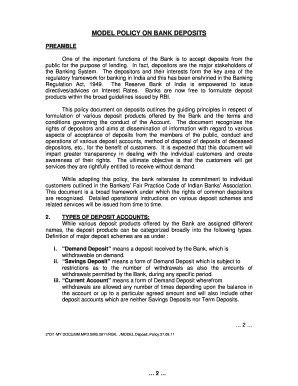

MODEL POLICY on BANK DEPOSITS Bank of India Form

What is the MODEL POLICY ON BANK DEPOSITS Bank Of India

The MODEL POLICY ON BANK DEPOSITS from the Bank of India outlines the framework for managing deposits in a secure and efficient manner. This policy serves as a guideline for banks to ensure compliance with regulatory requirements while providing a clear understanding of deposit-related services to customers. It includes provisions for deposit acceptance, interest rates, withdrawal processes, and the rights and responsibilities of both the bank and the depositors.

Key elements of the MODEL POLICY ON BANK DEPOSITS Bank Of India

The key elements of the MODEL POLICY ON BANK DEPOSITS include:

- Deposit Types: Different categories of deposits such as savings, current, and fixed deposits.

- Interest Rates: Guidelines for determining interest rates applicable to various deposit types.

- Withdrawal Procedures: Clear instructions on how customers can withdraw funds from their accounts.

- Customer Rights: Information on the rights of depositors regarding their funds and account management.

- Regulatory Compliance: Adherence to laws and regulations governing banking operations and deposits.

How to use the MODEL POLICY ON BANK DEPOSITS Bank Of India

Using the MODEL POLICY ON BANK DEPOSITS involves understanding its provisions and applying them to your banking practices. Customers can refer to this policy to comprehend the terms and conditions associated with their deposits. Banks utilize this policy to train staff and ensure consistent service delivery across branches. It is essential for customers to familiarize themselves with the policy to make informed decisions regarding their deposits.

Steps to complete the MODEL POLICY ON BANK DEPOSITS Bank Of India

To effectively implement the MODEL POLICY ON BANK DEPOSITS, banks should follow these steps:

- Review the Policy: Familiarize all staff with the policy details.

- Training: Conduct training sessions for employees to ensure they understand the policy.

- Customer Communication: Clearly communicate the policy to customers through brochures and digital platforms.

- Compliance Checks: Regularly review operations to ensure adherence to the policy.

- Feedback Mechanism: Establish a system for customers to provide feedback on deposit services.

Legal use of the MODEL POLICY ON BANK DEPOSITS Bank Of India

The legal use of the MODEL POLICY ON BANK DEPOSITS is crucial for maintaining compliance with banking regulations. This policy must align with the laws governing financial institutions in India. Banks are required to implement the policy in a manner that protects customer interests and upholds the integrity of the banking system. Legal counsel may be consulted to ensure that all provisions are enforceable and consistent with current legislation.

Examples of using the MODEL POLICY ON BANK DEPOSITS Bank Of India

Examples of applying the MODEL POLICY ON BANK DEPOSITS can include:

- Implementing a new savings account product that adheres to the interest rate guidelines outlined in the policy.

- Creating withdrawal forms that comply with the procedures specified in the policy.

- Training staff on customer rights as detailed in the policy to enhance service quality.

Quick guide on how to complete model policy on bank deposits bank of india

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight essential parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MODEL POLICY ON BANK DEPOSITS Bank Of India

Create this form in 5 minutes!

How to create an eSignature for the model policy on bank deposits bank of india

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MODEL POLICY ON BANK DEPOSITS Bank Of India?

The MODEL POLICY ON BANK DEPOSITS Bank Of India outlines the guidelines and procedures for managing bank deposits effectively. It serves as a framework for banks to ensure compliance with regulatory requirements while providing secure and efficient deposit services to customers.

-

How does the MODEL POLICY ON BANK DEPOSITS Bank Of India benefit customers?

The MODEL POLICY ON BANK DEPOSITS Bank Of India benefits customers by ensuring their deposits are handled with transparency and security. It establishes clear terms and conditions, which helps customers understand their rights and responsibilities regarding their deposits.

-

What features are included in the MODEL POLICY ON BANK DEPOSITS Bank Of India?

The MODEL POLICY ON BANK DEPOSITS Bank Of India includes features such as interest rate structures, deposit insurance details, and withdrawal procedures. These features are designed to enhance customer trust and provide clarity on how their funds are managed.

-

Is there a cost associated with the MODEL POLICY ON BANK DEPOSITS Bank Of India?

There is no direct cost associated with the MODEL POLICY ON BANK DEPOSITS Bank Of India for customers. However, banks may charge fees for specific services related to deposit accounts, which should be clearly outlined in the policy documentation.

-

How can businesses integrate the MODEL POLICY ON BANK DEPOSITS Bank Of India into their operations?

Businesses can integrate the MODEL POLICY ON BANK DEPOSITS Bank Of India by aligning their internal deposit management practices with the guidelines provided. This ensures compliance and enhances the overall efficiency of their banking operations.

-

What should I do if I have questions about the MODEL POLICY ON BANK DEPOSITS Bank Of India?

If you have questions about the MODEL POLICY ON BANK DEPOSITS Bank Of India, you should contact your bank's customer service or visit their website for detailed information. Banks typically provide resources and support to help customers understand the policy.

-

Can the MODEL POLICY ON BANK DEPOSITS Bank Of India change over time?

Yes, the MODEL POLICY ON BANK DEPOSITS Bank Of India can change as regulations and banking practices evolve. Banks are required to inform customers of any signNow changes to ensure transparency and compliance with updated guidelines.

Get more for MODEL POLICY ON BANK DEPOSITS Bank Of India

- Washington child support 497429405 form

- What do i write in my motion to enforce child support form

- Wpf dr 060520 response regarding oral testimony child support modification rsp washington form

- Wpf dr 060540 order regarding oral testimony child support modification orh washington form

- Child support modification sample form

- Schedule hearing form

- Modification child support form

- Order child support pdf form

Find out other MODEL POLICY ON BANK DEPOSITS Bank Of India

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free