Schedule B Form

What is the Schedule B

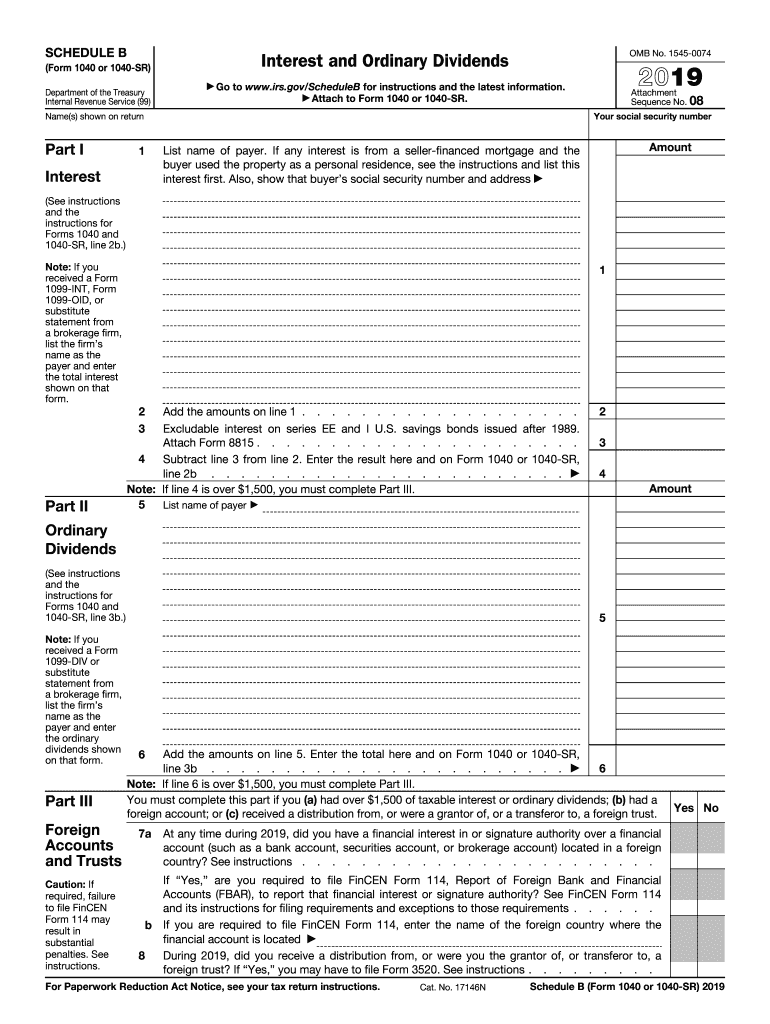

The Schedule B is a crucial form used by taxpayers in the United States to report interest and dividend income. Specifically, it is part of the Form 1040, which is the standard individual income tax return. Taxpayers must complete this form if they have received more than $1,500 in taxable interest or dividends during the tax year. The Schedule B also requires individuals to disclose any foreign accounts or trusts, ensuring compliance with IRS regulations regarding foreign income.

Steps to complete the Schedule B

Completing the Schedule B involves several key steps:

- Gather all necessary financial documents, including bank statements and brokerage statements that detail interest and dividend income.

- Fill in your name, Social Security number, and other identifying information at the top of the form.

- Report your interest income in Part I. List each source of interest income, including the amount received.

- In Part II, report dividend income. Similar to interest, list each source and the corresponding amount.

- If applicable, answer questions regarding foreign accounts and trusts, which may require additional disclosures.

- Review your entries for accuracy before submitting the form with your overall tax return.

Legal use of the Schedule B

The legal use of the Schedule B is essential for ensuring compliance with federal tax laws. When filling out the form, it is important to accurately report all interest and dividend income to avoid potential penalties. The IRS uses this information to verify income and assess tax liability. Failure to report income can lead to audits, fines, or other legal consequences. Using electronic tools, like signNow, can help ensure that your Schedule B is completed accurately and securely.

Filing Deadlines / Important Dates

For the tax year 2019, the deadline for filing the Form 1040, including the Schedule B, was April 15, 2020. If you filed for an extension, the extended deadline was October 15, 2020. It is crucial to adhere to these deadlines to avoid late fees and interest on unpaid taxes. Taxpayers should also be aware of any changes in deadlines for subsequent tax years as they can vary.

Examples of using the Schedule B

There are various scenarios where the Schedule B is applicable:

- A taxpayer who has multiple savings accounts earning interest will need to report each account's interest income on the Schedule B.

- Individuals receiving dividends from stocks or mutual funds must disclose these amounts to the IRS.

- If a taxpayer has foreign bank accounts that generate interest, they must report this income along with any relevant details about the accounts.

Required Documents

To complete the Schedule B accurately, taxpayers should gather the following documents:

- Bank statements showing interest earned.

- Brokerage statements detailing dividend income.

- Form 1099-INT for interest income and Form 1099-DIV for dividends received.

- Documentation for any foreign accounts, if applicable.

Quick guide on how to complete 2019 schedule b form 1040 or 1040 sr internal revenue

Effortlessly Prepare Schedule B on Any Device

The management of documents online has increasingly become favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling users to find the appropriate form and securely store it on the internet. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Schedule B seamlessly on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Schedule B Effortlessly

- Obtain Schedule B and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign Schedule B and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule b form 1040 or 1040 sr internal revenue

How to create an eSignature for the 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue online

How to make an electronic signature for your 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue in Google Chrome

How to generate an eSignature for putting it on the 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue in Gmail

How to generate an eSignature for the 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue right from your smartphone

How to create an electronic signature for the 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue on iOS devices

How to create an eSignature for the 2019 Schedule B Form 1040 Or 1040 Sr Internal Revenue on Android OS

People also ask

-

What is the 2019 schedule b and how does it relate to airSlate SignNow?

The 2019 schedule b is a tax form used to report foreign bank accounts and other financial assets. With airSlate SignNow, you can easily eSign and send documents related to your 2019 schedule b, streamlining your tax-filing process.

-

How can airSlate SignNow help with signing the 2019 schedule b?

AirSlate SignNow enables you to electronically sign your 2019 schedule b quickly and securely. Its intuitive interface allows for easy navigation, ensuring that your documents are signed and sent without hassle.

-

What are the pricing options for using airSlate SignNow for my 2019 schedule b?

AirSlate SignNow offers various pricing plans to cater to different business needs. Whether you're an individual or a company managing multiple 2019 schedule b forms, you can find a plan that delivers cost-effective solutions tailored to your needs.

-

Can I integrate airSlate SignNow with other tools for managing my 2019 schedule b?

Yes, airSlate SignNow supports integration with numerous applications, making it easier to manage your 2019 schedule b along with other documents. Popular integrations include Google Drive, Salesforce, and Dropbox, which can enhance your document workflow.

-

What security measures does airSlate SignNow have for documents like the 2019 schedule b?

AirSlate SignNow takes document security seriously, implementing robust measures such as encrypted eSignatures and secure document storage. This ensures that your 2019 schedule b and any sensitive information remain protected throughout the signing process.

-

Is airSlate SignNow user-friendly for handling the 2019 schedule b?

Absolutely! AirSlate SignNow is designed with a user-friendly interface that simplifies the process of handling the 2019 schedule b. Whether you're tech-savvy or new to digital tools, you will find it easy to navigate and execute document signing tasks.

-

What are the benefits of using airSlate SignNow for my 2019 schedule b?

By using airSlate SignNow, you can save time and improve efficiency when managing your 2019 schedule b. The platform offers quick turnaround for document signing, reduces paper use, and enhances overall productivity.

Get more for Schedule B

Find out other Schedule B

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free