Ohio it 3 Form

What is the Ohio IT 3?

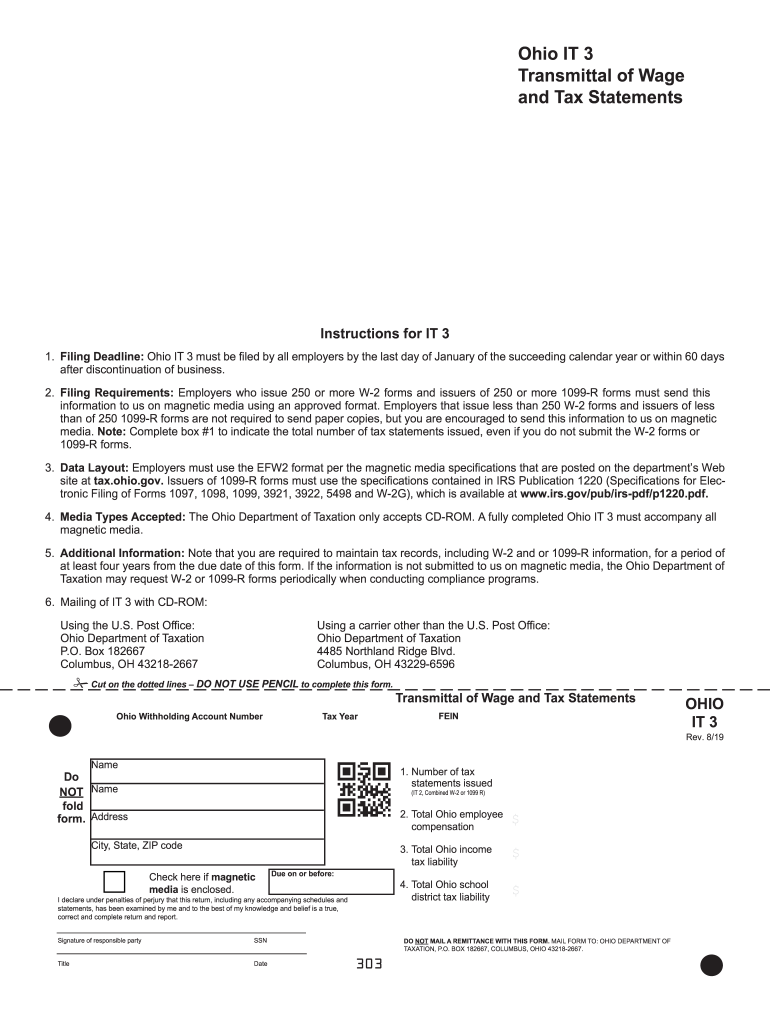

The Ohio IT 3 form is a tax document used by businesses and individuals to report income earned in the state of Ohio. This form is specifically designed for reporting income that is subject to Ohio's income tax. It is essential for ensuring compliance with state tax regulations and for accurately calculating the tax owed. Understanding the purpose and requirements of the IT 3 form is crucial for taxpayers to avoid penalties and ensure proper filing.

How to Use the Ohio IT 3

Using the Ohio IT 3 form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form with the required information, such as total income, deductions, and credits. It is important to double-check all entries for accuracy before submission. After completing the form, you can file it electronically or by mail, depending on your preference and the requirements of the state.

Steps to Complete the Ohio IT 3

Completing the Ohio IT 3 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include any taxable income.

- Calculate any deductions or credits you may qualify for and enter those amounts on the form.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or mail it to the appropriate Ohio tax authority.

Legal Use of the Ohio IT 3

The Ohio IT 3 form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, the form must comply with all relevant tax laws, including those related to income reporting and deductions. Using a reliable electronic signature tool can enhance the security and legitimacy of the form, ensuring that it meets all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio IT 3 form are crucial for taxpayers to avoid penalties. Typically, the form must be submitted by the due date for Ohio income tax returns, which is usually April 15th of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Required Documents

When preparing to file the Ohio IT 3 form, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts or statements

Having these documents ready will streamline the filing process and help ensure accuracy in reporting income.

Quick guide on how to complete form it 3 transmittal of wage and tax statements ohio

Easily Prepare Ohio It 3 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally-friendly substitute to traditional printed and signed forms, as you can locate the correct template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ohio It 3 on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Alter and Electronically Sign Ohio It 3 Effortlessly

- Locate Ohio It 3 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ohio It 3 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 3 transmittal of wage and tax statements ohio

How to create an eSignature for the Form It 3 Transmittal Of Wage And Tax Statements Ohio in the online mode

How to create an eSignature for your Form It 3 Transmittal Of Wage And Tax Statements Ohio in Google Chrome

How to create an eSignature for signing the Form It 3 Transmittal Of Wage And Tax Statements Ohio in Gmail

How to create an eSignature for the Form It 3 Transmittal Of Wage And Tax Statements Ohio right from your smart phone

How to make an eSignature for the Form It 3 Transmittal Of Wage And Tax Statements Ohio on iOS

How to generate an eSignature for the Form It 3 Transmittal Of Wage And Tax Statements Ohio on Android devices

People also ask

-

What is form it 3 and how does it work within airSlate SignNow?

Form it 3 is a powerful feature in airSlate SignNow that allows users to create customizable forms for eSigning documents. This tool streamlines the document signing process and enhances productivity by reducing paperwork. With form it 3, users can easily collect information and signatures in one seamless workflow.

-

What are the pricing options for using form it 3 with airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to form it 3. These plans are designed to accommodate businesses of all sizes, ensuring cost-effective solutions. Be sure to check our website for the latest pricing information as it may vary based on the features you select.

-

What are the key benefits of using form it 3 for document management?

The key benefits of using form it 3 in airSlate SignNow include improved efficiency, reduced errors, and enhanced collaboration. This feature allows teams to manage documents digitally, speeding up the signing process and facilitating easier access to important files. By utilizing form it 3, businesses can save time and resources while ensuring compliance.

-

Can I integrate form it 3 with other software applications?

Yes, form it 3 can be integrated with several popular applications, enhancing its functionality within airSlate SignNow. This interoperability allows users to connect their existing workflows and data systems for a smoother experience. Check our integrations page to see a full list of compatible applications.

-

Is form it 3 suitable for all business sizes and industries?

Absolutely! Form it 3 is designed to cater to businesses of all sizes and across various industries. Its customizable features make it versatile, allowing organizations to tailor it to their specific document needs, whether for small startups or large enterprises.

-

What kind of support is available for users of form it 3?

Users of form it 3 benefit from comprehensive support options provided by airSlate SignNow. This includes access to a knowledge base, help center, and live customer support for any queries. We strive to ensure that you have the resources needed for optimal use of form it 3.

-

How does form it 3 improve the security of document signing?

Form it 3 enhances document security by incorporating advanced encryption and authentication measures within airSlate SignNow. This ensures that all documents are securely signed and stored, protecting sensitive information from unauthorized access. With form it 3, businesses can have peace of mind about the integrity of their documents.

Get more for Ohio It 3

- Il application form

- Job information amp application pdf

- 911 n lotus drive round lake beach il 60073 2444 fax 847 270 9115 form

- Prepare for an interview worksheet form

- Child support services programhfs illinois form

- Www siue eduhuman resourcesfaqsi did not receive a statement of economic interests form in

- Chicago fire department bureau of fire prevention form

- East side firefighters association job description for volunteer form

Find out other Ohio It 3

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself