Form 5578

What is the Form 5578

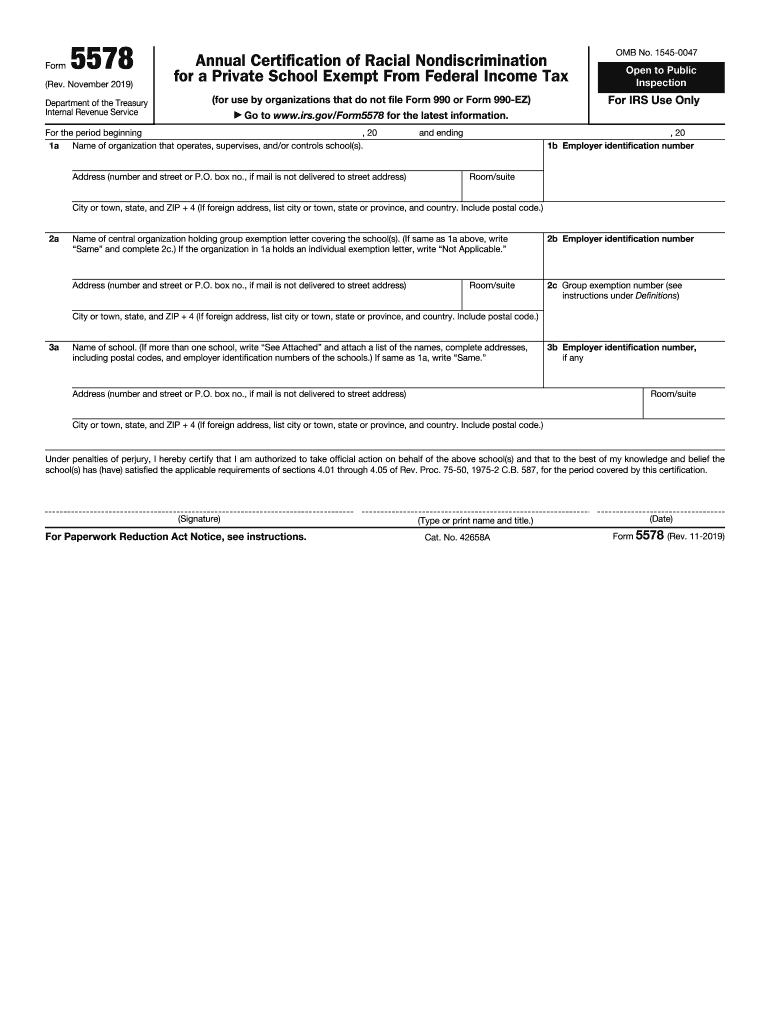

The Form 5578 is a federal tax form used by certain organizations to apply for tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit entities seeking to operate without paying federal income tax. It provides the IRS with necessary information about the organization’s purpose, structure, and activities to determine eligibility for tax exemption. Understanding this form is crucial for independent contractors and businesses that may work with or donate to tax-exempt organizations.

How to use the Form 5578

To use the Form 5578 effectively, organizations must complete it accurately to reflect their mission and operations. The form requires detailed information about the organization’s structure, governance, and financial activities. It is typically submitted alongside other required documentation to the IRS. Proper use of this form can facilitate the approval process for tax-exempt status, allowing organizations to focus on their charitable missions without the burden of federal taxes.

Steps to complete the Form 5578

Completing the Form 5578 involves several steps:

- Gather necessary documents, including the organization’s bylaws, articles of incorporation, and financial statements.

- Fill out the form with accurate information regarding the organization’s purpose, activities, and governance structure.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form along with any required supporting documents to the IRS.

Following these steps can help ensure a smooth application process for tax-exempt status.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 5578. Organizations must adhere to these guidelines to avoid delays or rejection of their application. Key guidelines include providing clear and concise information, ensuring all required signatures are present, and submitting the form within the designated time frame. Familiarity with these guidelines is essential for organizations seeking to maintain compliance and secure their tax-exempt status.

Eligibility Criteria

To qualify for tax-exempt status using the Form 5578, organizations must meet certain eligibility criteria. These criteria typically include being organized and operated exclusively for charitable, educational, or religious purposes. Additionally, the organization must not engage in substantial lobbying activities or political campaigning. Understanding these eligibility requirements is crucial for independent contractors and businesses that wish to partner with tax-exempt organizations.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 5578 can result in significant penalties. Organizations that do not maintain their tax-exempt status may face back taxes, fines, and loss of credibility. It is important for organizations to stay informed about their obligations and ensure that they adhere to all IRS regulations to avoid these consequences.

Quick guide on how to complete form 5578 rev november 2019 annual certificate of racial nondiscrimination for a private school exempt from federal income tax

Complete Form 5578 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form 5578 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The most efficient way to edit and eSign Form 5578 with ease

- Locate Form 5578 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 5578 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5578 rev november 2019 annual certificate of racial nondiscrimination for a private school exempt from federal income tax

How to make an eSignature for the Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax online

How to create an electronic signature for your Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax in Google Chrome

How to generate an eSignature for putting it on the Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax in Gmail

How to make an electronic signature for the Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax right from your mobile device

How to generate an electronic signature for the Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax on iOS devices

How to make an electronic signature for the Form 5578 Rev November 2019 Annual Certificate Of Racial Nondiscrimination For A Private School Exempt From Federal Income Tax on Android

People also ask

-

What are independent contractor taxes?

Independent contractor taxes refer to the taxes that self-employed individuals must pay on their earnings, which include federal income tax and self-employment tax. It's crucial for independent contractors to understand these obligations to avoid penalties. Knowing how to calculate these taxes can help manage your finances effectively.

-

How can airSlate SignNow help with managing independent contractor taxes?

While airSlate SignNow does not directly prepare taxes, it provides an easy platform to send and eSign documents related to independent contractor taxes, such as W-9 forms or contracts. This speeds up the document management process, allowing you to focus on tax planning. Efficient document handling can simplify your overall tax preparation.

-

What features of airSlate SignNow are beneficial for independent contractors?

AirSlate SignNow offers features like easy document eSigning, templates for contracts, and real-time collaboration, which are all essential for independent contractors. These tools help streamline your processes, making it simpler to manage agreements and stay compliant with tax regulations. Simplified document workflows can save you time, which is vital during tax season.

-

Is there a pricing plan for independent contractors using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans suitable for independent contractors, making it a cost-effective solution for managing documents. Each plan is designed to provide value with essential features that help with your workflow. By investing in this tool, you can save on administrative costs, allowing more focus on your independent contractor taxes.

-

Can airSlate SignNow integrate with accounting software for independent contractor taxes?

Absolutely! AirSlate SignNow can seamlessly integrate with several accounting software platforms, like QuickBooks or Xero. This integration allows you to automatically send signed documents to your financial tools, helping you stay organized when tracking independent contractor taxes. Efficient integration can enhance your overall financial management.

-

What documents should independent contractors manage for taxes?

Independent contractors should manage documents such as 1099 forms, invoices, and any contracts signed with clients. Proper documentation is essential for tracking income and applicable deductions, which directly affects your independent contractor taxes. Using airSlate SignNow can facilitate the management of these critical documents.

-

How can airSlate SignNow ensure compliance with independent contractor taxes?

AirSlate SignNow's platform helps ensure compliance by providing legally binding eSignatures and document templates that are compliant with regulations. Maintaining proper documentation through eSigning can help protect against disputes and make tax reporting smoother. Compliance is key to avoiding issues with independent contractor taxes.

Get more for Form 5578

- For office use only application for employment cit form

- Add dependent city of huntington beach form

- Lic 4006 form los angeles

- Carlucci transporttransportation done right form

- Il application city police form

- Harvard fire department fire station 502 s eastman st form

- Emmet chalmers fire protection district 3041 w adams rd form

- Charleston southern university maintenance request hoary form

Find out other Form 5578

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors