Schedule D Form

What is the Schedule D

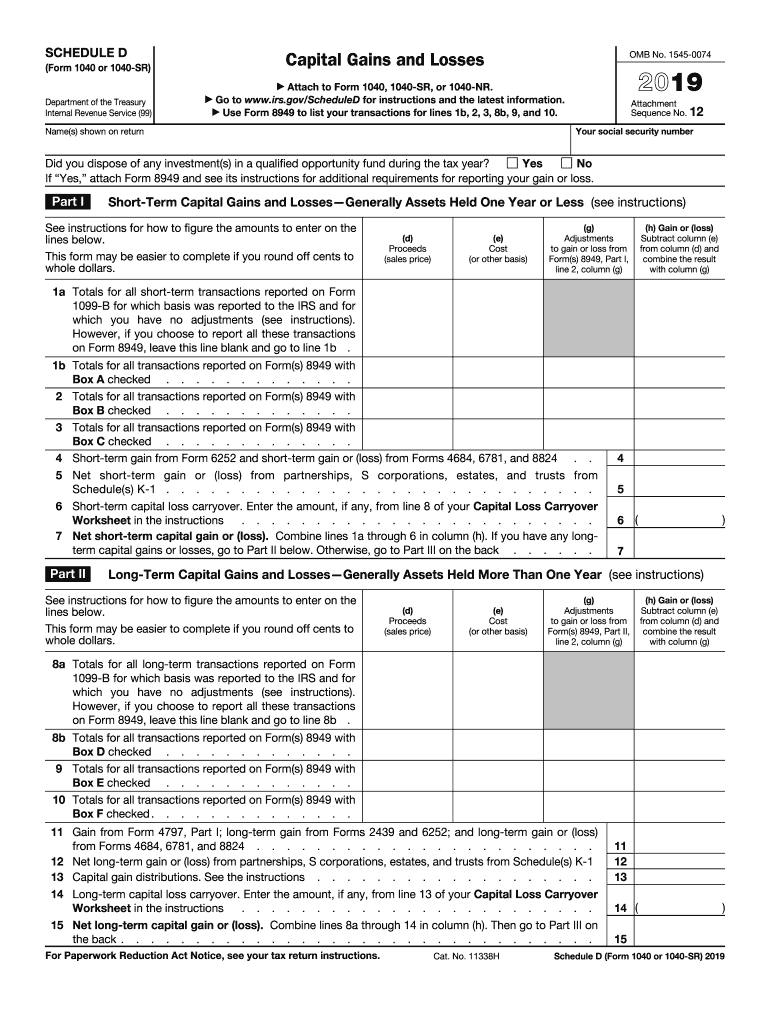

The Schedule D is a tax form used by individuals in the United States to report capital gains and losses from the sale of securities or assets. This form is an integral part of the 2019 federal tax return process, particularly for those who have engaged in investment activities throughout the year. It allows taxpayers to calculate their net capital gain or loss, which is then transferred to the main 1040 form. Understanding the Schedule D is essential for accurately reporting investment income and complying with IRS regulations.

How to use the Schedule D

To effectively use the Schedule D, taxpayers must first gather all relevant financial documents, including records of stock purchases, sales, and any dividends received. The form requires detailed information about each transaction, such as the date of acquisition, date of sale, proceeds from the sale, and the cost basis of the asset. Taxpayers will categorize their transactions into short-term and long-term gains or losses, depending on how long they held the asset before selling. This categorization is crucial as it affects the tax rate applied to the gains.

Steps to complete the Schedule D

Completing the Schedule D involves several steps:

- Gather all necessary documentation related to capital gains and losses.

- Fill out Part I for short-term capital gains and losses, listing each transaction.

- Complete Part II for long-term capital gains and losses, ensuring accurate categorization.

- Calculate total gains and losses for both parts and determine the net capital gain or loss.

- Transfer the net amount to the appropriate line on the 1040 form.

It is important to double-check all entries for accuracy to avoid potential issues with the IRS.

Legal use of the Schedule D

The legal use of the Schedule D hinges on compliance with IRS regulations. Taxpayers must ensure that all information reported is accurate and complete to avoid penalties. Electronic filing of the Schedule D is permitted, provided that the eSignature used meets the legal standards outlined in the ESIGN Act and UETA. Using a reliable platform for electronic signatures can enhance the legal validity of the submitted documents.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D, including instructions on how to report various types of capital gains and losses. Taxpayers should refer to the IRS instructions for the Schedule D to understand the nuances of reporting, including how to handle wash sales and special rules for certain assets. Following these guidelines is essential for ensuring compliance and minimizing the risk of audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D align with the overall tax return deadlines. For the 2019 tax year, the deadline for filing the 1040 form, along with the Schedule D, is typically April 15 of the following year. Taxpayers should also be aware of any extensions that may apply, as well as the implications of late filing. Staying informed about these dates is crucial for timely and accurate tax reporting.

Required Documents

To complete the Schedule D, taxpayers must have several key documents on hand, including:

- Brokerage statements detailing all transactions.

- Records of purchase prices and dates for each asset sold.

- Any relevant documentation related to dividends or interest earned.

- Previous year’s tax returns, if applicable, for reference on carryover losses.

Having these documents readily available will streamline the process of completing the Schedule D and help ensure accuracy in reporting.

Quick guide on how to complete federal form 1040 us individual income tax return

Effortlessly Prepare Schedule D on Any Device

Digital document management has gained popularity among corporations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right template and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Schedule D on any device using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Modify and eSign Schedule D with Ease

- Obtain Schedule D and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Mark signNow sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal authority as a traditional pen-and-ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule D to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal form 1040 us individual income tax return

How to create an eSignature for your Federal Form 1040 Us Individual Income Tax Return in the online mode

How to create an eSignature for your Federal Form 1040 Us Individual Income Tax Return in Google Chrome

How to generate an electronic signature for signing the Federal Form 1040 Us Individual Income Tax Return in Gmail

How to create an eSignature for the Federal Form 1040 Us Individual Income Tax Return from your smartphone

How to generate an electronic signature for the Federal Form 1040 Us Individual Income Tax Return on iOS devices

How to make an eSignature for the Federal Form 1040 Us Individual Income Tax Return on Android OS

People also ask

-

What is the schedule d 2019 pdf and why is it important?

The schedule d 2019 pdf is a document used to report capital gains and losses for the tax year 2019. It is important for taxpayers to accurately complete this form to ensure compliance and potentially minimize their tax liabilities.

-

How can airSlate SignNow help in filling out the schedule d 2019 pdf?

airSlate SignNow provides an intuitive platform that allows users to complete and eSign the schedule d 2019 pdf electronically. With its user-friendly features, businesses can streamline the document preparation process, saving time and reducing errors.

-

What are the pricing plans for airSlate SignNow when managing tax documents like the schedule d 2019 pdf?

airSlate SignNow offers a variety of pricing plans designed to accommodate different business needs, including features for eSigning the schedule d 2019 pdf. Pricing is scalable, starting from a basic plan to advanced features for larger organizations, ensuring businesses can find a cost-effective solution.

-

Can I integrate airSlate SignNow with other software to manage the schedule d 2019 pdf?

Yes, airSlate SignNow offers integrations with a variety of third-party applications, allowing users to manage the schedule d 2019 pdf within their existing workflows. This seamless integration enhances productivity by enabling easy document sharing and storage across platforms.

-

What features does airSlate SignNow provide to enhance the signing of the schedule d 2019 pdf?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure cloud storage, all of which enhance the eSigning experience for documents like the schedule d 2019 pdf. These features ensure that signatures are captured efficiently and securely.

-

Is it secure to eSign the schedule d 2019 pdf with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security and compliance, providing a safe environment for eSigning the schedule d 2019 pdf. With encryption and authentication protocols in place, users can be confident that their sensitive tax information is protected.

-

How does airSlate SignNow compare to other eSignature solutions for the schedule d 2019 pdf?

airSlate SignNow stands out among eSignature solutions with its unique combination of affordability, ease of use, and robust features for documents like the schedule d 2019 pdf. Many users appreciate its comprehensive set of tools designed specifically for business needs.

Get more for Schedule D

Find out other Schedule D

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document