Irs Form 433 a Oic

What is the IRS Form 433-A OIC?

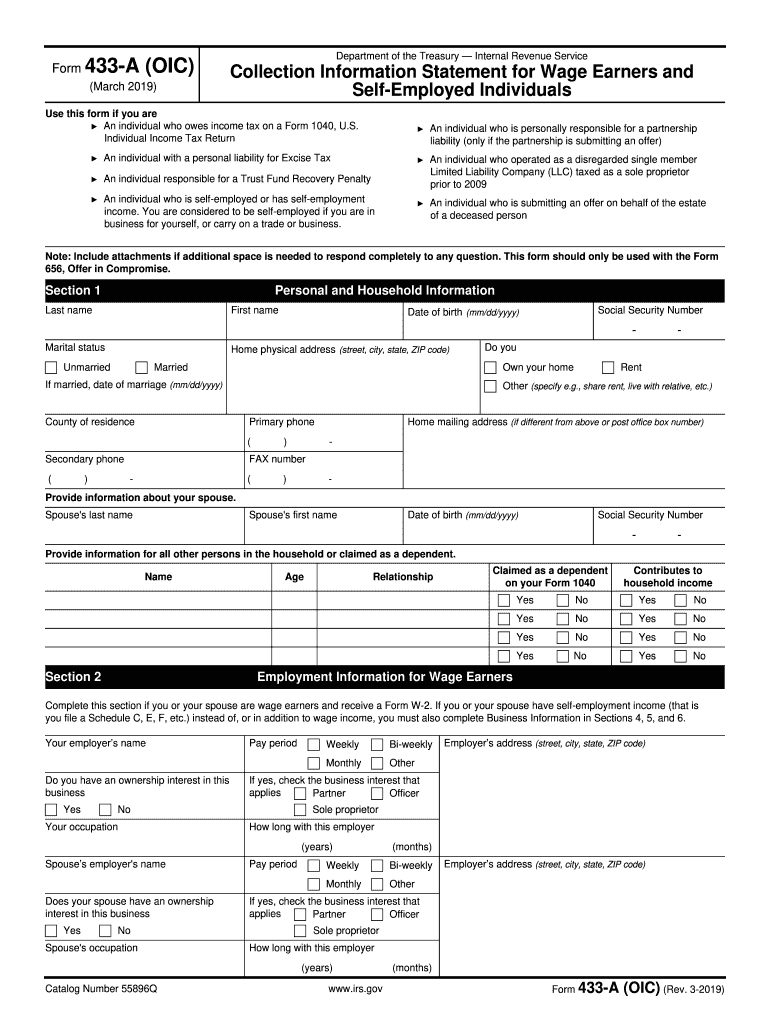

The IRS Form 433-A OIC, also known as the Collection Information Statement for Wage Earners and Self-Employed Individuals, is a crucial document used by taxpayers to apply for an Offer in Compromise (OIC). This form provides the IRS with a comprehensive overview of an individual's financial situation, including income, expenses, assets, and liabilities. By submitting this form, taxpayers can propose a settlement amount that is less than the total tax debt owed, based on their ability to pay. Understanding the purpose and requirements of the 433-A OIC is essential for anyone considering this option to resolve their tax liabilities.

Steps to Complete the IRS Form 433-A OIC

Completing the IRS Form 433-A OIC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including pay stubs, bank statements, and information about any assets. Next, fill out the form by providing detailed information about your income, expenses, and assets. It is important to be thorough and honest in your disclosures, as inaccuracies can lead to delays or denials. Once completed, review the form for any errors before submitting it to the IRS. Ensure that you include any required supporting documents to strengthen your application.

Legal Use of the IRS Form 433-A OIC

The IRS Form 433-A OIC is legally binding when it is completed and submitted according to IRS guidelines. This means that the information provided must be truthful and accurate, as any misrepresentation can lead to penalties or legal consequences. The form is designed to facilitate negotiations between the taxpayer and the IRS, allowing for a potential reduction in tax liability. By adhering to the legal requirements and ensuring all information is correct, taxpayers can utilize this form effectively to seek relief from their tax debts.

Eligibility Criteria for the IRS Form 433-A OIC

To qualify for submitting the IRS Form 433-A OIC, taxpayers must meet specific eligibility criteria. Generally, individuals must demonstrate that they cannot pay their full tax liability and that settling for a lesser amount is in the best interest of both parties. Additionally, taxpayers must be current with all filing and payment requirements, meaning all tax returns must be filed and any required estimated payments must be made. Understanding these criteria is vital for determining if pursuing an OIC is a feasible option.

Required Documents for the IRS Form 433-A OIC

When submitting the IRS Form 433-A OIC, certain documents are required to support the application. These typically include proof of income, such as pay stubs or profit and loss statements for self-employed individuals. Additionally, you may need to provide documentation of monthly expenses, including housing costs, utilities, and other necessary living expenses. Supporting documents that detail assets, such as bank statements and property valuations, are also essential. Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods for the IRS Form 433-A OIC

The IRS Form 433-A OIC can be submitted through various methods, depending on the taxpayer's preference. The most common submission method is by mail, where the completed form and supporting documents are sent to the appropriate IRS address. Additionally, some taxpayers may choose to submit the form electronically through authorized e-file providers. It is important to ensure that the submission method chosen is in compliance with IRS guidelines to avoid any processing delays.

Quick guide on how to complete form 433 a oic rev 3 2019 collection information statement for wage earners and

Handle Irs Form 433 A Oic effortlessly on any gadget

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly option to conventional printed and signed paperwork, as you can locate the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly without delays. Work with Irs Form 433 A Oic on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

The simplest way to alter and eSign Irs Form 433 A Oic without hassle

- Locate Irs Form 433 A Oic and then click Get Form to begin.

- Utilize the tools we supply to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 433 A Oic and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic rev 3 2019 collection information statement for wage earners and

How to make an electronic signature for your Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And in the online mode

How to create an eSignature for your Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And in Google Chrome

How to create an electronic signature for putting it on the Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And in Gmail

How to make an electronic signature for the Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And from your smart phone

How to generate an electronic signature for the Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And on iOS devices

How to generate an eSignature for the Form 433 A Oic Rev 3 2019 Collection Information Statement For Wage Earners And on Android devices

People also ask

-

What is a fillable 2019 433a form?

The fillable 2019 433a form is a financial statement used to provide details about an individual's financial situation. This form is essential for debt relief and financial assessments. Using airSlate SignNow, you can easily fill, sign, and send your 2019 433a form securely.

-

How can I create a fillable 2019 433a using airSlate SignNow?

Creating a fillable 2019 433a form with airSlate SignNow is straightforward. You can upload a blank 2019 433a document, use our intuitive editing tools to add fillable fields, and then streamline the signing process. This functionality ensures your form is completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for filling out 2019 433a forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to fill out and eSign documents like the 2019 433a form. Our pricing plans are designed to meet diverse business needs, ensuring that you can manage your documentation efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing fillable 2019 433a forms?

AirSlate SignNow provides several features for managing fillable 2019 433a forms, including customizable templates, real-time collaboration, and automated workflows. These features streamline your process and enhance document security, making it easier to complete and send your forms swiftly.

-

Can I integrate airSlate SignNow with other software to handle fillable 2019 433a forms?

Absolutely! AirSlate SignNow integrates seamlessly with various software to manage your fillable 2019 433a forms effectively. Whether you use CRM systems, cloud storage, or other document management tools, our integrations facilitate a smoother workflow.

-

What are the benefits of using airSlate SignNow for fillable 2019 433a forms?

Using airSlate SignNow for fillable 2019 433a forms offers numerous benefits including enhanced accuracy, faster turnaround times, and improved compliance. This platform simplifies the eSignature process, ensuring you can manage your forms efficiently and securely.

-

Is it secure to eSign a fillable 2019 433a form with airSlate SignNow?

Yes, security is a top priority when using airSlate SignNow. Our platform utilizes advanced encryption standards and authentication methods to ensure that your fillable 2019 433a forms are signed and stored safely, protecting your sensitive information.

Get more for Irs Form 433 A Oic

- Ohio franklin county township form

- Position applied for partime volunteer form

- Position applying for firefighter volunteer part time applicant form

- Fire department collaborative cities of clayton union form

- South kensington fire department berlin ct address and form

- Uc 217 rev form

- Www berlinct govegovdocumentsapplication for employment home berlin ct form

- Promise of employment letter sample form

Find out other Irs Form 433 A Oic

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online