Texas Fom 05 158 a Form

What is the Texas Form 05 169?

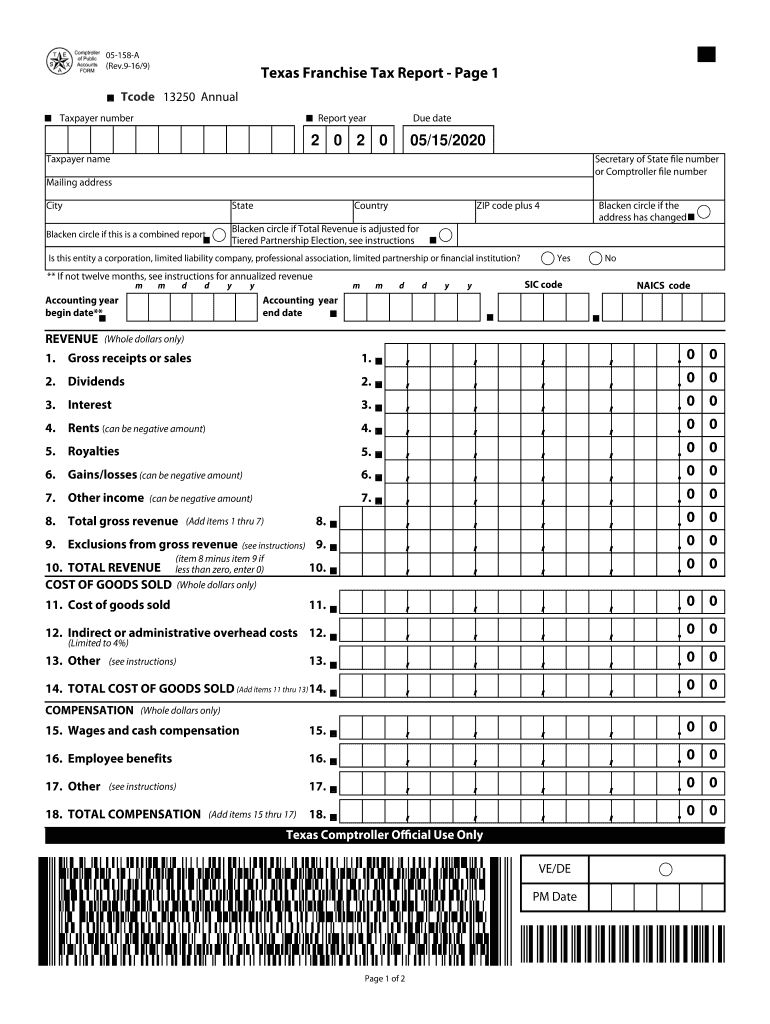

The Texas Form 05 169 is a specific document used for the Texas franchise tax reporting process. This form is essential for businesses operating within Texas, as it provides necessary information regarding the company's financial status and tax obligations. It is designed to assist the Texas Comptroller in assessing the tax liability of various business entities, including corporations and limited liability companies. The completion of this form is crucial for compliance with state tax regulations.

Key Elements of the Texas Form 05 169

The Texas Form 05 169 includes several key components that businesses must accurately complete. These elements typically consist of:

- Business Information: This section requires the legal name, address, and identification number of the business.

- Taxable Revenue: Businesses must report their total revenue for the reporting period, which is essential for calculating the franchise tax owed.

- Deductions: The form allows for certain deductions that may reduce the overall tax liability.

- Signature: An authorized representative must sign the form, confirming the accuracy of the information provided.

Steps to Complete the Texas Form 05 169

Completing the Texas Form 05 169 involves several important steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill in the business information section with accurate details.

- Calculate the total revenue and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Obtain the signature of an authorized representative.

- Submit the form by the designated deadline to the Texas Comptroller.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Texas Form 05 169. Typically, the form must be filed annually, with specific due dates depending on the entity type. Businesses should mark their calendars for:

- The annual filing deadline, which is usually on May 15 for most entities.

- Any extensions that may be applicable, which must be requested in advance.

Legal Use of the Texas Form 05 169

The Texas Form 05 169 holds legal significance as it serves as the official record of a business's franchise tax obligations. Proper completion and timely submission of this form help ensure compliance with Texas tax laws. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes.

Who Issues the Form

The Texas Form 05 169 is issued by the Texas Comptroller of Public Accounts. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Businesses can obtain the form directly from the Comptroller’s website or through official state publications.

Quick guide on how to complete download ebook career of evil titian kejahatan robert

Complete Texas Fom 05 158 A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Texas Fom 05 158 A on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Texas Fom 05 158 A with ease

- Find Texas Fom 05 158 A and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Texas Fom 05 158 A and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the download ebook career of evil titian kejahatan robert

How to create an electronic signature for the Download Ebook Career Of Evil Titian Kejahatan Robert online

How to make an electronic signature for the Download Ebook Career Of Evil Titian Kejahatan Robert in Google Chrome

How to generate an electronic signature for signing the Download Ebook Career Of Evil Titian Kejahatan Robert in Gmail

How to make an electronic signature for the Download Ebook Career Of Evil Titian Kejahatan Robert straight from your mobile device

How to make an electronic signature for the Download Ebook Career Of Evil Titian Kejahatan Robert on iOS devices

How to create an electronic signature for the Download Ebook Career Of Evil Titian Kejahatan Robert on Android devices

People also ask

-

What are Texas Comptroller Forms?

Texas Comptroller Forms are official documents required by the Texas Comptroller of Public Accounts for various state business transactions. These forms are essential for compliance and ensuring accurate reporting. airSlate SignNow simplifies the process of preparing, sending, and signing these Texas Comptroller Forms.

-

How can airSlate SignNow help with Texas Comptroller Forms?

airSlate SignNow provides a user-friendly platform to manage Texas Comptroller Forms efficiently. You can easily upload, send for signature, and track the completion of these forms in real-time. This streamlines the document workflow, saving you time and reducing errors.

-

What features support Texas Comptroller Forms in airSlate SignNow?

airSlate SignNow offers features such as customizable templates, automated notifications, and secure cloud storage that are specifically beneficial for managing Texas Comptroller Forms. You can create reusable templates tailored to your requirements, ensuring consistency and compliance. These tools enhance your productivity and document accuracy.

-

Is there a cost associated with using airSlate SignNow for Texas Comptroller Forms?

Yes, airSlate SignNow offers various pricing plans to fit your business needs when handling Texas Comptroller Forms. Each plan includes access to essential features and functionalities with no hidden costs. You can evaluate the options and choose a plan that provides the best value for your organization.

-

Are there integrations available for Texas Comptroller Forms?

Absolutely! airSlate SignNow seamlessly integrates with multiple applications to streamline the process of managing Texas Comptroller Forms. Whether you are using CRM systems or accounting software, these integrations ensure you can efficiently manage your documents across platforms without disruption.

-

Can I use airSlate SignNow on mobile devices for Texas Comptroller Forms?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to handle Texas Comptroller Forms on the go. With our mobile app, you can send, receive, and sign documents anytime, anywhere, ensuring you never miss an important deadline. This flexibility is crucial for busy professionals.

-

How secure is the signing process for Texas Comptroller Forms with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure access protocols to protect Texas Comptroller Forms throughout the signing process. With features like audit trails and user authentication, you can trust that your sensitive information is safe.

Get more for Texas Fom 05 158 A

- Implementation bprogramb which i have determined are appropriate for review and b justice form

- In the matter of the petition of the port of seattle clerk seattle form

- Summers property management form

- Illinois crop share cash farm lease farmdoc form

- Rev 0818 application for domestic partners under the court form

- Purchase contract template form

- Purchase of goods contract template form

- Purchase for sale by owner contract template form

Find out other Texas Fom 05 158 A

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast