Application for Refund of Excise Duty Sa Dhan Form

What is the Application For Refund Of Excise Duty Sa Dhan

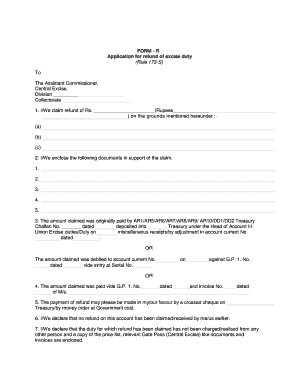

The Application For Refund Of Excise Duty Sa Dhan is a formal document used by individuals or businesses to request a refund of excise duty that has been overpaid or incorrectly assessed. This application is essential for ensuring that taxpayers can recover funds that are rightfully theirs due to errors in taxation. The form is typically used in the context of excise duties related to goods such as alcohol, tobacco, and fuel, and it adheres to specific guidelines set forth by the relevant authorities.

Steps to Complete the Application For Refund Of Excise Duty Sa Dhan

Completing the Application For Refund Of Excise Duty Sa Dhan involves several key steps:

- Gather necessary documentation, including proof of payment and any relevant receipts.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide a detailed explanation of the reason for the refund request, including any pertinent calculations.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Required Documents

To successfully submit the Application For Refund Of Excise Duty Sa Dhan, certain documents must be included to support the claim:

- Proof of excise duty payment, such as receipts or bank statements.

- Any correspondence with tax authorities regarding the duty assessment.

- Documentation that verifies the eligibility for a refund, such as invoices or contracts.

Application Process & Approval Time

The application process for the refund typically involves the following stages:

- Submission of the completed application and required documents to the appropriate tax authority.

- Review of the application by tax officials, which may include verification of the provided information.

- Notification of approval or denial of the refund request, which can take several weeks to months depending on the complexity of the case.

It is advisable to keep track of the application status and respond promptly to any requests for additional information from the tax authority.

Eligibility Criteria

To qualify for a refund through the Application For Refund Of Excise Duty Sa Dhan, applicants must meet specific eligibility criteria:

- Must have overpaid excise duty on goods subject to refund.

- Must provide adequate documentation supporting the refund claim.

- Must adhere to any deadlines set by the tax authority for submitting refund applications.

Legal Use of the Application For Refund Of Excise Duty Sa Dhan

The Application For Refund Of Excise Duty Sa Dhan serves a legal purpose, allowing taxpayers to reclaim funds that were improperly collected. It is important for applicants to understand the legal framework surrounding excise duties and the specific regulations that govern refund requests. Proper use of this application can help ensure compliance with tax laws while facilitating the recovery of overpaid amounts.

Quick guide on how to complete application for refund of excise duty sa dhan

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any holdups. Manage [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or mask sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Refund Of Excise Duty Sa Dhan

Create this form in 5 minutes!

How to create an eSignature for the application for refund of excise duty sa dhan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Refund Of Excise Duty Sa Dhan?

The Application For Refund Of Excise Duty Sa Dhan is a formal request submitted to reclaim excise duties paid on goods. This application is essential for businesses looking to recover costs associated with excise taxes. Utilizing airSlate SignNow can streamline this process, making it easier to manage and submit your application.

-

How can airSlate SignNow help with the Application For Refund Of Excise Duty Sa Dhan?

airSlate SignNow simplifies the process of preparing and submitting the Application For Refund Of Excise Duty Sa Dhan. With its user-friendly interface, you can easily fill out the necessary forms, eSign them, and send them directly to the relevant authorities. This saves time and reduces the risk of errors.

-

What are the costs associated with using airSlate SignNow for my Application For Refund Of Excise Duty Sa Dhan?

airSlate SignNow offers competitive pricing plans that cater to various business needs. The cost of using the platform for your Application For Refund Of Excise Duty Sa Dhan depends on the features you choose. You can start with a free trial to explore its capabilities before committing to a subscription.

-

Are there any features specifically designed for the Application For Refund Of Excise Duty Sa Dhan?

Yes, airSlate SignNow includes features tailored for the Application For Refund Of Excise Duty Sa Dhan, such as customizable templates and automated workflows. These features help ensure that your application is completed accurately and efficiently. Additionally, you can track the status of your application in real-time.

-

What benefits does airSlate SignNow provide for managing the Application For Refund Of Excise Duty Sa Dhan?

Using airSlate SignNow for your Application For Refund Of Excise Duty Sa Dhan offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick eSigning and document sharing, which accelerates the refund process. Furthermore, it enhances compliance by ensuring all documents are properly formatted and submitted.

-

Can I integrate airSlate SignNow with other tools for my Application For Refund Of Excise Duty Sa Dhan?

Absolutely! airSlate SignNow supports integrations with various business tools and software, enhancing your workflow for the Application For Refund Of Excise Duty Sa Dhan. This means you can connect it with your accounting software or CRM systems to streamline data management and improve overall efficiency.

-

Is airSlate SignNow secure for submitting my Application For Refund Of Excise Duty Sa Dhan?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Application For Refund Of Excise Duty Sa Dhan is submitted safely. The platform uses advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are secure throughout the entire process.

Get more for Application For Refund Of Excise Duty Sa Dhan

Find out other Application For Refund Of Excise Duty Sa Dhan

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself