Ri W 4 Form

What is the Ri W 4 Form

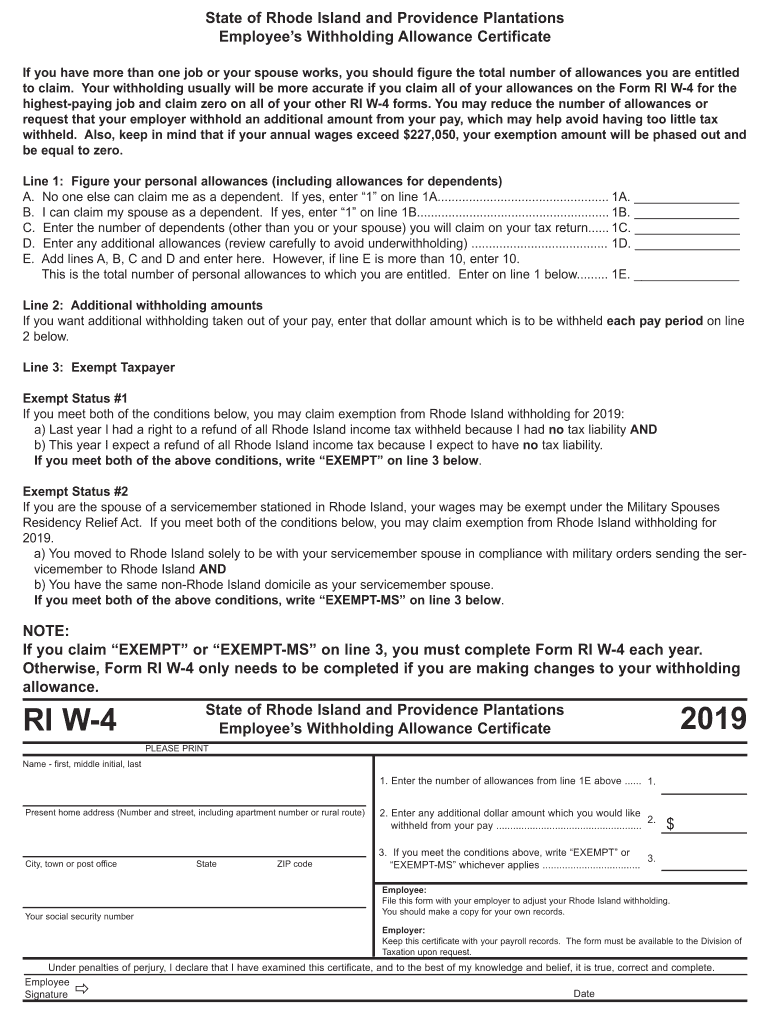

The 2019 Ri W 4 form is a state-specific tax document used by employees in Rhode Island to determine their state income tax withholding. It is essential for ensuring that the correct amount of state tax is withheld from an employee's paycheck. This form allows employees to specify their filing status, allowances, and any additional withholding they wish to request. Understanding this form is crucial for both employees and employers to maintain compliance with state tax regulations.

Steps to Complete the Ri W 4 Form

Completing the 2019 Ri W 4 form involves several key steps:

- Personal Information: Begin by entering your name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, which can be single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal and financial situation. This will affect your withholding amount.

- Additional Withholding: If you wish to have extra tax withheld, specify the amount in the designated section.

- Signature: Finally, sign and date the form to validate it.

Once completed, submit the form to your employer to ensure accurate withholding from your paychecks.

Legal Use of the Ri W 4 Form

The 2019 Ri W 4 form is legally binding once it is signed and submitted to your employer. It is vital for tax compliance, as it dictates how much state income tax will be withheld from your earnings. Employers are required to keep this form on file for their records and must use the information provided to calculate the appropriate withholding amounts. Failure to submit a valid Ri W 4 form may result in incorrect tax withholding, leading to potential penalties or unexpected tax liabilities.

How to Obtain the Ri W 4 Form

The 2019 Ri W 4 form can be obtained easily through various channels:

- Online: Visit the Rhode Island Division of Taxation website to download a printable version of the form.

- Employer: Request a copy from your employer, as they may provide it as part of the hiring process.

- Tax Professionals: Consult with a tax advisor or accountant who can provide you with the necessary forms and guidance.

Having the correct version of the form is essential to ensure compliance with state tax laws.

Key Elements of the Ri W 4 Form

Understanding the key elements of the 2019 Ri W 4 form is crucial for accurate completion:

- Personal Information: Includes your name, address, and Social Security number.

- Filing Status: Indicates whether you are single, married, or head of household, which affects your tax rate.

- Allowances: The number of allowances you claim can reduce your taxable income and affect withholding.

- Additional Withholding: Provides an option to request extra withholding to cover potential tax liabilities.

Each of these elements plays a significant role in determining the amount of state tax withheld from your paycheck.

Form Submission Methods

Submitting the 2019 Ri W 4 form can be done through several methods:

- In-Person: Deliver the completed form directly to your employer’s payroll department.

- Mail: Some employers may allow you to mail the form to their payroll office.

- Online: If your employer provides an online system, you may be able to submit the form digitally.

Always verify with your employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete request that your employer withhold an additional amount from your pay which may help avoid having too little tax

Effortlessly prepare Ri W 4 Form on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Ri W 4 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and electronically sign Ri W 4 Form with ease

- Locate Ri W 4 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of sharing the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ri W 4 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request that your employer withhold an additional amount from your pay which may help avoid having too little tax

How to make an eSignature for the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax in the online mode

How to create an electronic signature for the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax in Google Chrome

How to create an eSignature for putting it on the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax in Gmail

How to generate an eSignature for the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax straight from your mobile device

How to make an electronic signature for the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax on iOS devices

How to generate an electronic signature for the Request That Your Employer Withhold An Additional Amount From Your Pay Which May Help Avoid Having Too Little Tax on Android

People also ask

-

What is the 2019 RI withholding process in airSlate SignNow?

The 2019 RI withholding process in airSlate SignNow allows businesses to manage employee tax withholdings efficiently. With our easy-to-use platform, you can ensure accurate calculations and timely submissions of withholdings for the 2019 tax year.

-

How can airSlate SignNow help with 2019 RI withholding documentation?

AirSlate SignNow simplifies the creation and management of 2019 RI withholding documents. Our platform enables users to easily draft, sign, and store documents securely, ensuring compliance with state requirements for withholding documentation.

-

What features does airSlate SignNow offer for 2019 RI withholding?

Our platform provides several features for managing 2019 RI withholding, including customizable templates, electronic signatures, and automated workflows. These features help streamline the process, reduce errors, and save time for businesses.

-

Is airSlate SignNow cost-effective for handling 2019 RI withholding?

Yes, airSlate SignNow is a cost-effective solution for managing 2019 RI withholding. Our pricing plans are designed to fit businesses of all sizes, providing essential features without the high costs, making it an affordable choice.

-

Can airSlate SignNow integrate with other financial software for 2019 RI withholding?

Absolutely! airSlate SignNow offers integrations with popular financial software that can aid in the management of 2019 RI withholding. This ensures seamless data transfer between platforms, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for 2019 RI withholding?

Using airSlate SignNow for 2019 RI withholding offers numerous benefits, including improved accuracy in filing, reduced processing time, and enhanced security for sensitive documents. Our platform makes it easier to stay organized and compliant.

-

How does airSlate SignNow ensure compliance for 2019 RI withholding?

AirSlate SignNow ensures compliance for 2019 RI withholding by providing up-to-date templates and features that adhere to current tax regulations. Our platform is designed to help businesses meet all necessary requirements while minimizing the risk of errors.

Get more for Ri W 4 Form

- Fenway health medical records form

- Customer acknowledgement for non cancellable non form

- Private lesson contract template form

- Private lend contract template form

- Private lessons contract template form

- Private music lesson contract template form

- Private mortgage contract template form

- Private loan contract template form

Find out other Ri W 4 Form

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now