Form E 1r

What is the Form E 1r

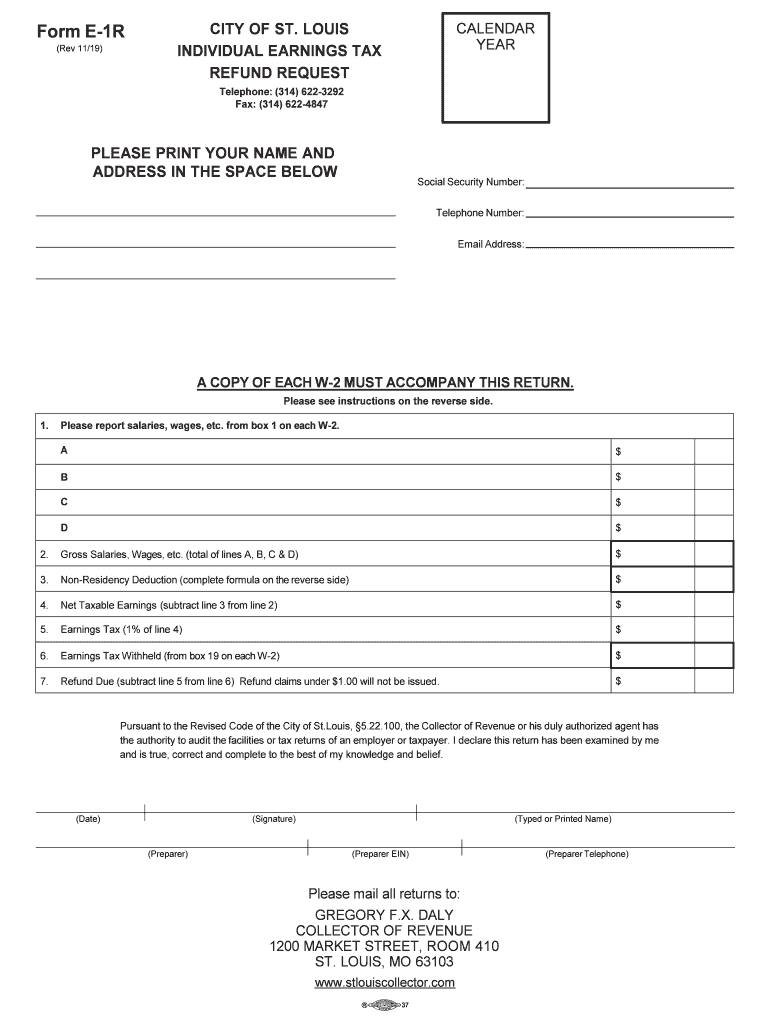

The Form E 1r is a specific document used in St. Louis, Missouri, primarily for the purpose of claiming a refund of the earnings tax. This form is essential for residents and non-residents who have overpaid their city earnings tax. Understanding its purpose and function is crucial for ensuring compliance with local tax regulations.

How to use the Form E 1r

Using the Form E 1r involves several key steps. First, individuals need to gather all necessary financial documents, including W-2s and any other income statements. Next, fill out the form accurately, ensuring that all personal information and financial details are correct. Finally, submit the completed form to the appropriate city department, either electronically or via mail, to initiate the refund process.

Steps to complete the Form E 1r

Completing the Form E 1r requires careful attention to detail. Here are the steps to follow:

- Collect all relevant tax documents, such as W-2 forms and previous tax returns.

- Provide your personal information, including your name, address, and Social Security number.

- Detail your earnings and any taxes withheld during the year.

- Calculate the amount of refund you are eligible for based on your earnings and tax payments.

- Review the form for accuracy before submission.

Legal use of the Form E 1r

The legal use of the Form E 1r is governed by local tax laws. To ensure that the form is considered valid, it must be filled out completely and accurately. Additionally, the submission must adhere to the deadlines set by the city of St. Louis. Utilizing electronic signatures through a reliable platform can enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the Form E 1r are critical for taxpayers to keep in mind. Typically, the form must be submitted within a specified timeframe after the end of the tax year. It is advisable to check the latest updates from the city’s tax office to confirm current deadlines, as they can change annually.

Form Submission Methods (Online / Mail / In-Person)

The Form E 1r can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the city’s official tax portal, which is often the fastest method.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices, allowing for direct interaction with tax officials.

Examples of using the Form E 1r

There are various scenarios in which individuals might use the Form E 1r. For instance, a resident who worked part of the year in St. Louis but moved out may file the form to reclaim overpaid earnings tax. Similarly, a non-resident who earned income in the city but had taxes withheld may also utilize this form to receive a refund.

Quick guide on how to complete forms and informationcollector of revenue city of st louis

Effortlessly Prepare Form E 1r on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your paperwork without delays. Manage Form E 1r on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Edit and eSign Form E 1r with Ease

- Obtain Form E 1r and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, a process that takes mere seconds and carries the same legal weight as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending the form, whether by email, SMS, invite link, or download to your computer.

No more concerns about lost or misplaced documents, exhausting form searches, or errors necessitating new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form E 1r and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forms and informationcollector of revenue city of st louis

How to make an eSignature for the Forms And Informationcollector Of Revenue City Of St Louis online

How to make an electronic signature for your Forms And Informationcollector Of Revenue City Of St Louis in Google Chrome

How to generate an eSignature for signing the Forms And Informationcollector Of Revenue City Of St Louis in Gmail

How to generate an eSignature for the Forms And Informationcollector Of Revenue City Of St Louis straight from your mobile device

How to make an eSignature for the Forms And Informationcollector Of Revenue City Of St Louis on iOS

How to make an eSignature for the Forms And Informationcollector Of Revenue City Of St Louis on Android

People also ask

-

What is airSlate SignNow and how does it relate to St Louis E 1R?

airSlate SignNow is a digital platform that allows users to send and eSign documents efficiently. Regarding St Louis E 1R, this platform is particularly beneficial for firms in the area looking to streamline their document workflows and enhance productivity with minimal effort.

-

How much does airSlate SignNow cost for St Louis E 1R users?

The pricing for airSlate SignNow is designed to be cost-effective and varies based on the features you choose. Users in St Louis E 1R can benefit from scalable plans that accommodate both small businesses and larger enterprises, ensuring a budget-friendly option for everyone.

-

What features does airSlate SignNow offer that cater to St Louis E 1R clients?

airSlate SignNow provides several features tailored to meet the needs of St Louis E 1R clients, including templates, collaboration tools, and real-time tracking of document status. These functionalities empower businesses to streamline their signing processes and improve response times.

-

Can airSlate SignNow integrate with other software solutions for St Louis E 1R?

Yes, airSlate SignNow offers seamless integrations with various software solutions, making it ideal for users in St Louis E 1R. This compatibility allows businesses to connect their existing systems, such as CRM and project management tools, enhancing overall operational efficiency.

-

What are the benefits of using airSlate SignNow for St Louis E 1R businesses?

Businesses in St Louis E 1R can benefit greatly from using airSlate SignNow, including increased efficiency and reduced turnaround times for document signing. The platform also enhances security and compliance, giving users peace of mind when managing sensitive information.

-

Is airSlate SignNow easy to use for customers in St Louis E 1R?

Absolutely! airSlate SignNow has an intuitive user interface that simplifies the process of sending and signing documents. St Louis E 1R customers will find that they can quickly adapt to the platform without extensive training or technical knowledge.

-

How secure is airSlate SignNow for St Louis E 1R users?

Security is a top priority for airSlate SignNow, especially for users in St Louis E 1R. The platform employs advanced encryption and authentication measures to ensure that all documents are handled with the utmost security, protecting sensitive data from unauthorized access.

Get more for Form E 1r

- Application for admissions stevens institute of technology stevens form

- Acfrogcgjze9z1ojsr1 iwt3loosyzv6wk ql jfnwtnzctvfio pa thv9tyq8mbkgehec9dpy form

- Dd form 1081

- Sd form 822

- Prepare statement of agent officers account dd form 1081

- Premium class travel authorizationapproval request form

- Public relations agency contract template form

- Public relations contract template form

Find out other Form E 1r

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer