Irs Form 4562 PDF

What is the IRS Form 4562?

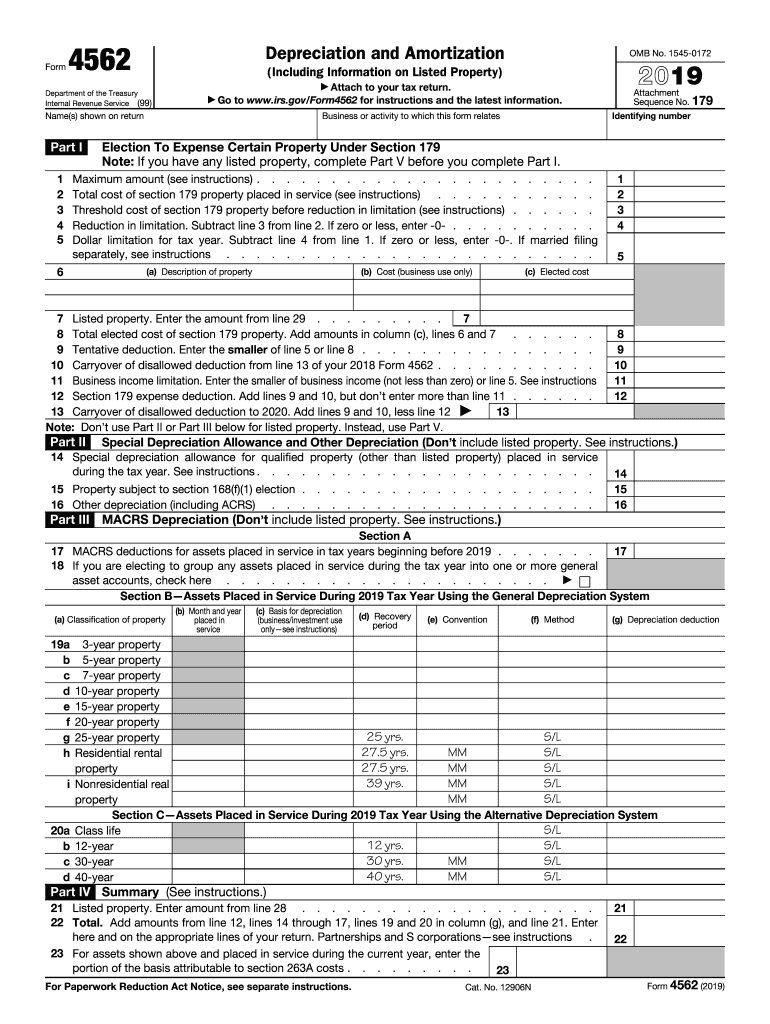

The IRS Form 4562, officially known as the Depreciation and Amortization form, is used by businesses to claim deductions for depreciation of property and amortization of certain intangible assets. This form is essential for reporting the depreciation of assets such as machinery, vehicles, and buildings, which can significantly reduce taxable income. The form allows taxpayers to detail the assets being depreciated, the method of depreciation used, and any applicable Section 179 deductions. Understanding the nuances of Form 4562 is crucial for accurate tax reporting and maximizing potential deductions.

Steps to Complete the IRS Form 4562

Completing the IRS Form 4562 involves several key steps. First, gather all necessary documentation regarding the assets you plan to depreciate. This includes purchase dates, costs, and the method of depreciation you intend to use. Next, fill out Part I of the form, which focuses on the Section 179 deduction. Here, you will list qualifying property and the total deduction claimed. Then, proceed to Part II to report the depreciation for property placed in service during the year. Make sure to use the correct IRS depreciation tables for 2019 to calculate the depreciation amounts accurately. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal Use of the IRS Form 4562

The legal use of IRS Form 4562 is governed by IRS guidelines, which stipulate that it must be filed accurately and on time to claim depreciation and amortization deductions. It is important to ensure that all information provided is truthful and substantiated by proper documentation. Failing to comply with IRS regulations can result in penalties or disallowance of deductions. Businesses should maintain records of all assets and the calculations used for depreciation, as these may be required in the event of an audit.

Filing Deadlines and Important Dates

Filing deadlines for IRS Form 4562 align with the overall tax filing deadlines for businesses. Typically, the form must be submitted with your annual tax return, which is due on April fifteenth for most businesses. If your business operates on a fiscal year, the deadline will correspond to the end of that fiscal year. It is crucial to stay aware of these dates to avoid late filing penalties and ensure that you can claim all eligible deductions.

Examples of Using the IRS Form 4562

IRS Form 4562 can be utilized in various scenarios. For instance, a small business purchasing new equipment can use the form to claim depreciation on that equipment over its useful life. Additionally, if a business invests in a vehicle for business purposes, it can report the depreciation of that vehicle on Form 4562. Another example includes businesses that acquire intangible assets, such as patents or trademarks, which can also be amortized using this form. Each of these examples highlights the importance of accurately reporting asset depreciation to maximize tax benefits.

Required Documents for IRS Form 4562

To successfully complete IRS Form 4562, certain documents are necessary. These include purchase invoices or receipts for the assets being depreciated, documentation of the asset's useful life, and any prior depreciation schedules if applicable. Additionally, businesses should have records of any Section 179 elections made in previous years, as well as any relevant IRS publications that provide guidance on depreciation methods. Having these documents organized will facilitate the accurate completion of the form and support claims made during tax filing.

Quick guide on how to complete 2017 form 4562 internal revenue service

Prepare Irs Form 4562 Pdf effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Irs Form 4562 Pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Irs Form 4562 Pdf easily

- Obtain Irs Form 4562 Pdf and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your document, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 4562 Pdf and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 4562 internal revenue service

How to generate an eSignature for the 2017 Form 4562 Internal Revenue Service in the online mode

How to make an eSignature for the 2017 Form 4562 Internal Revenue Service in Chrome

How to create an eSignature for signing the 2017 Form 4562 Internal Revenue Service in Gmail

How to create an eSignature for the 2017 Form 4562 Internal Revenue Service right from your mobile device

How to make an eSignature for the 2017 Form 4562 Internal Revenue Service on iOS devices

How to make an electronic signature for the 2017 Form 4562 Internal Revenue Service on Android

People also ask

-

What are the 4562 instructions 2019 for eSigning documents?

The 4562 instructions 2019 outline the requirements for electronically signing tax documents, ensuring compliance with IRS regulations. Using airSlate SignNow simplifies this process, allowing users to easily eSign and manage their documents while adhering to the 4562 instructions 2019.

-

How does airSlate SignNow help with the 4562 instructions 2019?

airSlate SignNow provides tools that streamline the eSigning process, enabling users to follow the 4562 instructions 2019 effortlessly. Our platform ensures secure, legally binding signatures, which are crucial when dealing with tax-related documents as per the 4562 instructions 2019.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our pricing options allow users to access features that support compliance with the 4562 instructions 2019 without breaking the budget.

-

What features does airSlate SignNow include for document management?

airSlate SignNow includes robust features such as template creation, document tracking, and advanced security measures. These features help businesses efficiently manage their documents in line with the 4562 instructions 2019.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow seamlessly integrates with popular software tools like Google Workspace, Salesforce, and Microsoft Office. This integration ensures that all workflows remain compliant with the 4562 instructions 2019, streamlining operations across various platforms.

-

What benefits does eSigning provide compared to traditional signing methods?

eSigning through airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times, and lower paper costs. By complying with the 4562 instructions 2019, users can confidently utilize these benefits in their document workflows.

-

Is airSlate SignNow compliant with legal regulations?

Absolutely! airSlate SignNow is fully compliant with Electronic Signatures in Global and National Commerce (ESIGN) Act and UETA laws. This compliance assures users that their eSigns adhere to all stipulations, including the 4562 instructions 2019.

Get more for Irs Form 4562 Pdf

- Wkc 13 a e wage information supplementwkc 13 a e wage information supplementwc forms listwc forms list

- Town of barre employment form

- Were hiring have you brimfield ma fire department form

- Vacation request letter how to write with format ampamp samplesvacation request letter how to write with format ampamp

- City of coeur dalene application and recruitment process form

- Www ketchumidaho org sites defaultcity of ketchum form

- Page 1 campbell county fire department 106 rohan avenue form

- Absconded worker form doc

Find out other Irs Form 4562 Pdf

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template