigan UC 1019

Taxpayers can obtain the Michigan UC 1019 form through several channels:

- Visit the Michigan Unemployment Insurance Agency's official website, where the form is available for download.

- Request a physical copy from local tax offices or unemployment offices.

- Access the form through tax preparation software that includes state tax forms.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan UC 1019 typically align with the annual income tax filing deadlines. Taxpayers should be aware of the following important dates:

- April 15 is the usual deadline for filing individual income tax returns.

- Extensions may be available, but the form must still be submitted by the extended deadline to avoid penalties.

Key Elements of the Michigan UC 1019

Understanding the key elements of the Michigan UC 1019 is vital for accurate completion. Important components include:

- Your personal identification information, including name and Social Security number.

- The total amount of unemployment compensation received during the tax year.

- Any federal taxes withheld from your unemployment benefits.

- Signature and date to certify the accuracy of the information provided.

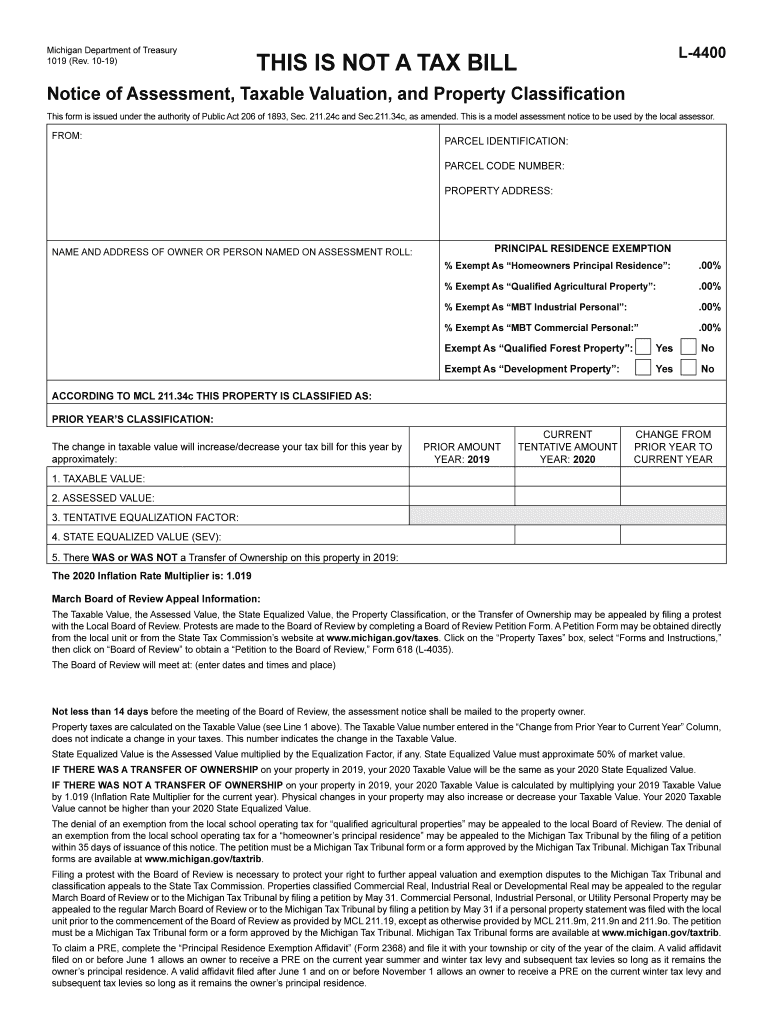

Quick guide on how to complete get the form 1019 notice of assessment taxable pdffiller

Complete Michigan Uc 1019 effortlessly on any gadget

Online document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Uc 1019 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The simplest way to edit and eSign Michigan Uc 1019 with ease

- Locate Michigan Uc 1019 and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Michigan Uc 1019 and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get the form 1019 notice of assessment taxable pdffiller

How to create an eSignature for your Get The Form 1019 Notice Of Assessment Taxable Pdffiller in the online mode

How to create an eSignature for the Get The Form 1019 Notice Of Assessment Taxable Pdffiller in Google Chrome

How to make an electronic signature for putting it on the Get The Form 1019 Notice Of Assessment Taxable Pdffiller in Gmail

How to make an electronic signature for the Get The Form 1019 Notice Of Assessment Taxable Pdffiller right from your mobile device

How to generate an electronic signature for the Get The Form 1019 Notice Of Assessment Taxable Pdffiller on iOS

How to generate an electronic signature for the Get The Form 1019 Notice Of Assessment Taxable Pdffiller on Android OS

People also ask

-

What is the 1019 tax form and why is it important?

The 1019 tax form is a crucial document used to report certain types of income and expenses to the IRS. It is important for individuals and businesses alike as it ensures compliance with tax regulations and accurate reporting of financial information. Understanding how to properly fill out the 1019 tax form can help avoid potential penalties.

-

How can airSlate SignNow help with the 1019 tax form?

With airSlate SignNow, you can easily eSign and send your 1019 tax form securely. Our platform offers templates that simplify the process, ensuring you don't miss any critical details. This streamlines your tax preparation and helps you focus on your business instead of paperwork.

-

Is there a cost associated with using airSlate SignNow for the 1019 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While there is a fee to access advanced features, many of our plans are cost-effective and designed to save you time and money. Additionally, investing in our solution can reduce the hassle of managing your 1019 tax form.

-

What features does airSlate SignNow offer for managing the 1019 tax form?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking. These tools are specifically designed to help you efficiently manage your 1019 tax form, ensuring it's filled out correctly and sent to the right recipients. Enhanced collaboration features also help engage your team seamlessly.

-

Can I integrate airSlate SignNow with other accounting software for the 1019 tax form?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easy to manage your 1019 tax form alongside your other financial documents. This integration enhances workflow efficiency and reduces the risk of errors during the submission process. Simply connect your existing tools to streamline your tax preparation.

-

What benefits do I gain by using airSlate SignNow for my 1019 tax form?

Using airSlate SignNow for your 1019 tax form offers benefits such as reduced turnaround times and increased compliance. Our user-friendly interface ensures that you can complete your forms accurately, while eSigning eliminates the need for printing and scanning. Additionally, the security features protect your sensitive information during the process.

-

Is airSlate SignNow compliant with regulations for the 1019 tax form?

Absolutely. airSlate SignNow adheres to industry-leading security and compliance standards, ensuring that your 1019 tax form submissions are safe and secure. Our platform meets regulatory requirements, giving you peace of mind when managing sensitive documents online.

Get more for Michigan Uc 1019

- Newark rent control office form

- Rental application form every occupant fillable

- Applications ampamp formslivonia mi

- Referral fee agreement new form

- Pointe community center form

- We encourage and support the nations affirmative form

- Purchase of real estate contract template form

- Quality laboratory contract template form

Find out other Michigan Uc 1019

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF