Frequently Asked Questions on Philippine Travel Tax Exemption Form

Understanding the Philippine Travel Tax Exemption

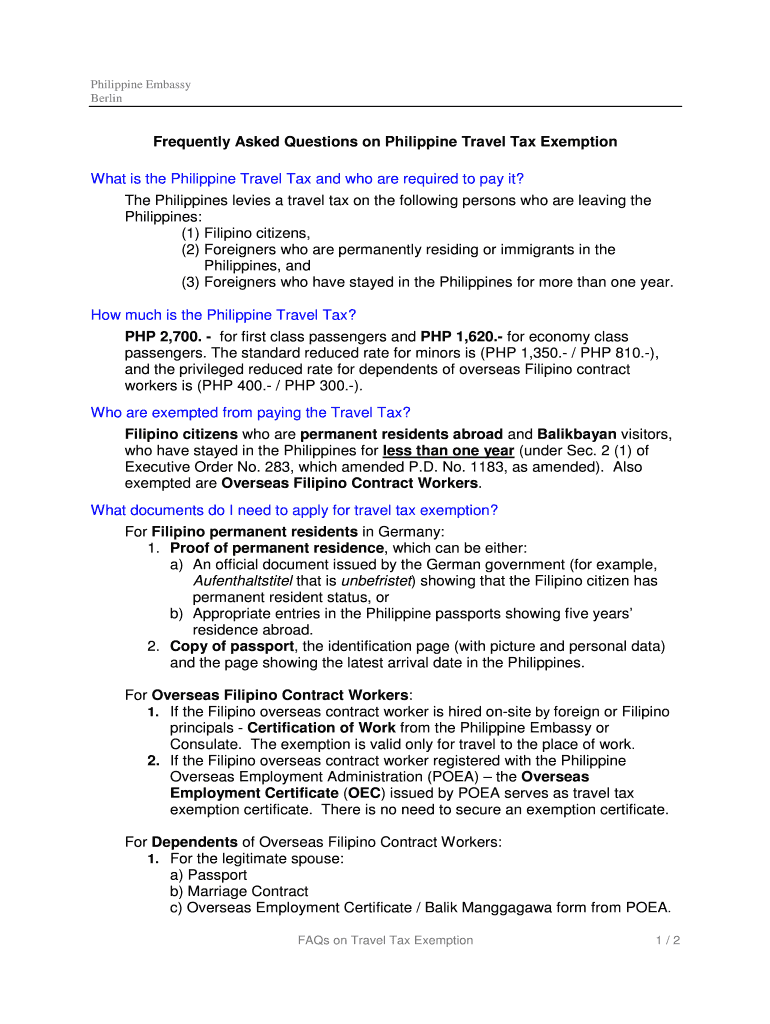

The Philippine Travel Tax Exemption allows certain travelers to avoid paying the travel tax when departing from the Philippines. This exemption typically applies to specific categories of individuals, including overseas Filipino workers (OFWs), diplomats, and certain government officials. Understanding who qualifies for this exemption is crucial for those planning to travel to or from the Philippines.

Eligibility criteria can vary based on the traveler's status and the purpose of their travel. It is essential to check the latest regulations to ensure compliance and avoid unnecessary fees.

Steps to Obtain the Philippine Travel Tax Exemption

To obtain the Philippine Travel Tax Exemption, travelers must follow a series of steps. First, they need to gather necessary documentation that proves their eligibility. This may include identification documents, proof of employment, or other relevant paperwork.

Next, travelers should visit the appropriate government office or authorized agency to submit their application. It is important to ensure that all documents are complete and accurate to avoid delays in processing. After submission, travelers will receive confirmation of their exemption status, which should be presented at the time of departure.

Required Documents for the Travel Tax Exemption

When applying for the Philippine Travel Tax Exemption, specific documents are required to verify eligibility. Commonly required documents include:

- Valid passport

- Proof of employment, such as a contract or company ID for overseas Filipino workers

- Diplomatic identification for diplomats and government officials

- Any additional documentation that supports the exemption claim

It is advisable to check with the relevant authorities for a complete list of required documents, as requirements may change.

Legal Use of the Philippine Travel Tax Exemption

The legal framework governing the Philippine Travel Tax Exemption is established by the Philippine government. Travelers must ensure that they comply with the laws and regulations to avoid penalties. Misuse of the exemption can lead to legal consequences, including fines or restrictions on future travel.

It is important to understand the legal implications of claiming the exemption, including any obligations to report or document the exemption status during travel.

Filing Deadlines and Important Dates

While the Philippine Travel Tax Exemption does not typically have a filing deadline like other tax forms, travelers should be aware of any specific timelines related to their travel plans. It is advisable to apply for the exemption well in advance of travel to ensure all documentation is processed in time.

Travelers should also stay informed about any changes in regulations or procedures that may affect their exemption status, especially in light of evolving travel policies.

Examples of Eligibility for the Travel Tax Exemption

Eligibility for the Philippine Travel Tax Exemption can vary based on individual circumstances. For instance, overseas Filipino workers traveling back to their place of employment are typically exempt. Similarly, diplomats traveling for official duties may also qualify.

Other scenarios may include students studying abroad or individuals returning to the Philippines for specific purposes. Understanding these examples can help travelers assess their eligibility and prepare the necessary documentation.

Quick guide on how to complete frequently asked questions on philippine travel tax exemption

Prepare [SKS] effortlessly on any device

Web-based document administration has gained traction among corporations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues related to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Frequently Asked Questions On Philippine Travel Tax Exemption

Create this form in 5 minutes!

How to create an eSignature for the frequently asked questions on philippine travel tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Philippine travel tax exemption?

The Philippine travel tax exemption refers to the waiver of travel tax for certain individuals traveling to or from the Philippines. This exemption is often applicable to specific categories of travelers, such as overseas Filipino workers and certain government officials. Understanding the details is crucial for ensuring compliance and maximizing your travel benefits.

-

Who qualifies for the Philippine travel tax exemption?

Individuals who qualify for the Philippine travel tax exemption typically include overseas Filipino workers, diplomats, and certain government officials. Additionally, minors and senior citizens may also be eligible under specific conditions. It's essential to check the latest regulations to confirm your eligibility.

-

How can I apply for the Philippine travel tax exemption?

To apply for the Philippine travel tax exemption, travelers must present the necessary documentation at the airport or relevant government offices. This may include proof of employment for overseas workers or identification for minors. Familiarizing yourself with the application process can help streamline your travel experience.

-

Are there any fees associated with the Philippine travel tax exemption?

Generally, there are no fees associated with obtaining the Philippine travel tax exemption itself. However, travelers should be aware of any potential administrative fees when processing their exemption claims. It's advisable to review the latest guidelines to avoid unexpected costs.

-

What documents do I need for the Philippine travel tax exemption?

To secure the Philippine travel tax exemption, travelers typically need to present valid identification, proof of employment, and any other relevant documentation. This may include travel itineraries or government-issued IDs. Ensuring you have the correct documents can facilitate a smoother travel experience.

-

How does the Philippine travel tax exemption benefit travelers?

The Philippine travel tax exemption benefits travelers by reducing the overall cost of travel, allowing them to allocate funds to other essential expenses. This exemption is particularly advantageous for overseas Filipino workers who frequently travel. Understanding these benefits can enhance your travel planning.

-

Can I use airSlate SignNow for travel tax exemption documentation?

Yes, airSlate SignNow can be an effective tool for managing and eSigning the necessary documentation for the Philippine travel tax exemption. Its user-friendly interface allows for quick and secure document handling, ensuring you have everything in order before your trip. Utilizing this solution can simplify your travel preparations.

Get more for Frequently Asked Questions On Philippine Travel Tax Exemption

- Knowledge development evaluation form a1 scuba

- Mdc septic reimbursement form

- Aerial lift daily inspection checklist form

- Blank self employed printable invoice template form

- Midamerican energy electric service facility application form

- Pagella scolastica pdf form

- Api 653 study materials form

- Recomputation edd form

Find out other Frequently Asked Questions On Philippine Travel Tax Exemption

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself