8829 Tax Form

What is the 8829 Tax Form

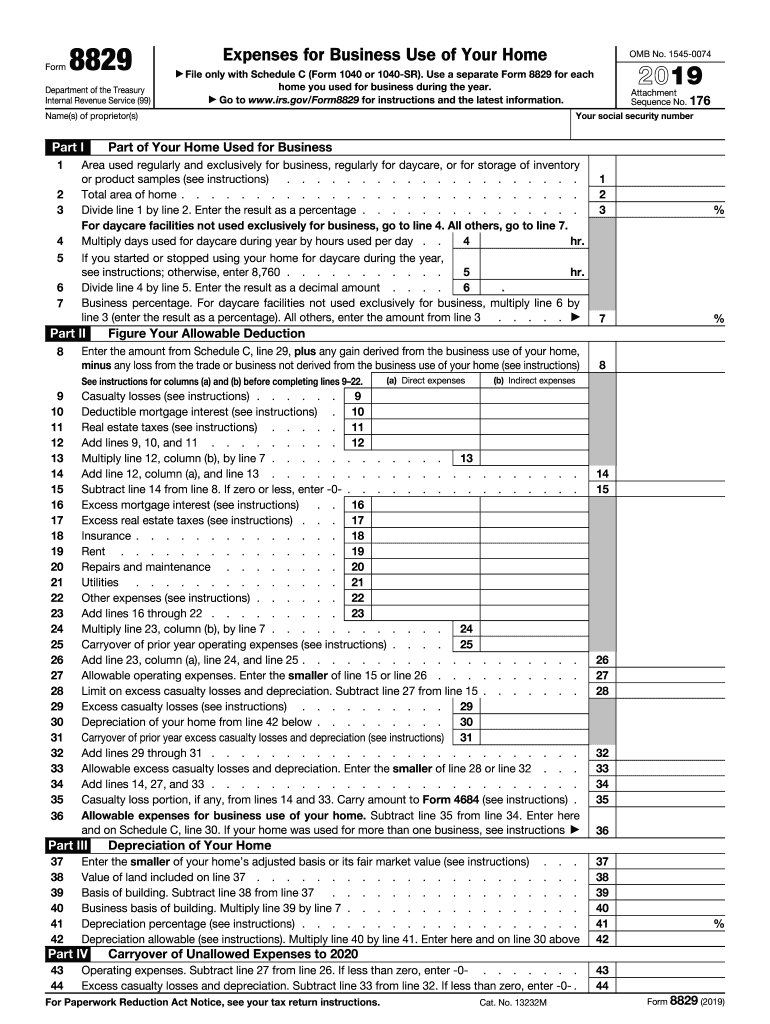

The 8829 Tax Form, officially known as the "Expenses for Business Use of Your Home," is a crucial document for taxpayers who wish to claim deductions related to the business use of their home. This form is specifically designed for self-employed individuals and small business owners who operate from their residences. By completing the 8829, taxpayers can detail their home office expenses, which may include a portion of rent or mortgage interest, utilities, repairs, and depreciation. Understanding this form is essential for maximizing tax deductions and ensuring compliance with IRS regulations.

How to use the 8829 Tax Form

Using the 8829 Tax Form involves several key steps to accurately report your home office expenses. First, gather all necessary documentation, including receipts for utilities, repairs, and any relevant mortgage statements. Next, determine the percentage of your home used exclusively for business purposes, as this will affect the deductions you can claim. The form requires detailed entries for various expenses, so ensure that each category is filled out correctly. After completing the form, it should be attached to your annual tax return, ensuring that all information aligns with your overall tax filings.

Steps to complete the 8829 Tax Form

Completing the 8829 Tax Form involves a systematic approach to ensure accuracy. Follow these steps:

- Determine the area of your home used for business, measuring square footage.

- Calculate the total square footage of your home.

- Divide the business area by the total area to find the business use percentage.

- List all eligible expenses, including mortgage interest, utilities, and repairs.

- Fill in the form with the calculated business use percentage and total expenses.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for using the 8829 Tax Form to ensure compliance and maximize deductions. Key points include the requirement that the business area must be used regularly and exclusively for business activities. Additionally, the IRS stipulates that taxpayers must maintain accurate records to substantiate their claims. Familiarizing yourself with these guidelines can help avoid potential issues during an audit and ensure that you are taking full advantage of available deductions.

Eligibility Criteria

To qualify for using the 8829 Tax Form, taxpayers must meet certain eligibility criteria. Primarily, the taxpayer must be self-employed or a small business owner who uses part of their home for business purposes. The space must be used regularly and exclusively for business activities. Additionally, the taxpayer must be able to substantiate their claims with proper documentation, including receipts and records of expenses. Understanding these criteria is essential for ensuring that your deductions are valid and compliant with IRS regulations.

Required Documents

When preparing to complete the 8829 Tax Form, several documents are essential to accurately report home office expenses. These include:

- Receipts for utilities, repairs, and maintenance.

- Mortgage statements or rental agreements.

- Records of any home improvements related to the business area.

- Documentation of the square footage of both the home and the business area.

Having these documents organized and readily available will streamline the process of completing the form and ensure that all claims are substantiated.

Quick guide on how to complete 2019 form 8829 expenses for business use of your home

Complete 8829 Tax Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to locate the needed form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage 8829 Tax Form across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign 8829 Tax Form with ease

- Obtain 8829 Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Alter and eSign 8829 Tax Form to guarantee excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8829 expenses for business use of your home

How to generate an electronic signature for your 2019 Form 8829 Expenses For Business Use Of Your Home in the online mode

How to create an eSignature for the 2019 Form 8829 Expenses For Business Use Of Your Home in Google Chrome

How to make an electronic signature for signing the 2019 Form 8829 Expenses For Business Use Of Your Home in Gmail

How to generate an eSignature for the 2019 Form 8829 Expenses For Business Use Of Your Home right from your smartphone

How to generate an eSignature for the 2019 Form 8829 Expenses For Business Use Of Your Home on iOS devices

How to create an eSignature for the 2019 Form 8829 Expenses For Business Use Of Your Home on Android

People also ask

-

What is the 2019 IRS Form 8829 used for?

The 2019 IRS Form 8829 is used by self-employed individuals to calculate and claim expenses for the business use of a home. It allows taxpayers to deduct certain home expenses related to their business, ensuring they maximize their savings on taxes.

-

How can airSlate SignNow help with the 2019 IRS Form 8829?

airSlate SignNow simplifies the process of managing documents like the 2019 IRS Form 8829 by allowing users to easily upload, eSign, and share forms securely. This helps streamline tax preparation and ensures that all necessary paperwork is handled accurately and efficiently.

-

What features does airSlate SignNow offer for filling out forms?

With airSlate SignNow, users can easily fill out the 2019 IRS Form 8829 and other documents with its user-friendly interface. Features include customizable templates, real-time collaboration, and backup options that enhance efficiency and accuracy in form completion.

-

Is airSlate SignNow affordable for small business owners handling the 2019 IRS Form 8829?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small business owners. Given the importance of accurately filing the 2019 IRS Form 8829, investing in an affordable solution like SignNow can save business owners money and time.

-

Can I integrate airSlate SignNow with other accounting tools for the 2019 IRS Form 8829?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax applications, making it easy to import and export data related to the 2019 IRS Form 8829. This integration helps ensure that all your financial records stay organized and accessible.

-

How does airSlate SignNow enhance document security for the 2019 IRS Form 8829?

Document security is a priority at airSlate SignNow. The platform employs advanced encryption and secure storage to protect your sensitive information, ensuring that your completed 2019 IRS Form 8829 and other documents remain confidential and safe from unauthorized access.

-

What benefits does airSlate SignNow provide for preparing the 2019 IRS Form 8829?

Using airSlate SignNow for the 2019 IRS Form 8829 offers several benefits, including ease of use, quick eSigning, and automatic data saving. These features help users efficiently prepare their forms without the hassle of traditional paperwork.

Get more for 8829 Tax Form

Find out other 8829 Tax Form

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast