Nj 1065 Instructions Form

What is the NJ 1065 Instructions

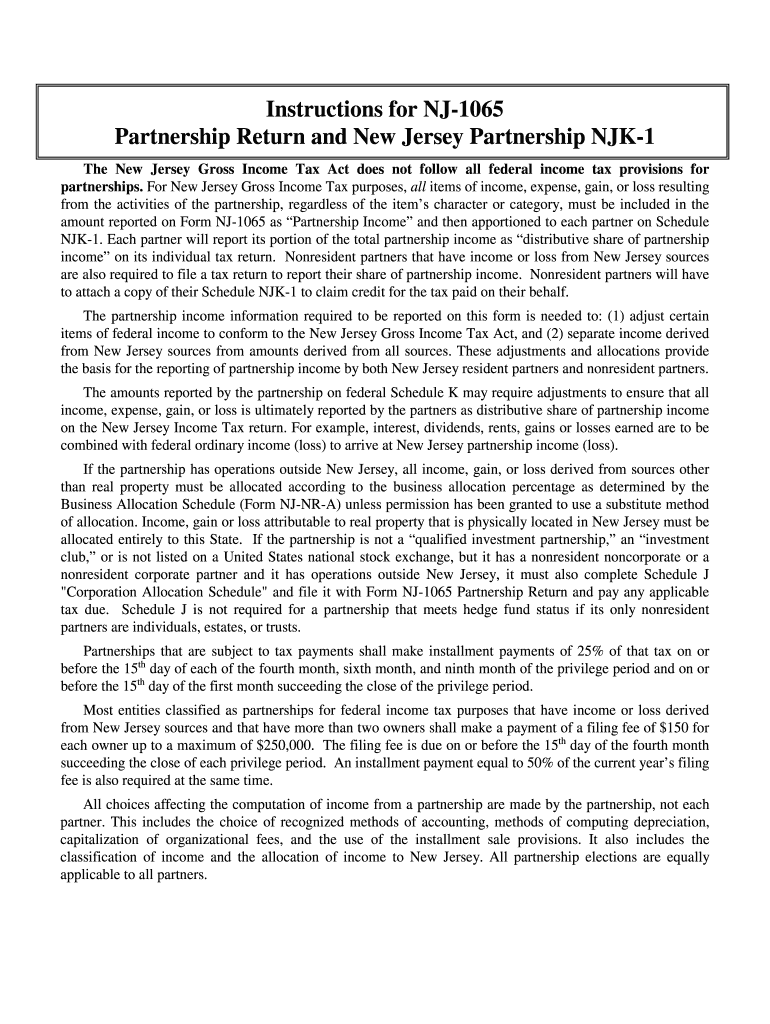

The NJ 1065 instructions provide guidance for partnerships and limited liability companies (LLCs) that are required to file Form NJ-1065 in New Jersey. This form is essential for reporting income, deductions, and credits for partnerships doing business in the state. The instructions detail how to correctly complete the form, including the necessary information about each partner's share of income and losses. Understanding these instructions is crucial for compliance with state tax laws and ensuring that all required information is accurately reported.

Steps to Complete the NJ 1065 Instructions

Completing the NJ 1065 instructions involves several key steps to ensure accurate filing:

- Gather all necessary financial documents, including income statements and expense records for the partnership.

- Fill out the basic information section of the NJ 1065 form, including the partnership name, address, and federal employer identification number (EIN).

- Report each partner's share of income, deductions, and credits in the appropriate sections as outlined in the instructions.

- Ensure that all calculations are accurate and that the form is signed by an authorized partner.

- Review the completed form and instructions for any errors before submission.

Key Elements of the NJ 1065 Instructions

The NJ 1065 instructions include several critical elements that must be understood for proper compliance:

- Partner Information: Each partner's details, including their share of profits and losses, must be accurately reported.

- Deductions and Credits: The instructions outline what deductions and credits can be claimed by the partnership.

- Filing Requirements: Specific deadlines and requirements for filing the form are detailed to avoid penalties.

- Signature Requirements: The form must be signed by an authorized partner, confirming the accuracy of the information provided.

Legal Use of the NJ 1065 Instructions

The NJ 1065 instructions are legally binding documents that must be adhered to when filing taxes for partnerships in New Jersey. Compliance with these instructions ensures that the partnership meets state tax obligations and avoids potential legal issues. Accurate completion of the form is essential for the legitimacy of the partnership's tax filings, as errors can lead to audits or penalties from the New Jersey Division of Taxation.

Form Submission Methods

Partnerships can submit the NJ 1065 form through various methods, ensuring flexibility for compliance:

- Online Submission: Partnerships can file electronically through the New Jersey Division of Taxation's online portal, which may expedite processing times.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided in the instructions.

- In-Person Submission: Partnerships may also choose to deliver the form directly to a local tax office for submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NJ 1065 is crucial for compliance. The form is typically due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form should be filed by April 15. Late submissions may incur penalties, so it is important for partnerships to be aware of these dates and plan accordingly.

Quick guide on how to complete instructions for form nj 1065 instructions for form nj 1065

Complete Nj 1065 Instructions seamlessly on any device

Online document management has gained traction with both businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Nj 1065 Instructions on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to edit and electronically sign Nj 1065 Instructions with ease

- Find Nj 1065 Instructions and select Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Mark pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Select how you wish to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or corrections that require new printed copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Nj 1065 Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nj 1065 instructions for form nj 1065

How to generate an electronic signature for the Instructions For Form Nj 1065 Instructions For Form Nj 1065 in the online mode

How to generate an electronic signature for your Instructions For Form Nj 1065 Instructions For Form Nj 1065 in Chrome

How to generate an electronic signature for putting it on the Instructions For Form Nj 1065 Instructions For Form Nj 1065 in Gmail

How to create an eSignature for the Instructions For Form Nj 1065 Instructions For Form Nj 1065 straight from your smart phone

How to generate an eSignature for the Instructions For Form Nj 1065 Instructions For Form Nj 1065 on iOS devices

How to create an electronic signature for the Instructions For Form Nj 1065 Instructions For Form Nj 1065 on Android devices

People also ask

-

What are the 2018 NJ instructions for eSigning documents with airSlate SignNow?

The 2018 NJ instructions outline the legal requirements for electronic signatures in New Jersey. With airSlate SignNow, you can ensure that your eSigned documents comply with these regulations. Our platform provides a secure and user-friendly environment to facilitate compliance with the 2018 NJ instructions.

-

How much does airSlate SignNow cost for businesses following the 2018 NJ instructions?

airSlate SignNow offers competitively priced plans that cater to various business needs, making it easy to comply with the 2018 NJ instructions. Whether you are a small start-up or a large corporation, we have flexible pricing options to fit your budget while providing full functionality. For specific pricing details, you can visit our pricing page.

-

What features does airSlate SignNow offer to help with the 2018 NJ instructions?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking, all designed to assist users in adhering to the 2018 NJ instructions. Additionally, our platform simplifies the eSigning process, enhancing efficiency while ensuring compliance. This makes it a powerful tool for businesses in New Jersey.

-

Are airSlate SignNow electronic signatures valid under the 2018 NJ instructions?

Yes, airSlate SignNow electronic signatures are fully valid under the 2018 NJ instructions. New Jersey recognizes electronic signatures as legally binding, provided they meet specific criteria. Our platform ensures you follow these guidelines to validate your documents.

-

Can airSlate SignNow integrate with other tools while following the 2018 NJ instructions?

airSlate SignNow offers seamless integrations with a variety of business applications to enhance your workflow in compliance with the 2018 NJ instructions. This means you can connect tools like CRM systems, document management software, and more, creating a cohesive and efficient process. Check our integrations page for more details.

-

What benefits does airSlate SignNow provide for complying with the 2018 NJ instructions?

Using airSlate SignNow offers signNow benefits such as time savings, increased accuracy, and reduced paperwork, all while adhering to the 2018 NJ instructions. This streamlined process allows businesses to operate efficiently without compromising legal compliance. It's designed to enhance customer satisfaction and ease the workflow.

-

Is there a trial available for airSlate SignNow to evaluate compliance with the 2018 NJ instructions?

Yes, airSlate SignNow provides a free trial that allows you to explore its features and assess how well it meets the 2018 NJ instructions for your business needs. This trial gives you the opportunity to test the platform's capabilities without any commitment. We encourage users to take advantage of this offer.

Get more for Nj 1065 Instructions

- Preparation of uniformly isotope labeled dna oligonucleotides for spin niddk nih

- Cdna sequence and heterologous expression of monomeric spinach biochemj form

- Changing the web paradigm lightstreamer form

- Eagle does space efficient ltl monitoring ti arc nasa form

- Fill online visit legacy americanpayroll org american payroll legacy americanpayroll form

- New mexico eviction notice to quit form eforms

- Orthodontic treatment contract template form

- Outsourc contract template form

Find out other Nj 1065 Instructions

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement