Form Kentucky Taxes

What is the Form Kentucky Taxes

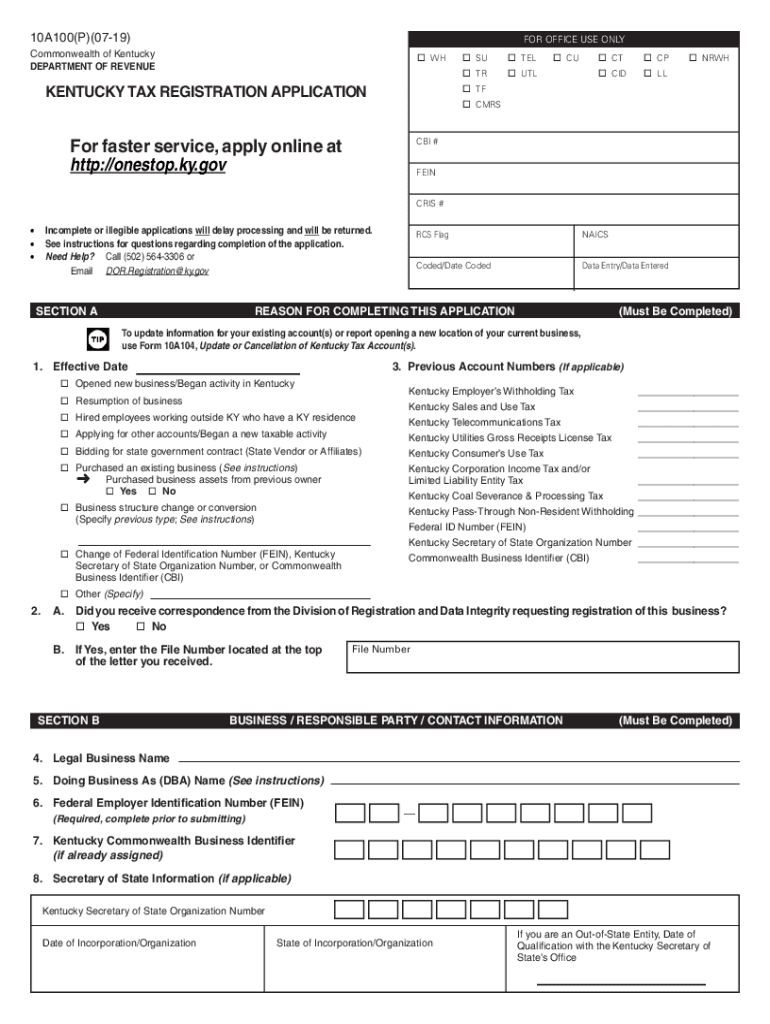

The 10a100 form, also known as the Kentucky Tax Registration Application, is essential for businesses operating in Kentucky. It serves as a formal request to register for a Kentucky sales tax number. This form is crucial for entities looking to collect sales tax on behalf of the state, ensuring compliance with Kentucky tax laws. The form gathers important information about the business, including its legal structure, ownership details, and the types of taxes it will collect.

How to use the Form Kentucky Taxes

Using the 10a100 form involves several steps to ensure proper completion and submission. First, gather all necessary information about your business, such as the legal name, address, and federal employer identification number (EIN). Next, accurately fill out the form, providing details about the types of taxes you intend to collect, including sales and use tax. After completing the form, it can be submitted online or via mail to the Kentucky Department of Revenue for processing.

Steps to complete the Form Kentucky Taxes

Completing the 10a100 form requires careful attention to detail. Follow these steps for successful completion:

- Gather your business information, including the legal name, address, and EIN.

- Indicate the type of business entity, such as sole proprietorship, LLC, or corporation.

- Provide details about the nature of your business and the types of taxes you will collect.

- Review the form for accuracy and completeness before submission.

- Submit the form to the Kentucky Department of Revenue either online or by mail.

Legal use of the Form Kentucky Taxes

The 10a100 form must be used in compliance with Kentucky tax regulations. It is legally binding once submitted and accepted by the Kentucky Department of Revenue. This form ensures that businesses are registered correctly to collect sales tax, which is a legal requirement for operating within the state. Failure to properly complete and submit this form can result in penalties, including fines and back taxes owed.

Required Documents

When completing the 10a100 form, certain documents may be required to support your application. These typically include:

- Federal Employer Identification Number (EIN) documentation.

- Proof of business registration with the state of Kentucky.

- Any applicable licenses or permits related to your business operations.

Having these documents ready can expedite the registration process and ensure compliance with all legal requirements.

Form Submission Methods (Online / Mail / In-Person)

The 10a100 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Complete and submit the form electronically through the Kentucky Department of Revenue's website.

- Mail Submission: Print the completed form and send it to the appropriate address provided by the Kentucky Department of Revenue.

- In-Person Submission: Visit a local Department of Revenue office to submit the form directly.

Choosing the right submission method can depend on your business's needs and preferences.

Quick guide on how to complete 10a100p 07 19

Complete Form Kentucky Taxes effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Form Kentucky Taxes on any platform with airSlate SignNow’s Android or iOS applications and streamline any document-centric workflow today.

How to modify and eSign Form Kentucky Taxes with ease

- Locate Form Kentucky Taxes and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your alterations.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and eSign Form Kentucky Taxes and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 10a100p 07 19

How to create an electronic signature for the 10a100p 07 19 in the online mode

How to generate an electronic signature for your 10a100p 07 19 in Chrome

How to make an electronic signature for putting it on the 10a100p 07 19 in Gmail

How to make an electronic signature for the 10a100p 07 19 from your smart phone

How to create an eSignature for the 10a100p 07 19 on iOS devices

How to generate an eSignature for the 10a100p 07 19 on Android OS

People also ask

-

What is the 10 a100 pricing structure for airSlate SignNow?

The 10 a100 pricing structure for airSlate SignNow offers flexible plans tailored to fit businesses of all sizes. Depending on your team's requirements, you can choose from various subscription options ensuring a cost-effective solution for secure document eSigning.

-

What features are included in the 10 a100 plan of airSlate SignNow?

The 10 a100 plan includes features like unlimited document sending, customizable templates, and advanced security measures. This ensures that businesses can efficiently manage their documents while maintaining compliance and data protection.

-

How does the 10 a100 benefit small businesses?

The 10 a100 plan from airSlate SignNow is designed specifically for small businesses by providing an affordable and easy-to-use eSigning solution. It helps streamline document workflows, reduce turnaround times, and enhance overall productivity without straining budgets.

-

What integrations are available with airSlate SignNow's 10 a100?

The 10 a100 version of airSlate SignNow seamlessly integrates with popular platforms like Google Drive, Salesforce, and Microsoft Office. These integrations help organizations work more efficiently by simplifying document management and enhancing collaboration across different tools.

-

How secure is the 10 a100 solution for document signing?

The 10 a100 solution prioritizes security with features like bank-level encryption and detailed audit trails. With airSlate SignNow, businesses can trust that their sensitive information is protected, providing peace of mind when managing critical documents.

-

Can I customize templates in the 10 a100 plan?

Yes, the 10 a100 plan allows users to create and customize templates tailored to their specific business needs. This feature facilitates faster document preparation and ensures consistency across all outgoing communications.

-

Is customer support included in the 10 a100 plan?

Absolutely! The 10 a100 plan includes robust customer support options to assist users with any queries or issues. Whether via live chat, email, or phone, our team is dedicated to ensuring you get the most out of your airSlate SignNow experience.

Get more for Form Kentucky Taxes

- Employment application westlands water district westlandswater form

- Humboldt bay fire joint powers authority in eureka ca form

- California fire protection district form

- California delete dependent city form

- Www cityofsusanville netcity employment applicationcity employment application city of susanville form

- California application employment form

- Document b narrative budget template and detail budget template cdss ca form

- Yuba county physician39s release return to work form yuba

Find out other Form Kentucky Taxes

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document