Schedule C Form

What is the Schedule C

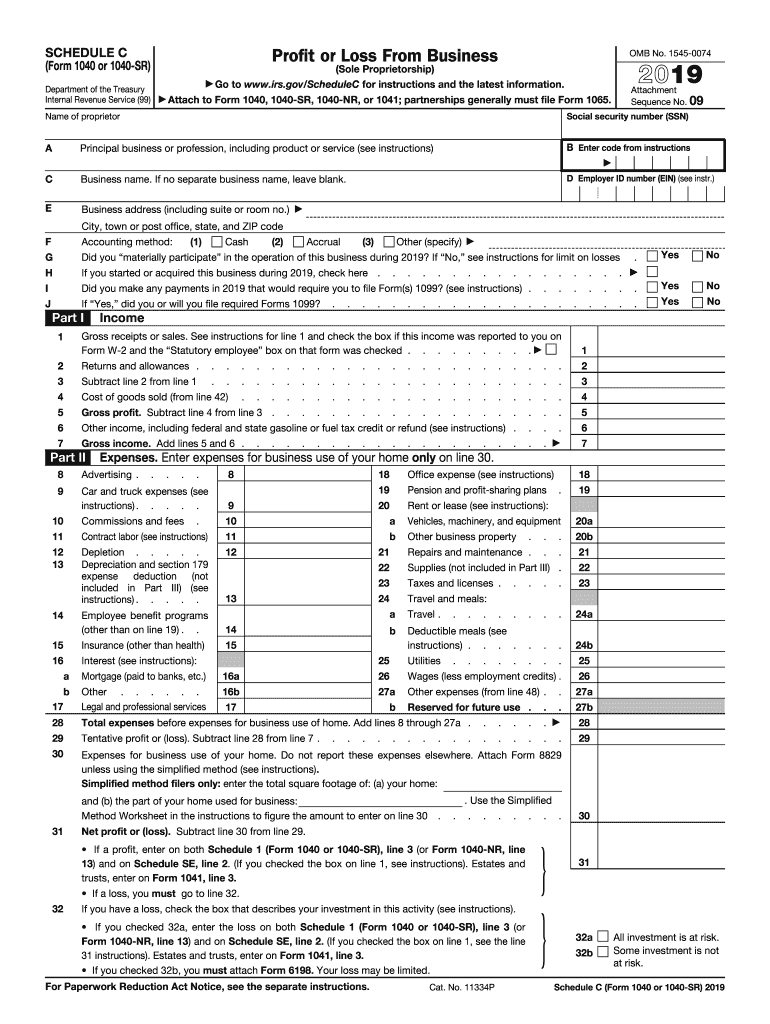

The Schedule C form, officially known as the Profit or Loss from Business, is a crucial document for self-employed individuals in the United States. It is used to report income and expenses related to a business operated as a sole proprietorship. This form is filed with the IRS as part of the individual’s tax return, typically on Form 1040. Understanding the Schedule C is essential for accurately reporting earnings, claiming deductions, and ensuring compliance with tax obligations.

How to use the Schedule C

Using the Schedule C involves several steps to accurately report your business income and expenses. First, gather all relevant financial documents, including receipts, invoices, and bank statements. Next, complete the form by entering your business income in Part I, followed by your business expenses in Part II. Common expenses include costs for supplies, utilities, and advertising. After filling out the form, calculate your net profit or loss, which will be transferred to your Form 1040. Ensure that all information is accurate to avoid issues with the IRS.

Steps to complete the Schedule C

Completing the Schedule C requires careful attention to detail. Follow these steps:

- Gather Documentation: Collect all income and expense records related to your business.

- Fill Out Business Information: Provide details such as your business name, address, and the type of business.

- Report Income: Enter total income earned from your business in Part I.

- List Expenses: Document all business-related expenses in Part II, categorizing them appropriately.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss.

- Transfer to Form 1040: Report the net figure on your individual tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C. It is important to follow these instructions to ensure compliance and avoid penalties. The IRS outlines acceptable business expenses, record-keeping requirements, and how to handle specific situations, such as business use of personal assets. Familiarizing yourself with these guidelines will help you accurately report your business activities and maximize potential deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C align with the individual tax return deadlines. Typically, the deadline for submitting your Form 1040, along with the Schedule C, is April 15 of the following year. If you need additional time, you can file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates is essential for maintaining compliance with IRS regulations.

Legal use of the Schedule C

The Schedule C is legally binding and must be completed accurately to reflect your business activities. Misreporting income or expenses can lead to audits, penalties, and interest charges from the IRS. It is crucial to maintain accurate records and ensure that all information reported on the Schedule C is truthful and complete. Utilizing reliable electronic tools, like signNow, can help streamline the process and ensure that your documents meet legal standards.

Quick guide on how to complete schedules for form 1040internal revenue service

Complete Schedule C effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule C on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Schedule C without hassle

- Locate Schedule C and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you choose. Modify and eSign Schedule C and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedules for form 1040internal revenue service

How to create an electronic signature for your Schedules For Form 1040internal Revenue Service in the online mode

How to make an electronic signature for your Schedules For Form 1040internal Revenue Service in Google Chrome

How to make an electronic signature for signing the Schedules For Form 1040internal Revenue Service in Gmail

How to generate an electronic signature for the Schedules For Form 1040internal Revenue Service straight from your smartphone

How to create an eSignature for the Schedules For Form 1040internal Revenue Service on iOS devices

How to make an eSignature for the Schedules For Form 1040internal Revenue Service on Android

People also ask

-

What is a 2019 Schedule C worksheet?

A 2019 Schedule C worksheet is a form used by sole proprietors to report income and expenses from their business. This worksheet helps you keep track of your financial performance and is essential for preparing your tax return accurately. Utilizing tools such as airSlate SignNow can streamline the process of gathering and eSigning the necessary documents.

-

How can airSlate SignNow assist with my 2019 Schedule C worksheet?

airSlate SignNow offers a user-friendly platform designed to help you efficiently send and eSign your documents. By utilizing our service, you can easily manage your 2019 Schedule C worksheet electronically, allowing for quicker preparation and submission of your tax forms. This efficiency can save you both time and hassle, ensuring accurate tax reporting.

-

Is there a cost associated with using airSlate SignNow to manage my 2019 Schedule C worksheet?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features designed to simplify the management of your 2019 Schedule C worksheet and other documentation processes. We provide a cost-effective solution to help you eSign your documents without impacting your budget.

-

What features does airSlate SignNow offer for handling tax-related documents like the 2019 Schedule C worksheet?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and automated reminders, making it ideal for handling tax documents like the 2019 Schedule C worksheet. These features streamline the workflow and ensure that all parties involved in the signing process stay informed. Experience seamless document management for all your tax needs.

-

Can I integrate airSlate SignNow with accounting software for my 2019 Schedule C worksheet?

Absolutely! airSlate SignNow integrates with various accounting software platforms, which allows seamless data transfer when working on your 2019 Schedule C worksheet. These integrations enhance efficiency, enabling you to sync your documents and financial information directly. This integration ensures that your data remains organized and up to date.

-

What are the benefits of using airSlate SignNow for the 2019 Schedule C worksheet?

The primary benefits of using airSlate SignNow for your 2019 Schedule C worksheet include increased efficiency, enhanced accuracy, and ease of use. Our platform simplifies the document signing process, allowing you to focus on your business operations while ensuring compliance with tax regulations. Whether you are a freelancer or a small business owner, our solution will help you manage your documents with confidence.

-

How can I ensure the security of my 2019 Schedule C worksheet documents with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents by employing robust encryption methods and secure data storage practices. When handling your 2019 Schedule C worksheet, you can rest assured that your information is protected while in transit and at rest. Our commitment to security helps you focus on your business, knowing your data is safe.

Get more for Schedule C

Find out other Schedule C

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free