State of Maine Rew 5 Form

What is the State Of Maine Rew 5 Form

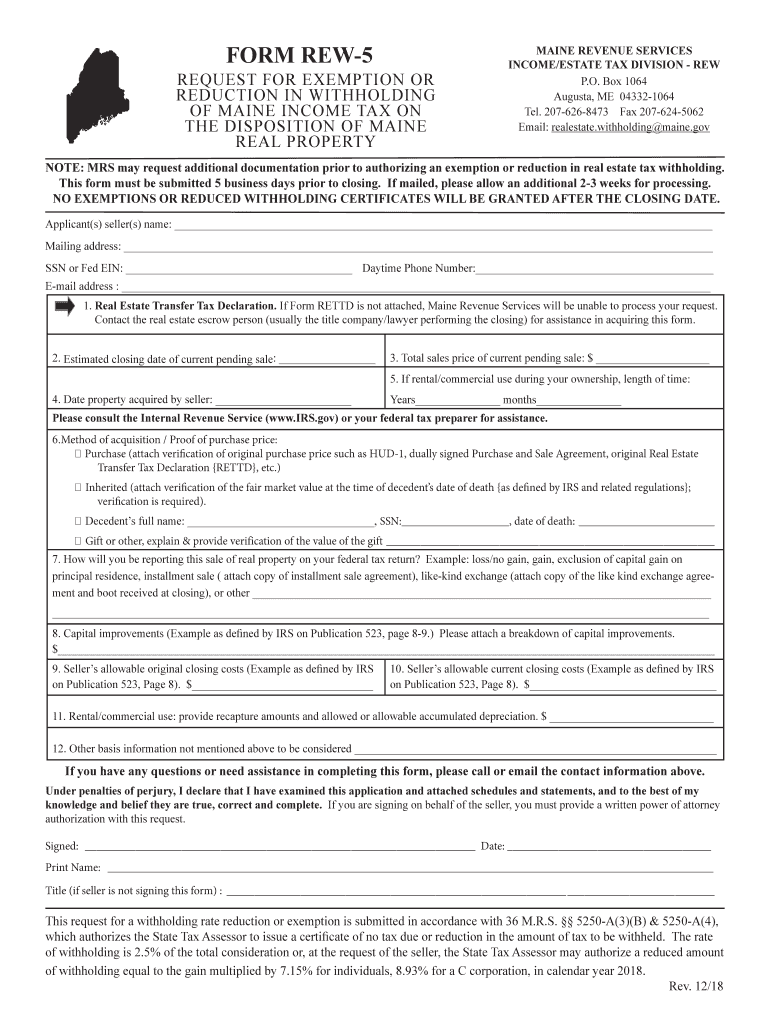

The State of Maine REW 5 form is a tax document used for requesting an exemption from withholding on certain types of income. This form is particularly relevant for individuals and businesses that qualify for specific tax exemptions under Maine state law. It allows taxpayers to avoid unnecessary withholding on income that may not be subject to taxation, thus ensuring that they retain more of their earnings throughout the year. Understanding the purpose and implications of the REW 5 form is crucial for accurate tax filing and compliance with state regulations.

How to obtain the State Of Maine Rew 5 Form

To obtain the State of Maine REW 5 form, individuals can visit the official website of the Maine Revenue Services. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, individuals may request a physical copy of the form by contacting the Maine Revenue Services directly. It is important to ensure that the most current version of the form is used to avoid any issues during the filing process.

Steps to complete the State Of Maine Rew 5 Form

Completing the State of Maine REW 5 form involves several key steps:

- Download and print the REW 5 form from the Maine Revenue Services website.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Indicate the type of income for which you are requesting exemption from withholding.

- Provide any additional information required, such as the reason for the exemption.

- Sign and date the form to certify the accuracy of the information provided.

After completing the form, it can be submitted to the appropriate tax authority as specified in the instructions.

Legal use of the State Of Maine Rew 5 Form

The legal use of the State of Maine REW 5 form is governed by state tax laws that outline the eligibility criteria for exemptions from withholding. To ensure compliance, taxpayers must accurately complete the form and provide truthful information regarding their income and exemption status. The form serves as a formal request to the state for withholding exemption, and misuse or inaccuracies can lead to penalties or additional tax liabilities. Understanding the legal implications is essential for maintaining compliance with Maine tax regulations.

Key elements of the State Of Maine Rew 5 Form

Key elements of the State of Maine REW 5 form include:

- Personal Information: Name, address, and identification numbers.

- Type of Income: Specification of the income type for which the exemption is requested.

- Exemption Reason: A clear explanation of why the exemption is warranted.

- Signature: The taxpayer's signature to validate the information provided.

Each of these elements plays a crucial role in the form's validity and the taxpayer's ability to secure the requested exemption.

Filing Deadlines / Important Dates

Filing deadlines for the State of Maine REW 5 form can vary depending on the specific tax year and the type of income involved. Generally, it is advisable to submit the form as early as possible to ensure that the exemption is recognized for the current tax year. Taxpayers should check the Maine Revenue Services website or consult with a tax professional for specific deadlines related to their situation. Staying informed about important dates helps avoid penalties and ensures compliance with state tax regulations.

Quick guide on how to complete reduction in withholding

Complete State Of Maine Rew 5 Form effortlessly on any device

Online document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional paper documents, allowing you to locate the required form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage State Of Maine Rew 5 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to edit and eSign State Of Maine Rew 5 Form with ease

- Locate State Of Maine Rew 5 Form and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you prefer. Modify and eSign State Of Maine Rew 5 Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reduction in withholding

How to make an electronic signature for the Reduction In Withholding in the online mode

How to generate an electronic signature for the Reduction In Withholding in Google Chrome

How to generate an electronic signature for signing the Reduction In Withholding in Gmail

How to create an electronic signature for the Reduction In Withholding straight from your smartphone

How to generate an eSignature for the Reduction In Withholding on iOS

How to create an electronic signature for the Reduction In Withholding on Android OS

People also ask

-

What is the State Of Maine Rew 5 Form, and why is it important?

The State Of Maine Rew 5 Form is a crucial document for businesses and individuals in Maine, allowing for the proper reporting of certain transactions. Understanding its requirements ensures compliance with state regulations, making it essential for anyone conducting business in Maine.

-

How can airSlate SignNow help me with the State Of Maine Rew 5 Form?

airSlate SignNow streamlines the process of completing and submitting the State Of Maine Rew 5 Form by providing an intuitive eSignature platform. You can easily fill out the form, obtain signatures, and send it securely, ensuring that your documentation is both efficient and compliant.

-

Are there any costs associated with using airSlate SignNow for the State Of Maine Rew 5 Form?

Yes, while airSlate SignNow offers a cost-effective solution for managing the State Of Maine Rew 5 Form, pricing varies based on your needs. Plans typically include a range of features that enhance your eSigning experience, making it a worthwhile investment for your business.

-

What features does airSlate SignNow offer for managing the State Of Maine Rew 5 Form?

airSlate SignNow provides features like customizable templates, secure cloud storage, and real-time tracking specifically designed to simplify the handling of the State Of Maine Rew 5 Form. These tools ensure that you can manage your documents seamlessly and efficiently.

-

Can I integrate airSlate SignNow with other tools for the State Of Maine Rew 5 Form?

Absolutely! airSlate SignNow offers integrations with popular business applications, allowing you to manage the State Of Maine Rew 5 Form alongside your existing workflows. This connectivity enhances productivity and makes document management even easier.

-

Is airSlate SignNow secure for submitting the State Of Maine Rew 5 Form?

Yes, airSlate SignNow employs robust security measures to protect your data when submitting the State Of Maine Rew 5 Form. With advanced encryption and compliance with industry standards, you can trust that your documents are safe and secure.

-

Can I track the status of my State Of Maine Rew 5 Form submissions with airSlate SignNow?

Yes, one of the signNow benefits of using airSlate SignNow is the ability to track the status of your State Of Maine Rew 5 Form submissions in real-time. You’ll receive notifications and updates, ensuring you are always informed about the progress of your documents.

Get more for State Of Maine Rew 5 Form

- Office of the maine ag consumer protection privacy form

- Lobbyist client identification form city of irving

- Abm w2 reissue form

- East missoula voluteer fire dept app 1 doc form

- Montana public employee retirement administration form

- How to implement a driver fuel card policy template form

- Emailfax name of nurese form

- Www craigak com sites defaultcity of craig employment application form

Find out other State Of Maine Rew 5 Form

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe