Form 8812

What is the Form 8812

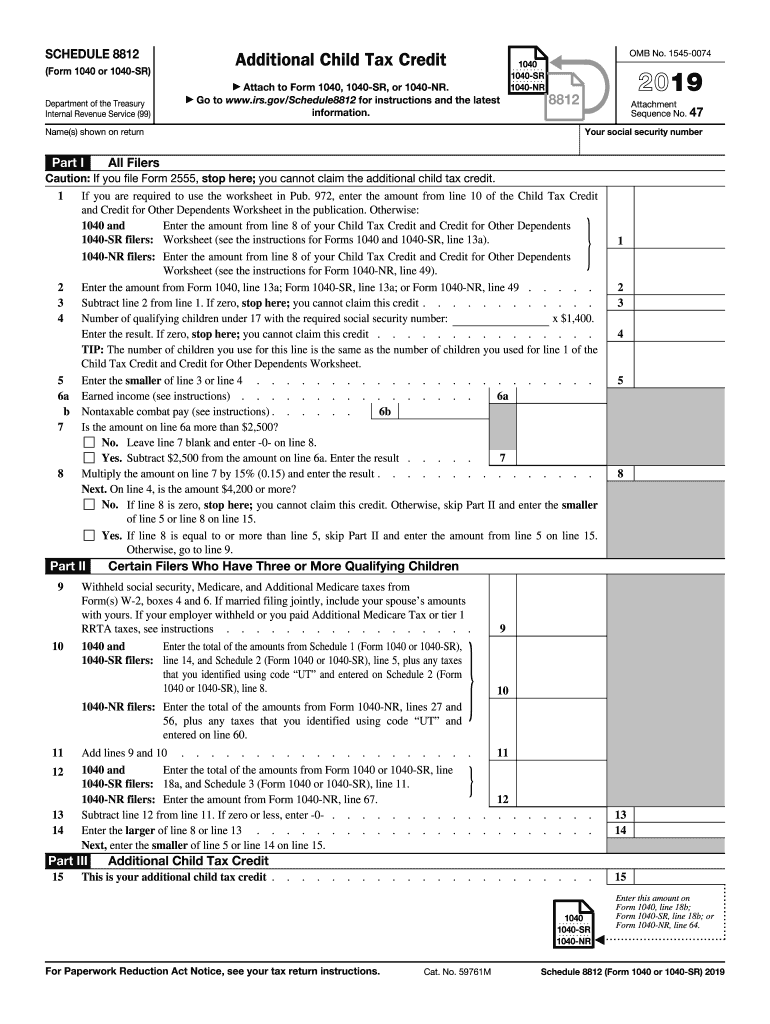

The Form 8812, also known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers to claim a refundable credit for qualifying children. This form allows families to receive a portion of the child tax credit even if they do not owe any federal income tax. The 2019 child tax credit amount can significantly benefit families, providing financial relief and supporting their overall tax situation. Understanding this form is essential for maximizing tax benefits related to dependents.

How to use the Form 8812

To use Form 8812, taxpayers must first determine their eligibility based on the number of qualifying children and their income level. The form requires information such as the taxpayer's filing status, the number of qualifying children, and the amount of the child tax credit being claimed. It is crucial to follow the IRS instructions carefully to ensure accurate completion. The form can be filled out electronically or printed for manual submission, depending on the taxpayer's preference.

Steps to complete the Form 8812

Completing Form 8812 involves several key steps:

- Gather necessary documents, including your tax return and information about your qualifying children.

- Fill out the personal information section, including your name, Social Security number, and filing status.

- Complete the section detailing your qualifying children, ensuring that you meet the eligibility criteria.

- Calculate the child tax credit and any additional credit you may be eligible for.

- Review the form for accuracy and completeness before submitting it with your tax return.

Eligibility Criteria

To qualify for the 2019 child tax credit, taxpayers must meet specific eligibility criteria. This includes having a qualifying child under the age of 17 at the end of the tax year, being a U.S. citizen or resident alien, and having a valid Social Security number for each qualifying child. Additionally, the taxpayer's income must fall below certain thresholds to claim the full credit. Understanding these criteria is essential for ensuring that you can take advantage of the credit available to you.

Required Documents

When preparing to fill out Form 8812, it is important to have the following documents on hand:

- Your completed tax return (Form 1040, 1040A, or 1040SR).

- Social Security numbers for yourself and your qualifying children.

- Any previous tax returns that may provide context for your current filing.

- Documentation of income, such as W-2 forms or 1099s, to determine eligibility based on income levels.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing your tax return, including Form 8812, was April 15, 2020. If you filed for an extension, the extended deadline was October 15, 2020. It is essential to be aware of these dates to avoid penalties and ensure timely processing of your tax return. Keeping track of filing deadlines helps in maximizing your potential tax credits and refunds.

Quick guide on how to complete 2019 schedule 8812 form 1040 or 1040sr additional child tax credit

Effortlessly Prepare Form 8812 on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 8812 on any device via airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Form 8812 with Ease

- Locate Form 8812 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 8812 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule 8812 form 1040 or 1040sr additional child tax credit

How to generate an eSignature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit in the online mode

How to create an eSignature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit in Chrome

How to create an electronic signature for signing the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit in Gmail

How to generate an electronic signature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit straight from your smart phone

How to generate an eSignature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit on iOS

How to create an electronic signature for the 2019 Schedule 8812 Form 1040 Or 1040sr Additional Child Tax Credit on Android devices

People also ask

-

What is the 2019 child tax credit and how does it work?

The 2019 child tax credit provides financial relief to eligible families by giving them a tax credit for each qualifying child under the age of 17. This credit helps reduce the overall tax liability and in many cases results in a refund. It's essential to understand eligibility requirements and how to claim this credit when filing your taxes.

-

How can I check if I'm eligible for the 2019 child tax credit?

Eligibility for the 2019 child tax credit primarily depends on your income level, filing status, and the number of qualifying children you have. You can check with the IRS guidelines or consult a tax professional to determine your eligibility. Gathering documents like Social Security numbers and income statements is crucial for this process.

-

What are the potential benefits of the 2019 child tax credit?

The 2019 child tax credit can provide signNow financial benefits, including reducing your taxable income and increasing your tax refund. For many families, this credit can offer up to $2,000 for each qualifying child, which can be a substantial benefit during tax season. Understanding how to leverage this credit can greatly impact your overall financial situation.

-

When is the deadline to claim the 2019 child tax credit?

To take advantage of the 2019 child tax credit, you'll need to file your tax return by the due date, which is typically April 15th of the following year. If you file for an extension, you may have until October 15th, but it's important to submit your return to access this credit. Filing early is recommended to ensure you receive any refund due.

-

How does the 2019 child tax credit affect my overall tax refund?

The 2019 child tax credit can directly increase your overall tax refund by reducing your tax liability. If your credit exceeds the amount you owe, you may receive the difference as a refund. Understanding how this credit interacts with other credits and deductions can help maximize your refund.

-

What documentation do I need to claim the 2019 child tax credit?

To claim the 2019 child tax credit, you'll need documents that provide proof of income and the age of your children, such as Social Security numbers and W-2 forms. Additionally, filing complete and accurate tax forms with the necessary information is crucial. Ensuring all documentation is in order will streamline the claiming process.

-

Can I amend my tax return to include the 2019 child tax credit?

Yes, if you initially filed your tax return without claiming the 2019 child tax credit, you can amend your return. The amendment process allows you to correct any errors and potentially receive a refund if you become eligible for the credit. You'll need to use Form 1040-X to make any changes and resubmit your tax return.

Get more for Form 8812

Find out other Form 8812

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement