Ri T 204r Form

What is the Ri T 204r

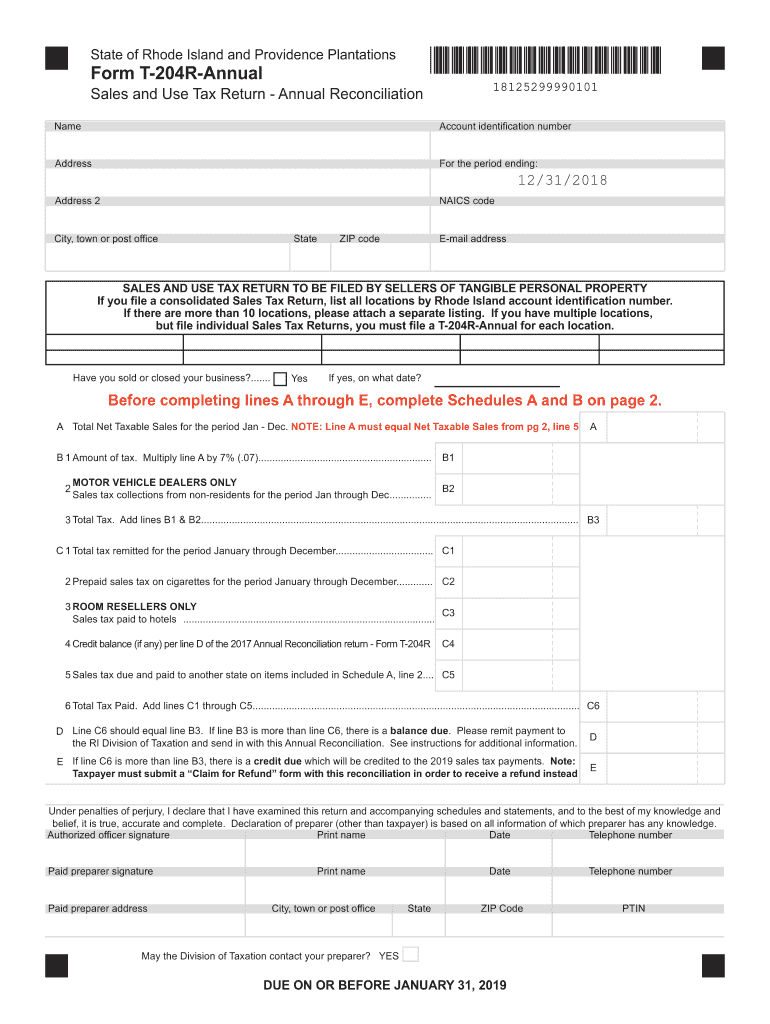

The Ri T 204r is a form used for annual reconciliation of sales and use tax in Rhode Island. It is essential for businesses to report their taxable sales and to reconcile the amount of tax collected with the amount owed to the state. This form ensures compliance with Rhode Island tax laws and helps maintain accurate records for both the business and the state tax authority.

How to use the Ri T 204r

To effectively use the Ri T 204r, businesses must first gather all necessary financial records for the reporting period. This includes total sales, exempt sales, and any use tax incurred. The form allows for the calculation of the total tax due based on these figures. It is important to fill out the form accurately to avoid discrepancies that could lead to penalties.

Steps to complete the Ri T 204r

Completing the Ri T 204r involves several key steps:

- Gather financial records, including sales receipts and tax collected.

- Calculate total taxable sales and exempt sales for the year.

- Determine the total use tax owed based on purchases made without sales tax.

- Fill out the Ri T 204r form, entering the calculated figures in the appropriate sections.

- Review the completed form for accuracy before submission.

Legal use of the Ri T 204r

The legal use of the Ri T 204r is governed by Rhode Island tax regulations. Filing this form accurately is crucial for compliance with state laws. Failure to submit the form or inaccuracies in reporting can result in penalties, including fines or interest on unpaid taxes. Businesses are encouraged to keep detailed records to support the information provided on the form.

Filing Deadlines / Important Dates

It is vital for businesses to be aware of the filing deadlines associated with the Ri T 204r. Typically, the form must be submitted annually, with specific deadlines set by the Rhode Island Division of Taxation. Missing these deadlines can lead to penalties, so businesses should mark their calendars and prepare their documentation in advance.

Required Documents

To complete the Ri T 204r, businesses will need various documents, including:

- Sales records for the reporting period.

- Invoices for exempt sales.

- Documentation of any use tax incurred.

- Previous year’s Ri T 204r for reference.

Form Submission Methods

The Ri T 204r can be submitted through multiple methods. Businesses have the option to file online through the Rhode Island Division of Taxation's website, or they can choose to mail the completed form to the appropriate tax office. In-person submissions may also be possible, depending on current regulations and office hours.

Quick guide on how to complete if there are more than 10 locations please attach a separate listing

Easily Prepare Ri T 204r on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage Ri T 204r on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Ri T 204r Effortlessly

- Locate Ri T 204r and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or inaccuracies that require printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Ri T 204r while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the if there are more than 10 locations please attach a separate listing

How to make an eSignature for the If There Are More Than 10 Locations Please Attach A Separate Listing online

How to make an electronic signature for the If There Are More Than 10 Locations Please Attach A Separate Listing in Chrome

How to make an eSignature for putting it on the If There Are More Than 10 Locations Please Attach A Separate Listing in Gmail

How to create an eSignature for the If There Are More Than 10 Locations Please Attach A Separate Listing straight from your smart phone

How to make an eSignature for the If There Are More Than 10 Locations Please Attach A Separate Listing on iOS

How to make an electronic signature for the If There Are More Than 10 Locations Please Attach A Separate Listing on Android OS

People also ask

-

What is the RI Form T 70C and how is it used?

The RI Form T 70C is a crucial document used in various business transactions, particularly for state tax filings. airSlate SignNow makes it easy to fill out and send this form electronically, ensuring compliance and accuracy. With our platform, you can eSign the RI Form T 70C securely, streamlining your processes.

-

How much does it cost to use airSlate SignNow for eSigning the RI Form T 70C?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, starting from a very affordable monthly rate. Each plan allows unlimited eSigning of documents like the RI Form T 70C, providing great value for your investment. Visit our pricing page for detailed information and choose the best option for you.

-

What features does airSlate SignNow offer for completing the RI Form T 70C?

airSlate SignNow includes features such as customizable templates, user-friendly editing tools, and secure cloud storage for easy management of the RI Form T 70C. Additionally, our document tracking feature allows you to monitor the status of your submitted forms, ensuring that everything is completed promptly and efficiently.

-

Can I integrate airSlate SignNow with other software for the RI Form T 70C?

Yes, airSlate SignNow seamlessly integrates with various applications, such as CRMs and cloud storage services, to enhance your workflow. This capability allows you to manage the RI Form T 70C alongside other essential documents in your preferred software environment, improving productivity and organization.

-

Is it safe to eSign the RI Form T 70C using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security with industry-standard encryption protocols to protect your sensitive information when eSigning the RI Form T 70C. Our platform is compliant with various regulations, ensuring that your documents are handled safely and securely throughout the signing process.

-

What benefits does airSlate SignNow provide for businesses using the RI Form T 70C?

Using airSlate SignNow to handle the RI Form T 70C efficiently reduces paperwork and minimizes processing times. The ability to eSign documents from anywhere, anytime, streamlines your operations and enhances collaboration among team members, leading to greater overall productivity.

-

How can I get started with airSlate SignNow to use the RI Form T 70C?

Getting started with airSlate SignNow is quick and easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and you can begin eSigning the RI Form T 70C right away. Our user-friendly interface allows you to navigate smoothly through the process and create your documents effortlessly.

Get more for Ri T 204r

- Features nie form

- Sergei nirenburgs home page cognitive science department form

- Private house sale contract template form

- Private investigation contract template form

- Private investigator contract template form

- Private label contract template form

- Private label manufactur contract template form

- Private landlord contract template form

Find out other Ri T 204r

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document