Form 1120

What is the Form 1120?

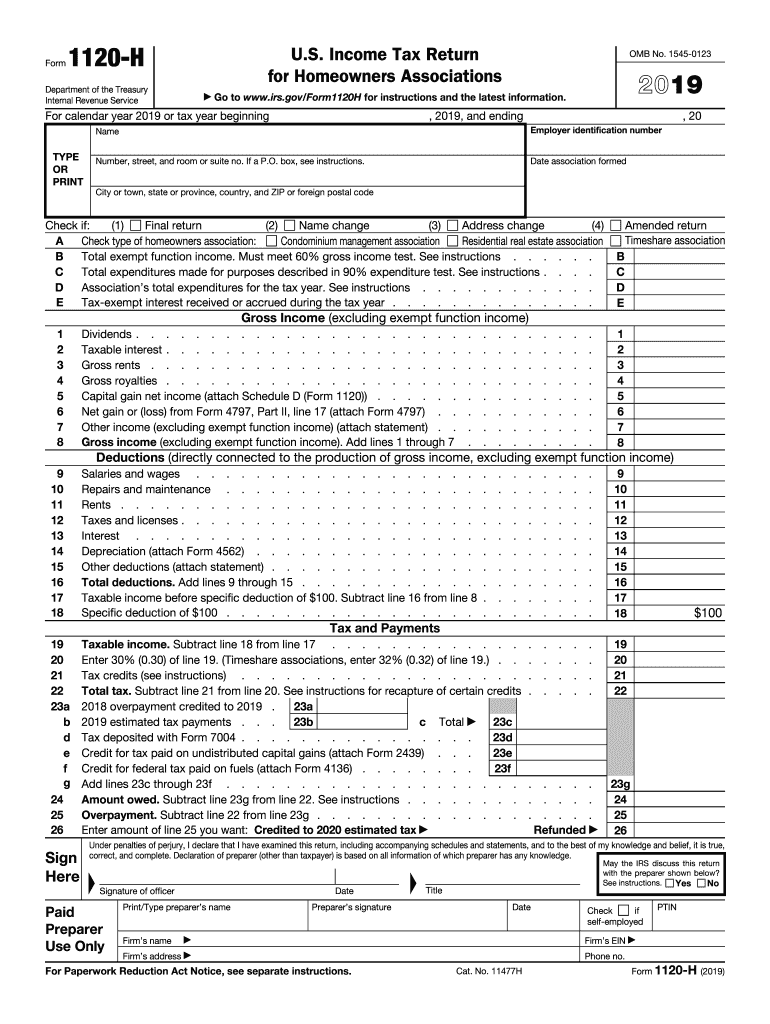

The Form 1120 is a U.S. federal tax form used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and ensure compliance with IRS regulations. Specifically, the 2019 IRS 1120 H is designed for homeowners associations, allowing them to report income and expenses related to their operations. Understanding the purpose of this form is crucial for accurate tax reporting and maintaining good standing with the IRS.

How to use the Form 1120

To effectively use the Form 1120, it is important to gather all relevant financial information for the tax year. This includes income from assessments, dues, and any other sources, as well as expenses related to property maintenance, management fees, and other operational costs. Once the necessary data is collected, you can fill out the form by entering the information in the designated sections. Ensure that all calculations are accurate, as errors can lead to delays or penalties. After completing the form, it must be submitted to the IRS by the appropriate deadline.

Steps to complete the Form 1120

Completing the Form 1120 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the basic information section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report total income by entering all sources of revenue.

- Detail deductions for business expenses, ensuring to categorize them correctly.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the tax owed.

- Review the form for accuracy before submission.

Legal use of the Form 1120

The legal use of the Form 1120 is governed by IRS regulations, which require accurate reporting of income and expenses. Filing the form correctly ensures compliance with federal tax laws and avoids potential legal issues. Additionally, the form must be signed by an authorized officer of the corporation, affirming that the information provided is true and complete. Electronic filing options are available, which can streamline the submission process while maintaining legal validity.

Filing Deadlines / Important Dates

For the 2019 IRS 1120, the filing deadline was typically the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form was due by April 15, 2020. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also apply for an extension, but it is essential to file the extension request before the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 1120 on time can result in significant penalties. The IRS imposes a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, if the corporation owes taxes and does not pay them by the due date, interest will accrue on the unpaid balance. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form 1120 h internal revenue service

Effortlessly Prepare Form 1120 on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly and efficiently. Handle Form 1120 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and eSign Form 1120 Effortlessly

- Find Form 1120 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes no time and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 1120 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 h internal revenue service

How to create an eSignature for your Form 1120 H Internal Revenue Service in the online mode

How to generate an eSignature for the Form 1120 H Internal Revenue Service in Google Chrome

How to make an electronic signature for putting it on the Form 1120 H Internal Revenue Service in Gmail

How to create an electronic signature for the Form 1120 H Internal Revenue Service straight from your smartphone

How to make an electronic signature for the Form 1120 H Internal Revenue Service on iOS devices

How to generate an eSignature for the Form 1120 H Internal Revenue Service on Android devices

People also ask

-

What is the 1120 H 2019 merge feature in airSlate SignNow?

The 1120 H 2019 merge feature in airSlate SignNow allows users to seamlessly combine data from multiple sources into a single 1120 H form. This functionality streamlines the filing process and ensures accuracy, which is crucial for effective tax management. With this feature, users can ensure all necessary information is compiled efficiently.

-

How does the 1120 H 2019 merge benefit my business?

Using the 1120 H 2019 merge in airSlate SignNow can signNowly save time and reduce errors during tax preparation. It ensures that all data is consolidated and accurately reflected in your forms, simplifying your overall filing process. This can help businesses stay compliant while avoiding costly mistakes.

-

What pricing options are available for the 1120 H 2019 merge feature?

airSlate SignNow offers various pricing tiers to accommodate different business needs, including features like the 1120 H 2019 merge. You can choose from monthly or annual subscriptions, depending on your budget and usage frequency. Additionally, there may be special promotions available for new users.

-

Is the 1120 H 2019 merge feature easy to use?

Absolutely! The 1120 H 2019 merge feature in airSlate SignNow is designed for user-friendly navigation, ensuring that even those with minimal technical skills can execute merges effortlessly. Comprehensive guides and customer support are available to assist users throughout the process.

-

Can I integrate the 1120 H 2019 merge with other software?

Yes, airSlate SignNow supports integrations with a variety of third-party applications, enhancing the functionality of the 1120 H 2019 merge feature. These integrations allow for a seamless flow of information from other platforms, making tax preparation and eSigning processes more cohesive and efficient.

-

Is there a trial period for the 1120 H 2019 merge feature?

Yes, airSlate SignNow offers a free trial that includes access to the 1120 H 2019 merge feature. This allows businesses to explore its capabilities and determine if it meets their needs before committing to a subscription plan. Sign up today to see how it can streamline your tax processes.

-

What security measures are in place for using the 1120 H 2019 merge?

airSlate SignNow prioritizes user security, employing industry-leading encryption methods to protect your sensitive data during the 1120 H 2019 merge process. Regular security updates and compliance with relevant regulations ensure that your information remains safe at all times while using the platform.

Get more for Form 1120

- Www pinehurst k12 or uswp contentuploadshealthy and safe schools plan pinehurst k12 or us form

- Seeking application packet cannon beach rural fire protection form

- Employment application and instructionsbarefoot bay fl form

- Leave of absence approval form constructionprosins

- Www cityofcrestview orgagendacenterviewfilecity of crestview police department form

- Employment application ocala housing authority oha form

- Pinellas suncoast fire rescue indian rocks beach fl form

- Last first m i city state zip code form

Find out other Form 1120

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract