Tc69c Form

What is the TC69C?

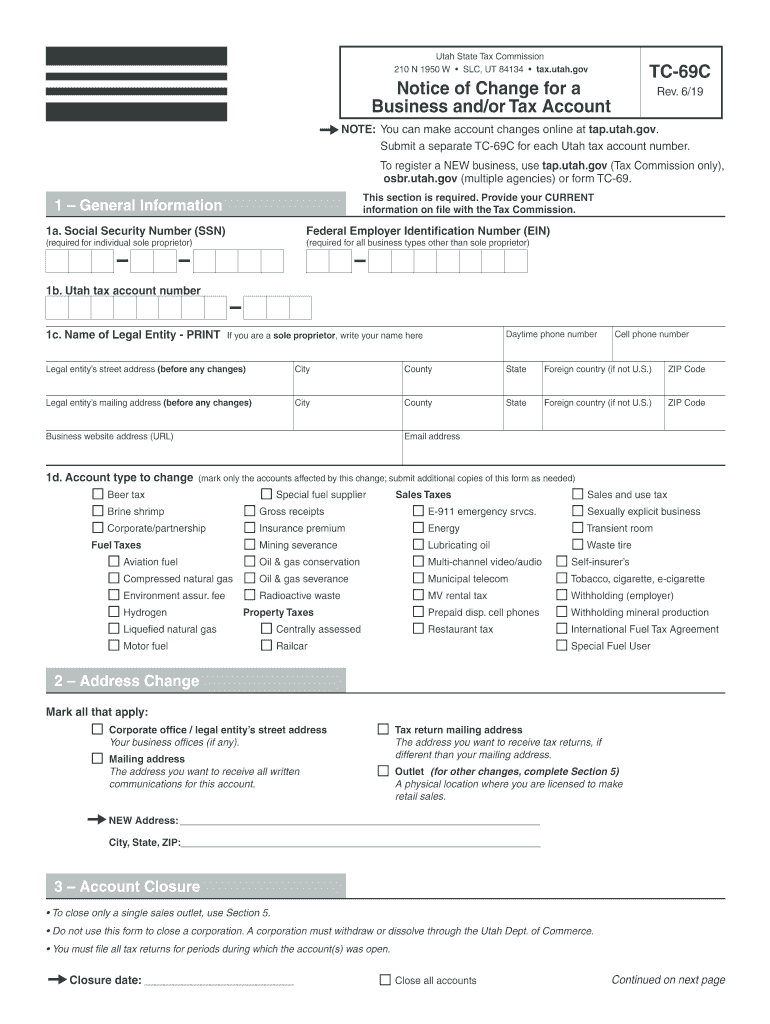

The TC69C is a form used primarily in the context of tax reporting and compliance. It serves as a notice of change account, allowing taxpayers to update their information with the relevant tax authority. This form is essential for ensuring that records are accurate and up to date, which can help prevent issues related to tax filings and notifications. The TC69C is particularly relevant for businesses and individuals who need to communicate changes in their tax status or account details.

How to Use the TC69C

Using the TC69C involves filling out the form with accurate and updated information. Taxpayers should ensure that all fields are completed, including personal identification details and the specific changes being reported. Once the form is filled out, it can be submitted electronically or through traditional mail, depending on the guidelines provided by the issuing authority. Utilizing a digital platform like signNow can streamline this process, allowing for easy completion and secure submission.

Steps to Complete the TC69C

Completing the TC69C requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your taxpayer identification number and details of the changes.

- Access the TC69C form, either in digital format or as a printable PDF.

- Fill in all required fields accurately, ensuring that the information reflects your current status.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the preferred method, ensuring you keep a copy for your records.

Legal Use of the TC69C

The TC69C is legally binding when completed and submitted according to the regulations set forth by the tax authority. Compliance with eSignature laws, such as the ESIGN Act and UETA, ensures that electronically signed documents hold the same legal weight as traditional signatures. This legal framework supports the use of digital platforms like signNow, which provide secure and compliant options for signing and submitting the TC69C.

Required Documents

When completing the TC69C, certain documents may be required to support the changes being reported. These can include:

- Previous tax returns or notices from the tax authority.

- Identification documents, such as a driver's license or Social Security card.

- Any relevant correspondence that outlines the changes to your account.

Having these documents ready can facilitate a smoother completion process and ensure all necessary information is accurately reported.

Form Submission Methods

The TC69C can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission via a secure digital platform, which can enhance efficiency and tracking.

- Mailing a printed version of the form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help ensure timely processing and compliance with deadlines.

Quick guide on how to complete can make account changes online at tap

Manage Tc69c effortlessly on any device

Digital document management has seen a rise in popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct template and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Handle Tc69c on any device using airSlate SignNow's Android or iOS applications and streamline any document-dependent task today.

How to modify and eSign Tc69c with ease

- Locate Tc69c and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Tc69c to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the can make account changes online at tap

How to make an electronic signature for your Can Make Account Changes Online At Tap online

How to make an electronic signature for your Can Make Account Changes Online At Tap in Chrome

How to make an electronic signature for signing the Can Make Account Changes Online At Tap in Gmail

How to make an electronic signature for the Can Make Account Changes Online At Tap from your smartphone

How to generate an eSignature for the Can Make Account Changes Online At Tap on iOS

How to generate an electronic signature for the Can Make Account Changes Online At Tap on Android OS

People also ask

-

What is form tc 69c and how is it used?

Form tc 69c is a document required for tax-related activities in certain jurisdictions. It is often used by businesses to report certain transactions or status. Utilizing airSlate SignNow, you can easily upload, send, and eSign this form securely for efficient processing.

-

How can airSlate SignNow help with managing form tc 69c?

AirSlate SignNow streamlines the management of form tc 69c by allowing users to fill out, sign, and send the document all in one platform. This reduces the time spent on paperwork and ensures that your form is filed correctly. Our user-friendly interface makes it easy to manage all your documents electronically.

-

Are there any costs associated with using airSlate SignNow for form tc 69c?

AirSlate SignNow offers various pricing plans that cater to different business needs, including the management of form tc 69c. Our pricing is straightforward with no hidden fees, allowing you to choose a plan that suits your budget and requirements. Enjoy the benefits of eSigning at a cost-effective rate.

-

What features does airSlate SignNow offer for eSigning form tc 69c?

AirSlate SignNow provides robust eSigning features for form tc 69c, including customizable signing workflows, real-time tracking, and secure cloud storage. These features ensure that your documents are signed efficiently and stored safely. The ability to gather signatures quickly enhances your overall productivity.

-

Can form tc 69c be integrated with other applications using airSlate SignNow?

Yes, airSlate SignNow allows for seamless integrations with various applications, which can facilitate the handling of form tc 69c. You can easily connect with platforms like Google Drive, Salesforce, and more. This integration capability enhances your workflow by enabling straightforward document sharing and collaboration.

-

Is it secure to eSign form tc 69c with airSlate SignNow?

Absolutely! AirSlate SignNow employs advanced security measures to ensure that your form tc 69c and other documents are protected. We utilize encryption and security protocols to safeguard your information. You can sign documents with peace of mind, knowing that your data is secure.

-

Can I track the status of form tc 69c after sending it with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking features for all documents, including form tc 69c. You can easily monitor who has viewed, signed, or completed the document, giving you full visibility into the signing process. This feature helps you stay informed and manage your paperwork efficiently.

Get more for Tc69c

- Assessing and improving the safety of internet ben edelman benedelman form

- Spy name threat level occurences spy type definition 2nd dowling form

- Rating the net jonathan weinbergal yalelawtech form

- Marche suivrenotes explicatives demande de copies form

- Product photography contract template form

- Product development contract template form

- Product sale contract template form

- Product purchase contract template form

Find out other Tc69c

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word