Irs Tax Forms

Understanding IRS Tax Forms

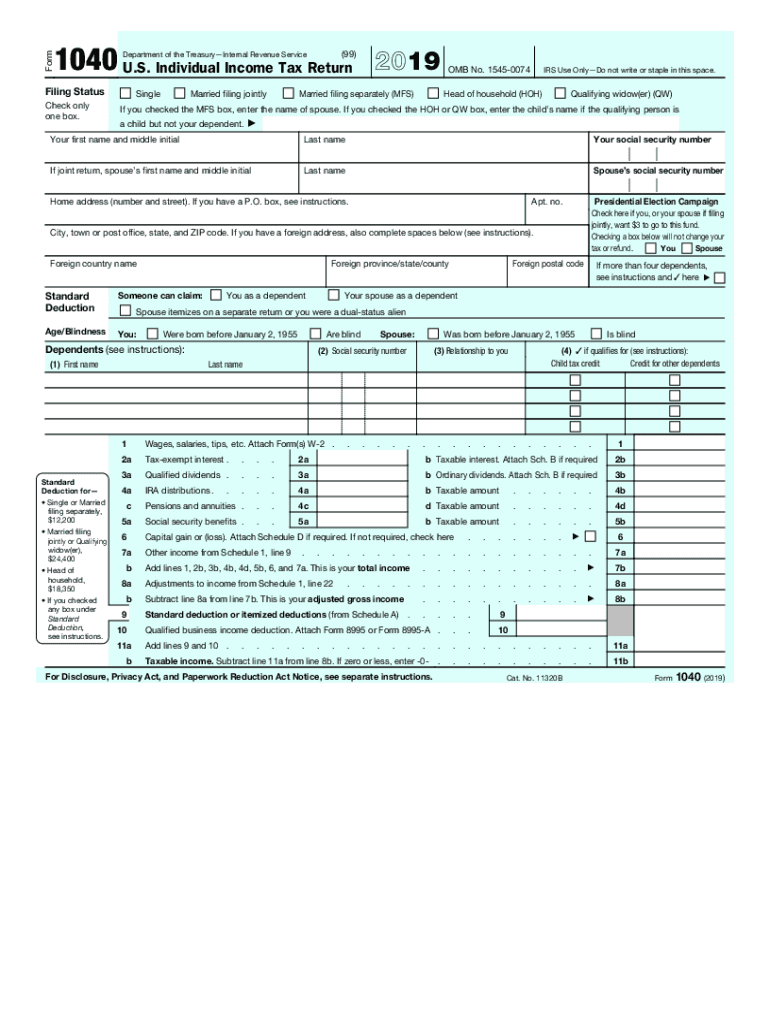

The IRS tax forms are essential documents required for filing your taxes with the Internal Revenue Service. Each form serves a specific purpose, such as reporting income, claiming deductions, or calculating tax liabilities. For the 2019 tax year, the most commonly used form is the Form 1040, which is the standard individual income tax return. Other forms, like the W-2 for wage and tax statement and the 1099 for various types of income, may also be required depending on your financial situation.

Steps to Complete IRS Tax Forms

Completing IRS tax forms involves several steps to ensure accuracy and compliance. Start by gathering all necessary documents, including your W-2s, 1099s, and any receipts for deductible expenses. Next, choose the appropriate form based on your filing status and income level. For most individuals, the Form 1040 is suitable. Fill out the form carefully, ensuring that all income is reported and deductions are accurately claimed. After completing the form, review it for errors before submitting it to the IRS.

Filing Deadlines and Important Dates

For the 2019 tax year, the deadline to file your federal tax return was April 15, 2020. If you needed additional time, you could file for an extension, which would give you until October 15, 2020, to submit your return. However, it’s important to note that any taxes owed were still due by the original April deadline to avoid penalties and interest.

Legal Use of IRS Tax Forms

IRS tax forms must be completed and submitted in accordance with federal regulations to be considered legally binding. This means providing accurate information and ensuring that all required signatures are included. E-signatures are accepted, provided they comply with the ESIGN and UETA acts, which establish the legality of electronic signatures in the U.S. Using a reliable digital solution can help ensure compliance and security when submitting your tax forms.

Required Documents for Filing

To file your 2019 tax return, you will need several key documents. These typically include:

- W-2 Forms from your employer(s), detailing your earnings and withheld taxes.

- 1099 Forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable donations.

- Form 1098 for mortgage interest paid, if applicable.

Having these documents organized will streamline the process of filling out your tax forms.

Form Submission Methods

IRS tax forms can be submitted in various ways, including:

- Online: Many taxpayers choose to file electronically using tax software, which can simplify the process and reduce errors.

- Mail: You can also print your completed forms and send them to the appropriate IRS address based on your state.

- In-Person: Some taxpayers may opt to file in person at designated IRS offices or through authorized tax professionals.

Each method has its own advantages, so consider your preferences and needs when deciding how to submit your tax return.

Quick guide on how to complete current tax return pdf form 1040 us individual income

Effortlessly prepare Irs Tax Forms on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without any holdups. Manage Irs Tax Forms on any device using airSlate SignNow's Android or iOS applications and streamline any document-related activity today.

How to edit and eSign Irs Tax Forms with ease

- Locate Irs Tax Forms and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to finalize your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Irs Tax Forms to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the current tax return pdf form 1040 us individual income

How to generate an eSignature for the Current Tax Return Pdf Form 1040 Us Individual Income online

How to make an eSignature for your Current Tax Return Pdf Form 1040 Us Individual Income in Chrome

How to generate an electronic signature for putting it on the Current Tax Return Pdf Form 1040 Us Individual Income in Gmail

How to create an electronic signature for the Current Tax Return Pdf Form 1040 Us Individual Income straight from your mobile device

How to make an eSignature for the Current Tax Return Pdf Form 1040 Us Individual Income on iOS devices

How to generate an electronic signature for the Current Tax Return Pdf Form 1040 Us Individual Income on Android devices

People also ask

-

How can airSlate SignNow help me with my 2019 taxes?

airSlate SignNow simplifies the process of signing and sending documents, which is crucial for managing your 2019 taxes. You can easily gather necessary signatures on tax forms, ensuring everything is processed smoothly and efficiently. This feature is particularly beneficial for freelancers and businesses looking to maintain accurate tax documentation.

-

What features does airSlate SignNow offer for handling 2019 tax documents?

With airSlate SignNow, you can create templates for your 2019 tax documents, automate workflows, and securely store your files. These features save you time and ensure that your tax documentation is organized and easily accessible. Additionally, you can track the status of all your documents in real time.

-

Is airSlate SignNow cost-effective for managing 2019 taxes?

Yes, airSlate SignNow is a cost-effective solution for handling your 2019 taxes. With various pricing plans to fit different budgets, you can choose the best option that meets your needs without sacrificing functionality. This affordability is especially appealing for small businesses and individuals preparing their taxes.

-

Can I integrate airSlate SignNow with my accounting software for 2019 taxes?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage your 2019 taxes. This compatibility enables you to streamline your tax preparation process, so you can save time and reduce the risk of errors when filing your taxes.

-

What are the benefits of using airSlate SignNow for my 2019 taxes?

Using airSlate SignNow for your 2019 taxes provides numerous benefits, including faster document turnaround times and improved organization. You can easily request signatures and keep track of deadlines without the clutter of paper forms. Additionally, digital records help ensure compliance with tax regulations.

-

How secure is airSlate SignNow for storing 2019 tax documents?

airSlate SignNow prioritizes security, offering encrypted solutions for storing your 2019 tax documents. This means your sensitive information remains safe, protecting you and your clients from data bsignNowes. With robust security features, you can focus on your taxes without worrying about document safety.

-

Is airSlate SignNow user-friendly for managing 2019 taxes?

Yes, airSlate SignNow is designed to be user-friendly, making it simple to manage your 2019 taxes. The intuitive interface allows users of all skill levels to navigate the platform with ease. You can quickly learn how to send and eSign documents, making tax season less stressful.

Get more for Irs Tax Forms

- Mad river application form

- Nederland fire protection district form

- Chestertwp comresourcesdocumentsan equal opportunity employer application chestertwp com form

- Www rittman k12 oh ussitesrittmannew employee payroll packets rittman high school form

- Employee emergency information contact form

- Arlington urgent care inc application for employment form

- Fillable online springdale download application forms in

- Marksman security application form online 611275019

Find out other Irs Tax Forms

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo