Form1095b

What is the Form 1095-B?

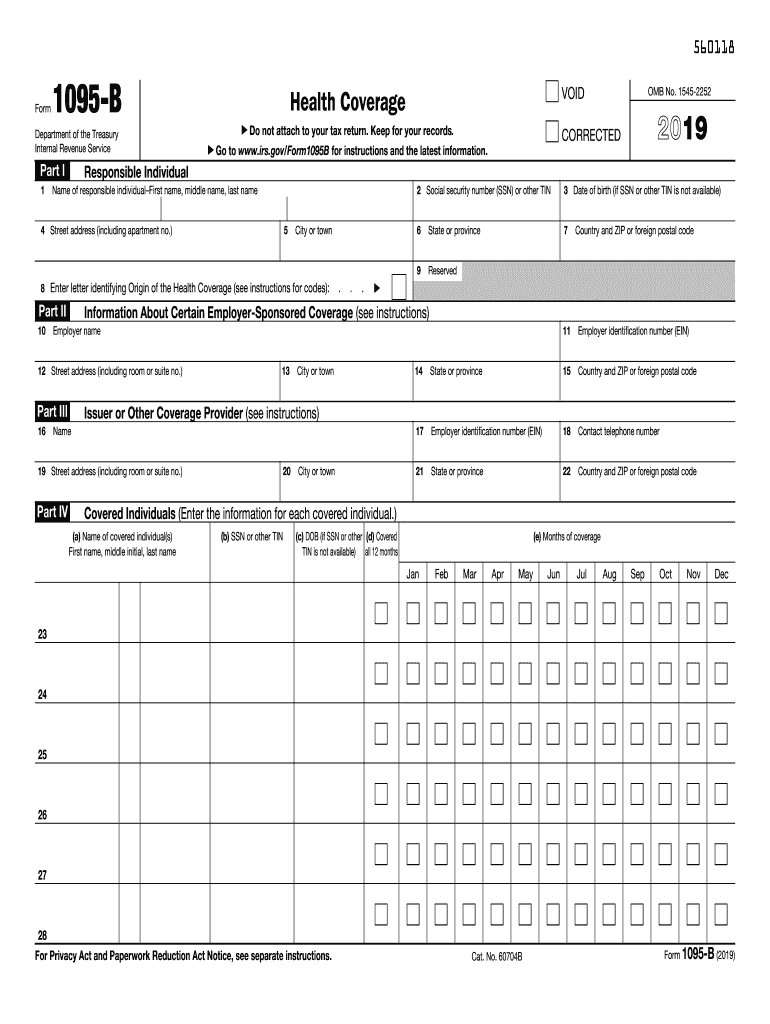

The IRS 2019 Form 1095-B is a tax form used to report information about health coverage. It is provided by health insurance providers to individuals and the IRS. This form serves as proof that an individual had minimum essential coverage during the tax year, which is essential for compliance with the Affordable Care Act (ACA). The form includes details such as the type of coverage, the months covered, and the name of the insured. Understanding this form is crucial for taxpayers to ensure they meet their health insurance requirements and avoid potential penalties.

How to Obtain the Form 1095-B

To obtain the 1095-B 2019 form, individuals can follow several methods. Health insurance providers typically send this form automatically to their clients. If you do not receive it, you can contact your insurance provider directly to request a copy. Additionally, some providers may offer electronic access to the form through their online portals. It is important to ensure you have this form before filing your federal tax return, as it provides necessary information regarding your health coverage.

Steps to Complete the Form 1095-B

Completing the form 2-B involves several key steps. First, gather all necessary information, including your personal details and coverage information. Next, fill out the form accurately, ensuring that all fields are completed, such as the name of the covered individuals, their Social Security numbers, and the months they were covered. After completing the form, review it for accuracy before submitting it to the IRS or keeping it for your records. Utilizing a digital platform can simplify this process, allowing for easy editing and signing.

Legal Use of the Form 1095-B

The legal use of the 1095-B 2019 form is primarily to verify compliance with health insurance mandates. It is essential for individuals to retain this form as it may be required when filing their tax returns. The form serves as evidence of health coverage, which can protect taxpayers from penalties associated with not having insurance. Furthermore, eSigning the form using a compliant digital platform ensures that it meets legal requirements, making it a valid document for tax purposes.

Filing Deadlines / Important Dates

For the 2019 tax year, the IRS typically requires that Form 1095-B be filed by the end of January of the following year. This means that you should expect to receive your form by January 31, 2020. It is important to keep track of these deadlines to ensure compliance and to avoid any potential penalties. If you are filing your tax return, you should have all necessary forms, including the 1095-B, ready by the tax filing deadline, which is usually April 15.

Key Elements of the Form 1095-B

The key elements of the IRS 1095-B form include several important sections. These sections typically consist of the name and address of the insurance provider, the name of the insured individuals, their Social Security numbers, and the months of coverage. Each section must be filled out accurately to ensure that the form is valid. Additionally, the form may include a unique identifier for the coverage, which is crucial for the IRS's records. Understanding these elements can help ensure that the form is completed correctly.

Quick guide on how to complete department of the treasury internal revenue service do not

Complete Form1095b effortlessly on any device

Digital document management has gained considerable traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly without delays. Manage Form1095b on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Form1095b with minimal effort

- Locate Form1095b and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or black out sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form1095b and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury internal revenue service do not

How to generate an electronic signature for the Department Of The Treasury Internal Revenue Service Do Not online

How to make an eSignature for your Department Of The Treasury Internal Revenue Service Do Not in Google Chrome

How to make an electronic signature for putting it on the Department Of The Treasury Internal Revenue Service Do Not in Gmail

How to generate an electronic signature for the Department Of The Treasury Internal Revenue Service Do Not from your mobile device

How to make an eSignature for the Department Of The Treasury Internal Revenue Service Do Not on iOS

How to create an eSignature for the Department Of The Treasury Internal Revenue Service Do Not on Android devices

People also ask

-

What is the purpose of the 1095 b 2019 form?

The 1095 b 2019 form is used to report health coverage information to the IRS. It provides details regarding whether an individual was covered by minimum essential health coverage for the year. Understanding this form is essential for compliance with the Affordable Care Act.

-

How can airSlate SignNow assist with the 1095 b 2019 form?

airSlate SignNow offers an efficient solution for sending and eSigning the 1095 b 2019 form. With our platform, businesses can easily manage document workflows, ensuring that forms are securely signed and sent on time, minimizing the risk of compliance issues.

-

What are the pricing options for using airSlate SignNow for the 1095 b 2019?

Our pricing for airSlate SignNow is designed to be both cost-effective and flexible. Depending on your business needs, we offer various plans that cater to different user requirements while providing access to essential features for handling the 1095 b 2019 form and other documents efficiently.

-

What features does airSlate SignNow provide for managing the 1095 b 2019 documents?

airSlate SignNow includes features like customizable templates, status tracking, and automated reminders, specifically for documents such as the 1095 b 2019. These tools streamline the signing process, making it easier for businesses to manage their compliance documentation efficiently.

-

How secure is airSlate SignNow when handling the 1095 b 2019 form?

Security is our top priority at airSlate SignNow. We use advanced encryption protocols and offer secure access controls to ensure that all transacted documents, including the 1095 b 2019, are protected from unauthorized access or data bsignNowes.

-

Can airSlate SignNow integrate with other systems for processing the 1095 b 2019?

Yes, airSlate SignNow has various integration capabilities with popular business applications. This means you can seamlessly process the 1095 b 2019 along with your existing systems, enhancing overall productivity and streamlining document workflow management.

-

What benefits can I expect from using airSlate SignNow for the 1095 b 2019?

Using airSlate SignNow for the 1095 b 2019 provides numerous benefits, including enhanced efficiency, reduced turnaround times, and improved compliance. Our platform simplifies the document signing process, allowing businesses to focus on what matters most—growing their operations.

Get more for Form1095b

Find out other Form1095b

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later