Texas 133 Form

What is the Texas 133?

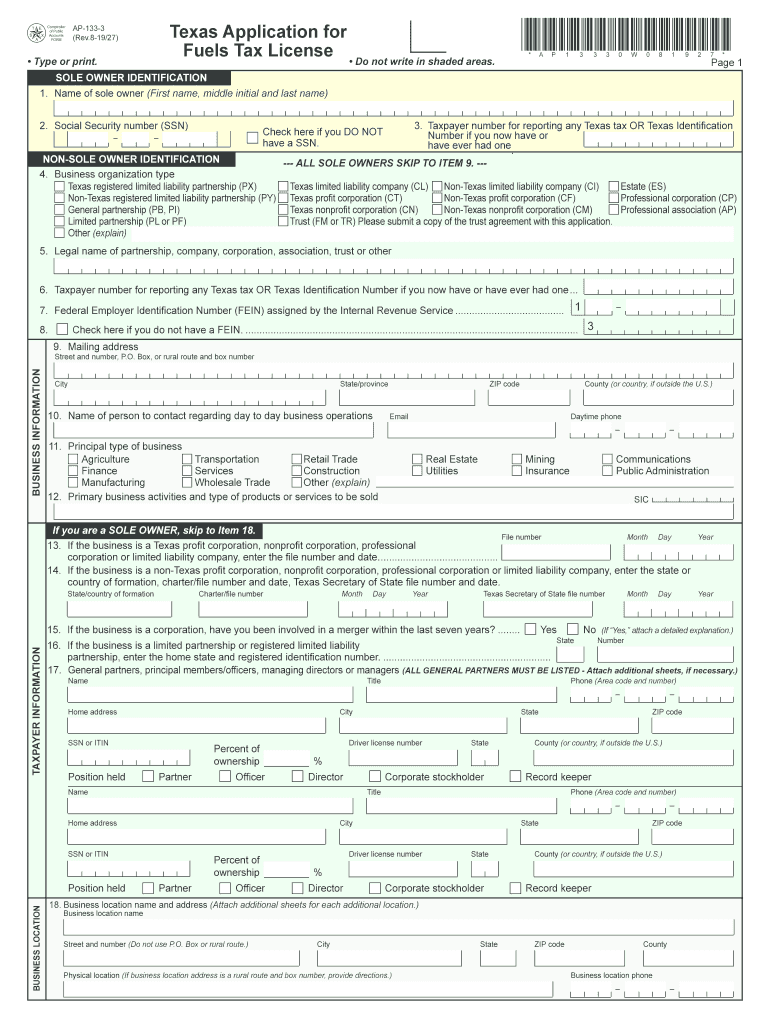

The Texas 133 application, also known as the Texas application for fuels tax license, is a crucial document for businesses involved in the distribution or sale of fuel within the state of Texas. This application allows entities to obtain a fuels tax license, which is necessary for compliance with state tax regulations. The license is essential for those who wish to engage in activities such as selling, distributing, or using fuel that is subject to state taxes.

How to obtain the Texas 133

To obtain the Texas 133 application, businesses must first ensure they meet the eligibility criteria set by the Texas Comptroller of Public Accounts. The application can be accessed online through the Texas Comptroller's website or obtained in person at designated offices. Applicants will need to provide specific information, including their business details, type of fuel involved, and any relevant tax identification numbers.

Steps to complete the Texas 133

Completing the Texas 133 application involves several key steps:

- Gather necessary documentation, including business identification and tax information.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application either online or via mail, depending on the chosen method.

Legal use of the Texas 133

The Texas 133 application is legally binding once submitted and approved, allowing businesses to operate within the legal framework established by Texas tax laws. Compliance with the regulations governing the fuels tax license is essential to avoid penalties and ensure lawful operation. The application must be completed in accordance with the Texas Administrative Code and other relevant legal guidelines.

Required Documents

When applying for the Texas 133, businesses must prepare and submit several required documents, which may include:

- Proof of business registration.

- Tax identification number.

- Details of the types of fuel to be sold or distributed.

- Any previous tax compliance documentation, if applicable.

Form Submission Methods

The Texas 133 application can be submitted through multiple methods to accommodate various preferences:

- Online: Businesses can complete and submit the application electronically through the Texas Comptroller's website.

- Mail: The application can be printed, filled out, and mailed to the appropriate office.

- In-Person: Applicants may also choose to submit their application in person at designated Comptroller offices.

Quick guide on how to complete tax code ann

Complete Texas 133 seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Texas 133 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Texas 133 with ease

- Obtain Texas 133 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Stop worrying about lost or misplaced files, laborious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Texas 133 and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax code ann

How to create an electronic signature for the Tax Code Ann in the online mode

How to generate an eSignature for your Tax Code Ann in Google Chrome

How to make an eSignature for putting it on the Tax Code Ann in Gmail

How to create an electronic signature for the Tax Code Ann from your smartphone

How to make an electronic signature for the Tax Code Ann on iOS devices

How to generate an eSignature for the Tax Code Ann on Android

People also ask

-

What is Texas 133 in relation to airSlate SignNow?

Texas 133 refers to the specific regulations and requirements for electronic signatures in the state of Texas. airSlate SignNow complies with Texas 133, ensuring that all eSignatures are legally binding and secure for businesses operating within Texas. This compliance helps organizations streamline their document workflows while adhering to state laws.

-

How does airSlate SignNow support Texas 133 compliance?

airSlate SignNow is fully compliant with Texas 133, which means it incorporates secure authentication methods and audit trails for every eSignature transaction. This level of compliance ensures that businesses in Texas can trust that their electronic signatures will hold up in legal situations. By using airSlate SignNow, you can confidently manage your document signing process.

-

What are the pricing options for using airSlate SignNow in Texas?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses in Texas. Depending on the size of your organization and the volume of documents, you can choose from various subscription plans that provide features compliant with Texas 133. This ensures that you receive a cost-effective solution while maintaining full compliance with state regulations.

-

What features does airSlate SignNow offer for Texas businesses?

airSlate SignNow provides several features that are essential for businesses in Texas, including document templates, bulk sending, and customizable workflows. These features enhance efficiency and ensure that your processes align with Texas 133 requirements. Additionally, the platform offers robust security measures, ensuring that all transactions are protected.

-

Can airSlate SignNow integrate with other tools for Texas 133 compliance?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications that businesses in Texas frequently use. These integrations help streamline document management processes while ensuring compliance with Texas 133. By connecting with tools like CRM systems or cloud storage, you can enhance your workflow efficiency.

-

What are the benefits of using airSlate SignNow for electronic signatures in Texas?

Using airSlate SignNow for electronic signatures provides Texas businesses with a user-friendly and legally compliant solution. It helps reduce turnaround time for document signing, increases productivity, and minimizes paper waste. Furthermore, compliance with Texas 133 means you can trust that all signatures are secure and valid.

-

Is customer support available for Texas users of airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support for users in Texas, ensuring that you receive assistance with any questions or issues related to Texas 133 compliance. Our support team is trained to help you navigate the platform and maximize your use of its features for a seamless experience.

Get more for Texas 133

- Oldblackdiamondwebsite comdeptsclerkcity of black diamond citizen feedback form po box 599

- Dance choreographer contract template form

- Dance company contract template form

- Dance performance contract template

- Political consultant contract template form

- Pool build contract template form

- Pool clean service contract template form

- Pool clean contract template form

Find out other Texas 133

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online