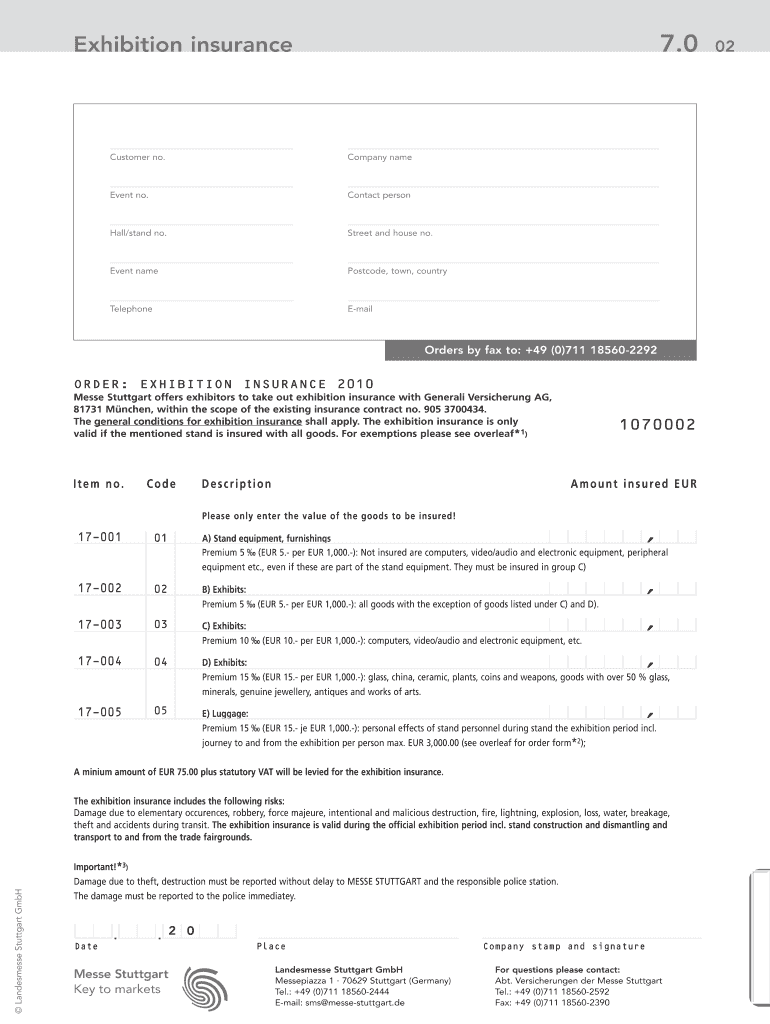

Exhibition Insurance Form

What is Exhibition Insurance

Exhibition insurance is a specialized form of coverage designed to protect exhibitors from potential risks associated with displaying their products or services at trade shows, fairs, and other events. This type of insurance typically covers property damage, theft, and liability claims that may arise during the exhibition period. It is essential for businesses to consider this insurance to safeguard their investments and ensure a smooth experience at events.

How to Obtain Exhibition Insurance

Obtaining exhibition insurance involves several straightforward steps. First, businesses should assess their specific needs based on the type of exhibition and the value of the items being displayed. Next, they can research and compare different insurance providers that offer coverage tailored for exhibitions. It's advisable to request quotes from multiple insurers to find the best policy that meets both coverage and budget requirements. Once a suitable policy is selected, businesses can complete the application process, which typically involves providing details about the exhibition and the items to be insured.

Key Elements of Exhibition Insurance

When considering exhibition insurance, several key elements should be evaluated:

- Coverage Types: This includes property damage, theft, and liability coverage.

- Policy Limits: The maximum amount the insurer will pay in the event of a claim.

- Deductibles: The amount the insured must pay out of pocket before the insurance kicks in.

- Exclusions: Specific situations or items that are not covered by the policy.

- Duration of Coverage: The period during which the insurance is valid, often extending from setup to dismantling of the exhibition.

Steps to Complete the Exhibition Insurance Application

Completing the application for exhibition insurance involves several key steps:

- Gather Information: Collect details about the exhibition, including dates, location, and the items to be insured.

- Choose Coverage: Decide on the types of coverage needed based on the assessed risks.

- Fill Out the Application: Provide all required information accurately to avoid delays.

- Review the Policy: Carefully read through the terms and conditions before finalizing the purchase.

- Submit Payment: Complete the transaction to activate the coverage.

Legal Use of Exhibition Insurance

Exhibition insurance is legally recognized and can provide significant protection for businesses participating in events across the United States. It is important for exhibitors to understand the legal implications of their coverage, including compliance with any venue-specific requirements. Some venues may mandate proof of insurance before allowing exhibitors to set up, making it crucial to have the necessary documentation readily available.

Examples of Using Exhibition Insurance

Exhibition insurance can be beneficial in various scenarios, such as:

- A vendor whose display equipment is damaged during transport to the event.

- An exhibitor facing a liability claim due to an accident involving a visitor at their booth.

- Theft of valuable merchandise from an exhibition space.

These examples illustrate the importance of having adequate coverage to mitigate financial losses and ensure a successful exhibition experience.

Quick guide on how to complete exhibition insurance

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate lost or misplaced files, tedious document searching, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Exhibition Insurance

Create this form in 5 minutes!

How to create an eSignature for the exhibition insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Exhibition Insurance and why do I need it?

Exhibition Insurance is a specialized coverage designed to protect your assets during events and exhibitions. It safeguards against potential risks such as theft, damage, or liability claims. Having Exhibition Insurance ensures that your investment is secure, allowing you to focus on showcasing your products without worry.

-

How much does Exhibition Insurance cost?

The cost of Exhibition Insurance varies based on factors such as the type of coverage, the value of the items insured, and the duration of the event. Typically, premiums are affordable, making it a cost-effective solution for businesses participating in exhibitions. It's advisable to get quotes from multiple providers to find the best rate.

-

What types of coverage are included in Exhibition Insurance?

Exhibition Insurance generally includes coverage for property damage, theft, and liability claims. Some policies may also offer additional options like cancellation coverage or coverage for equipment breakdown. It's important to review the policy details to ensure it meets your specific needs for the exhibition.

-

How can Exhibition Insurance benefit my business?

Exhibition Insurance provides peace of mind by protecting your investment during events. It minimizes financial risks associated with unforeseen incidents, allowing you to focus on networking and promoting your brand. Additionally, having insurance can enhance your credibility with clients and partners.

-

Can I customize my Exhibition Insurance policy?

Yes, many providers offer customizable Exhibition Insurance policies to fit your unique requirements. You can choose the coverage limits, types of risks covered, and additional endorsements based on your specific exhibition needs. Customization ensures that you only pay for the coverage you truly need.

-

How do I file a claim for Exhibition Insurance?

Filing a claim for Exhibition Insurance typically involves contacting your insurance provider and providing necessary documentation, such as proof of loss and any relevant incident reports. Most providers have a straightforward claims process to ensure you receive compensation quickly. Always review your policy for specific claim procedures.

-

Does Exhibition Insurance cover international exhibitions?

Many Exhibition Insurance policies can be extended to cover international exhibitions, but it's essential to confirm with your provider. Coverage terms may vary based on the location and specific risks associated with international events. Always discuss your plans with your insurer to ensure adequate protection.

Get more for Exhibition Insurance

Find out other Exhibition Insurance

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer