Form 3903

What is the Form 3903

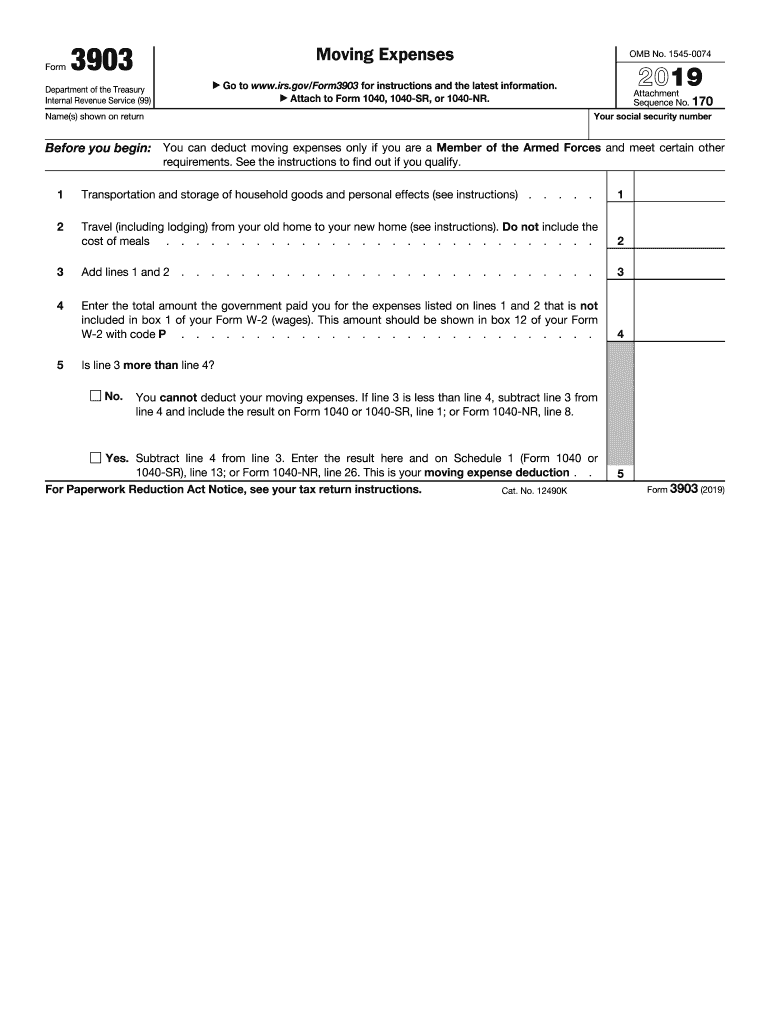

The 2019 Form 3903 is a tax form used by individuals to report moving expenses that qualify for deduction under the Internal Revenue Code. This form is particularly relevant for taxpayers who have moved due to a change in their job location or for other qualifying reasons. The IRS allows certain moving expenses to be deducted, which can help reduce the overall tax liability for the year. Understanding the specifics of this form is essential for ensuring compliance and maximizing potential deductions.

How to use the Form 3903

Using the 2019 Form 3903 involves several steps to accurately report moving expenses. Taxpayers must first determine their eligibility based on the IRS guidelines for moving expenses. Once eligibility is established, individuals should gather all necessary documentation, including receipts and invoices related to the move. The form requires detailed information about the moving expenses incurred, including transportation, storage, and travel costs. After completing the form, it should be submitted with the taxpayer’s annual tax return.

Steps to complete the Form 3903

Completing the 2019 Form 3903 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documentation, including receipts for moving expenses.

- Fill out personal information, including name, address, and Social Security number.

- Detail the moving expenses incurred, categorizing them as transportation, storage, or travel costs.

- Calculate the total deductible moving expenses and enter this amount on the form.

- Review the completed form for accuracy before submission.

Legal use of the Form 3903

The legal use of the 2019 Form 3903 hinges on compliance with IRS regulations regarding moving expense deductions. To ensure the form is legally valid, taxpayers must adhere to the guidelines set forth by the IRS, including eligibility criteria and the types of expenses that can be deducted. It is essential to maintain accurate records and documentation to support the claims made on the form, as this can be vital in the event of an audit.

IRS Guidelines

The IRS provides specific guidelines for completing the 2019 Form 3903. Taxpayers should familiarize themselves with these guidelines to ensure compliance. Key points include understanding the types of moving expenses that qualify for deduction, the eligibility criteria based on job-related moves, and the importance of accurate record-keeping. The IRS also outlines the process for claiming these deductions, which is crucial for maximizing tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 Form 3903 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of the following year, unless an extension is filed. It is essential to keep track of these dates to avoid penalties and ensure timely submission of the form along with the tax return. Taxpayers should also be aware of any changes in deadlines that may occur due to special circumstances or IRS announcements.

Eligibility Criteria

To qualify for deductions reported on the 2019 Form 3903, taxpayers must meet specific eligibility criteria set by the IRS. Generally, these criteria include moving due to a job change, the distance of the move, and the time frame in which the move occurred. Understanding these criteria is crucial for taxpayers to determine if they can legitimately claim moving expenses and to avoid potential issues with the IRS.

Quick guide on how to complete 2019 form 3903 moving expenses

Prepare Form 3903 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents quickly without delays. Manage Form 3903 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Form 3903 with ease

- Obtain Form 3903 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 3903 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 3903 moving expenses

How to generate an electronic signature for your 2019 Form 3903 Moving Expenses online

How to create an eSignature for the 2019 Form 3903 Moving Expenses in Chrome

How to make an eSignature for putting it on the 2019 Form 3903 Moving Expenses in Gmail

How to create an electronic signature for the 2019 Form 3903 Moving Expenses from your mobile device

How to create an electronic signature for the 2019 Form 3903 Moving Expenses on iOS devices

How to create an electronic signature for the 2019 Form 3903 Moving Expenses on Android OS

People also ask

-

What is the 2019 3903 form, and why is it important?

The 2019 3903 form is used to claim business-related moving expenses on your tax returns. It's important as it helps professionals reduce their taxable income, maximizing their deductions effectively. By utilizing airSlate SignNow, you can easily eSign and file this form securely and quickly.

-

How can airSlate SignNow assist with completing the 2019 3903 form?

AirSlate SignNow simplifies the process of completing the 2019 3903 form by allowing you to enter your information directly onto the document. Our easy-to-use platform provides templates that ensure you don’t miss any critical fields while eSigning, making the process efficient and straightforward.

-

What are the pricing options for using airSlate SignNow with the 2019 3903 form?

AirSlate SignNow offers flexible pricing plans designed to meet the needs of all businesses, including those needing to manage the 2019 3903 form. Our pricing is competitive and transparent, ensuring that you only pay for what you use. We provide a free trial so you can explore our features before committing.

-

Are there any integrations available for streamlined eSigning of the 2019 3903 form?

Yes, airSlate SignNow integrates seamlessly with various applications, including document storage and project management tools, to enhance your workflow when dealing with the 2019 3903 form. These integrations allow for a more organized approach, helping you keep all your essential documents in one location.

-

What features make airSlate SignNow a better choice for handling the 2019 3903?

AirSlate SignNow provides a host of features to help users efficiently manage the 2019 3903 form. Key features include customizable templates, advanced security measures, and mobile access, allowing you to sign from anywhere. Our platform is designed to simplify document management and accelerate the eSigning process.

-

How can airSlate SignNow enhance compliance when using the 2019 3903 form?

Using airSlate SignNow ensures compliance with eSignature laws, making it a safe choice when submitting the 2019 3903 form electronically. Our platform keeps track of all signed documents, providing a clear audit trail that can be referenced if needed, thus enhancing your organization’s compliance practices.

-

Is customer support available for queries about the 2019 3903 form?

Absolutely! AirSlate SignNow offers dedicated customer support to assist users with any questions related to the 2019 3903 form. Whether you need help with eSigning or understanding the features of our platform, our knowledgeable support team is available via chat, email, or phone.

Get more for Form 3903

Find out other Form 3903

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document