Dor M4 Form

What is the Massachusetts M-4 Withholding Form?

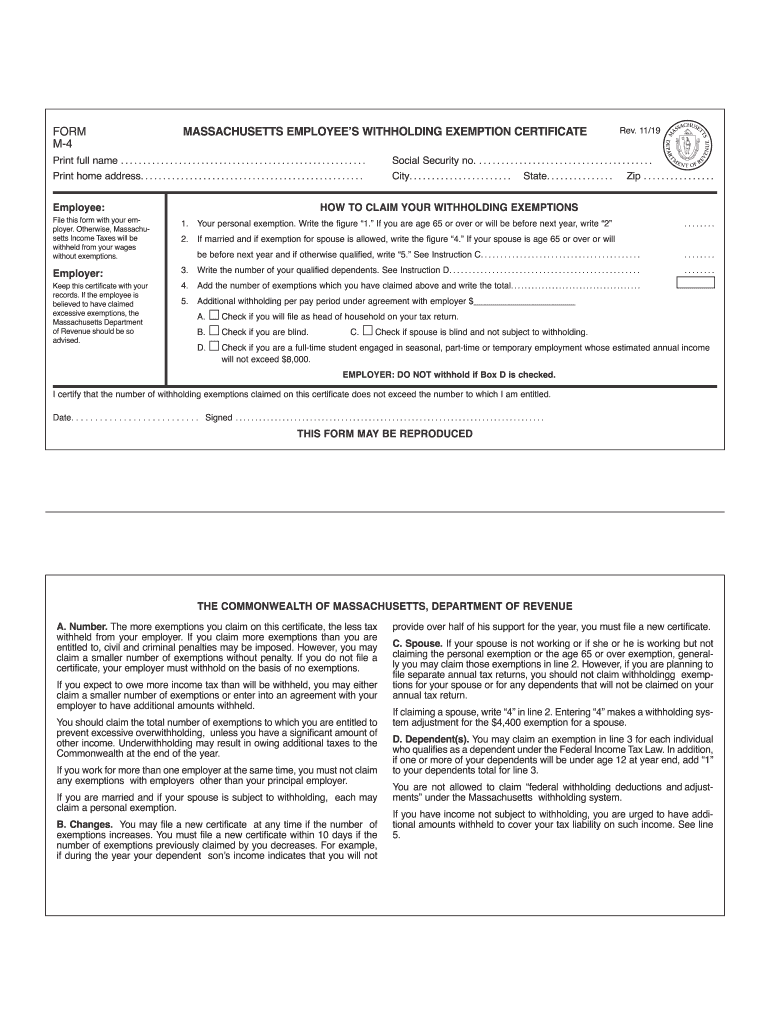

The Massachusetts M-4 withholding form is an essential document used by employees to claim exemptions from state income tax withholding. This form allows individuals to indicate their personal exemption amounts and any additional withholding preferences. By submitting the M-4, employees can ensure that the correct amount of tax is withheld from their paychecks, aligning with their financial situations. Understanding this form is crucial for maintaining compliance with state tax regulations and optimizing tax withholdings.

How to Complete the Massachusetts M-4 Withholding Form

Filling out the Massachusetts M-4 form involves several straightforward steps. First, you will need to provide your personal information, including your name, address, and Social Security number. Next, indicate your filing status and the number of exemptions you are claiming. It is important to accurately assess your exemptions to avoid over- or under-withholding. Finally, sign and date the form before submitting it to your employer. Ensuring that all information is correct will help prevent issues with your tax withholdings.

Legal Use of the Massachusetts M-4 Withholding Form

The Massachusetts M-4 form is legally recognized for tax purposes, provided it is filled out correctly and submitted on time. Electronic signatures are valid under U.S. law, making it convenient to complete and submit the form digitally. Compliance with state regulations is essential, as improper use of the form can lead to penalties or incorrect tax withholdings. Utilizing a reliable electronic signature platform can help ensure that your M-4 is executed properly and securely.

Key Elements of the Massachusetts M-4 Withholding Form

Understanding the key elements of the Massachusetts M-4 form can facilitate its completion. This includes personal information, filing status, and exemptions claimed. The form also allows for additional withholding amounts, which can be specified if desired. Each section must be completed accurately to reflect your current tax situation. Familiarizing yourself with these elements will help ensure that the form meets all necessary requirements.

Filing Deadlines for the Massachusetts M-4 Withholding Form

Filing deadlines for the Massachusetts M-4 form are crucial for ensuring compliance with state tax laws. Typically, employees should submit the M-4 form to their employers at the start of their employment or whenever there is a change in their tax situation. It is advisable to review your withholding status at least annually or whenever significant life changes occur, such as marriage or the birth of a child. Staying informed about these deadlines can help prevent issues with tax withholdings.

Form Submission Methods for the Massachusetts M-4

The Massachusetts M-4 form can be submitted through various methods, including online, by mail, or in person. Many employers offer electronic submission options, allowing for a quick and efficient process. If submitting by mail, ensure that the form is sent to the correct address provided by your employer. In-person submissions may be available at your employer’s human resources department. Choosing the right submission method can streamline the process and ensure timely processing.

Quick guide on how to complete massachusetts m 4 employees withholding exemption certificate

Effortlessly manage Dor M4 on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely keep them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Dor M4 on your device using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to edit and electronically sign Dor M4 with ease

- Locate Dor M4 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure confidential information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and electronically sign Dor M4 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts m 4 employees withholding exemption certificate

How to generate an electronic signature for your Massachusetts M 4 Employees Withholding Exemption Certificate online

How to generate an electronic signature for your Massachusetts M 4 Employees Withholding Exemption Certificate in Google Chrome

How to create an electronic signature for signing the Massachusetts M 4 Employees Withholding Exemption Certificate in Gmail

How to create an electronic signature for the Massachusetts M 4 Employees Withholding Exemption Certificate right from your mobile device

How to create an electronic signature for the Massachusetts M 4 Employees Withholding Exemption Certificate on iOS

How to generate an eSignature for the Massachusetts M 4 Employees Withholding Exemption Certificate on Android OS

People also ask

-

What is the Massachusetts M 4 withholding form?

The Massachusetts M 4 withholding form is a document used by employers to determine the amount of state income tax to withhold from employees' wages. This form helps ensure that the correct amount of tax is deducted based on individual circumstances, including dependents and filing status.

-

How do I fill out the Massachusetts M 4 withholding form?

To fill out the Massachusetts M 4 withholding form, you need to provide personal information such as your name, address, and Social Security number. Additionally, you must disclose the number of allowances you are claiming, which determine the withholding amount for state taxes.

-

Is there a fee for using airSlate SignNow to manage the Massachusetts M 4 withholding form?

airSlate SignNow offers an affordable and cost-effective solution for managing your Massachusetts M 4 withholding form. With our subscription plans, you can access various features without hidden fees or charges, ensuring you stay in control of your document management.

-

Can I eSign the Massachusetts M 4 withholding form with airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the Massachusetts M 4 withholding form securely and efficiently. Our platform offers a legally binding eSignature solution, making it easy to execute this important tax form without the hassle of printing and scanning.

-

What are the benefits of using airSlate SignNow for the Massachusetts M 4 withholding form?

Using airSlate SignNow to manage your Massachusetts M 4 withholding form streamlines the process, saves time, and increases efficiency. The platform is user-friendly and allows for quick access to templates and signing, ensuring compliance with state regulations.

-

Does airSlate SignNow integrate with other tools for handling the Massachusetts M 4 withholding form?

Yes, airSlate SignNow seamlessly integrates with various software tools, enhancing your workflow when handling the Massachusetts M 4 withholding form. Our robust integrations with popular applications ensure you can manage your documents efficiently alongside your existing tools.

-

How secure is my information when using airSlate SignNow for the Massachusetts M 4 withholding form?

Security is a priority at airSlate SignNow. When you use our platform for the Massachusetts M 4 withholding form, your data is protected with advanced encryption methods and complies with industry standards to ensure confidentiality and security.

Get more for Dor M4

- Gewerbeabmeldung regensburg form

- Targobank duisburg postfach 21 02 54 form

- This lease the quotleasequot dated this 19th day of november memoryproject form

- Private chef contract template form

- Private contract template form

- Private dance lesson contract template 787753891 form

- Private event contract template 787753892 form

- Private home sale contract template form

Find out other Dor M4

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document