Lgst Form

What is the LGST Form?

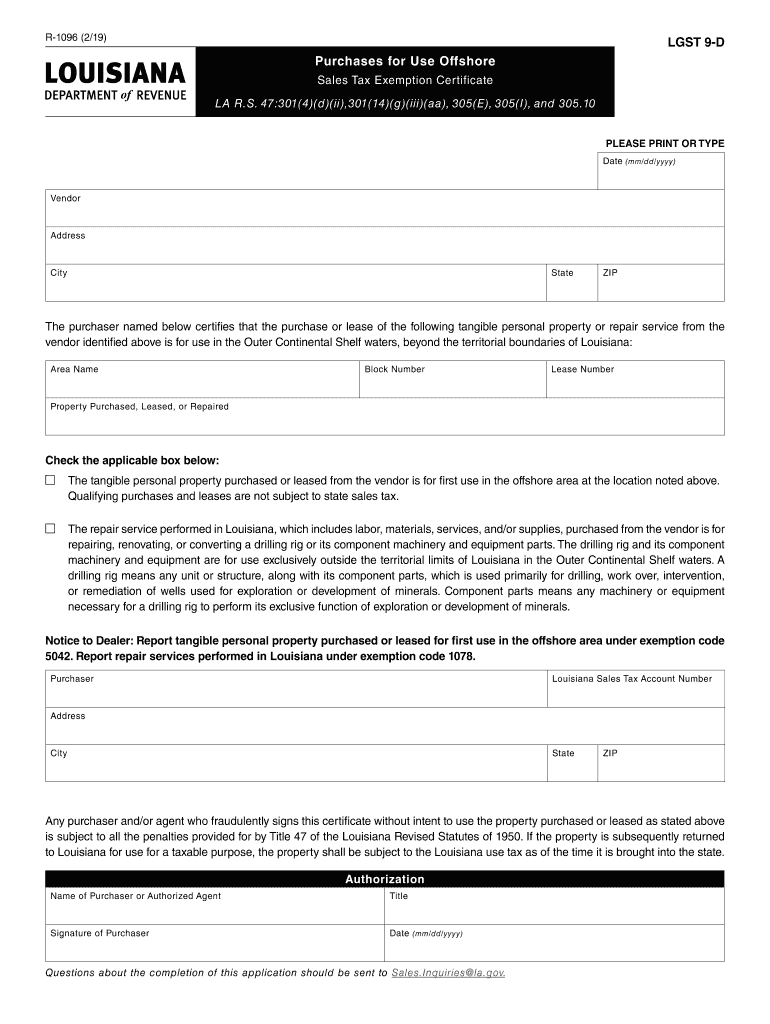

The LGST form, specifically the R 1096 exemption, is a crucial document used in Louisiana for tax purposes. It is designed to provide exemptions from the Louisiana sales tax for certain transactions. This form is essential for businesses and individuals looking to comply with state tax regulations while taking advantage of available exemptions. Understanding the purpose of the LGST form is vital for proper tax management and compliance.

Steps to Complete the LGST Form

Completing the LGST form involves several key steps to ensure accuracy and compliance. Follow these steps for a smooth process:

- Gather Required Information: Collect all necessary details, including your business information and the specific exemption you are claiming.

- Fill Out the Form: Carefully enter the required information in the designated fields. Ensure all entries are accurate to avoid delays.

- Review for Accuracy: Double-check all information for errors or omissions. This step is crucial to prevent complications during processing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, to ensure timely processing.

Legal Use of the LGST Form

The LGST form must be used in accordance with Louisiana tax laws to ensure its legal validity. The form serves as a declaration of exemption and should only be used for eligible transactions as defined by state regulations. Misuse of the form can lead to penalties or legal repercussions. Therefore, it is essential to understand the legal framework surrounding the exemption claims made through this form.

Filing Deadlines / Important Dates

Filing deadlines for the LGST form are critical for compliance. It is important to be aware of the specific dates related to tax submissions to avoid penalties. Generally, the LGST form should be filed by the end of the tax period for which the exemption is claimed. Keeping track of these deadlines ensures that businesses can take full advantage of available exemptions without facing unnecessary fines.

Eligibility Criteria

To qualify for the R 1096 exemption, certain eligibility criteria must be met. These criteria typically include the nature of the transaction, the type of goods or services involved, and the status of the purchaser. Understanding these requirements is essential for businesses and individuals to determine if they can legitimately claim the exemption, thereby avoiding potential compliance issues.

Form Submission Methods

The LGST form can be submitted through various methods, catering to different preferences and needs. Options include:

- Online Submission: Many users prefer to submit the form electronically for convenience and speed.

- Mail: Traditional mail is also an option, though it may take longer for processing.

- In-Person Submission: For those who prefer direct interaction, submitting the form in person at designated locations is available.

Complete Lgst Form easily on any device

How to change and eSign Lgst Form without breaking a sweat

- Get Lgst Form and click on Get Form to get started.

- Utilize the tools we provide to fill out your document.

- Highlight relevant segments of your documents or blackout delicate data with tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign instrument, which takes seconds and holds exactly the same legal weight as a traditional wet ink signature.

- Double-check all the information and click on on the Done button to preserve your adjustments.

- Select how you want to provide your form, by email, text message (SMS), or invitation link, or download it to the PC.

Forget about missing or misplaced documents, tedious form browsing, or errors that need printing out new document copies. airSlate SignNow addresses all your requirements in document administration in a few clicks from a device of your choice. Modify and eSign Lgst Form and ensure exceptional communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1096 219

How to create an electronic signature for your R 1096 219 online

How to generate an electronic signature for your R 1096 219 in Google Chrome

How to create an electronic signature for signing the R 1096 219 in Gmail

How to make an eSignature for the R 1096 219 straight from your mobile device

How to make an eSignature for the R 1096 219 on iOS devices

How to make an electronic signature for the R 1096 219 on Android

People also ask

-

What is the Lgst Form and how does it work with airSlate SignNow?

The Lgst Form is a customizable document template that simplifies the process of collecting signatures and information. With airSlate SignNow, you can easily create and send the Lgst Form to recipients for electronic signing, streamlining your workflow and ensuring compliance.

-

How much does it cost to use the Lgst Form feature on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the Lgst Form feature. Depending on your business needs, you can choose a plan that allows you to create, send, and manage Lgst Forms effectively without breaking the bank.

-

What are the main benefits of using the Lgst Form with airSlate SignNow?

Using the Lgst Form with airSlate SignNow provides several benefits, such as increased efficiency in document management and the ability to track the signing status in real-time. Additionally, it enhances the user experience by allowing for easy customization and integration into existing workflows.

-

Can I integrate the Lgst Form with other software tools?

Yes, airSlate SignNow allows for seamless integration of the Lgst Form with various software tools, including CRM systems, project management platforms, and cloud storage services. This integration capability ensures that your document workflows remain efficient and connected across different platforms.

-

Is the Lgst Form secure for collecting sensitive information?

Absolutely! The Lgst Form created with airSlate SignNow is designed with security in mind. It utilizes advanced encryption protocols and complies with industry standards to protect sensitive information, ensuring that your data is safe during the signing process.

-

How can I customize my Lgst Form in airSlate SignNow?

Customizing your Lgst Form in airSlate SignNow is user-friendly and straightforward. You can add fields, change layouts, and include branding elements to ensure that the form aligns with your business identity and meets your specific needs.

-

What types of documents can I send using the Lgst Form?

The Lgst Form can be used for a variety of documents, including contracts, agreements, and consent forms. With airSlate SignNow, you can tailor the Lgst Form to suit your specific document needs, making it a versatile tool for any business.

Get more for Lgst Form

- Yatzy score sheet form

- As32 antrag auf rckzahlung formular forms2web electronic forms

- Introduction to linguistics schoolrack form

- Model release form photographers name mo

- Password list template printable form

- Proof of concept contract template 787753981 form

- Property contract template form

- Property investment contract template form

Find out other Lgst Form

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement