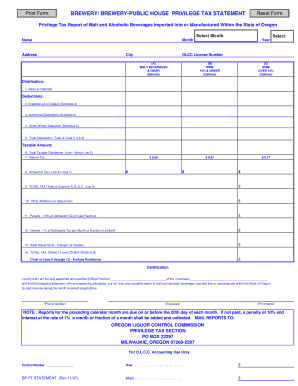

Brewery Brewery Public House Privilege Tax State of Oregon Oregon Form

Understanding the Brewery Brewery Public House Privilege Tax in Oregon

The Brewery Brewery Public House Privilege Tax in the State of Oregon is a specific tax levied on breweries and public houses operating within the state. This tax is designed to regulate and generate revenue from establishments that produce and sell alcoholic beverages. It is essential for business owners in the brewing industry to understand the implications of this tax, as it impacts their financial obligations and compliance requirements.

How to Navigate the Brewery Brewery Public House Privilege Tax

To effectively manage the Brewery Brewery Public House Privilege Tax, businesses should familiarize themselves with the specific tax rates and regulations that apply to their operations. This includes understanding how the tax is calculated based on sales volume and the types of beverages sold. Keeping accurate records of sales and expenses will aid in the accurate reporting and payment of this tax.

Steps to Complete the Brewery Brewery Public House Privilege Tax Form

Completing the Brewery Brewery Public House Privilege Tax form involves several key steps:

- Gather necessary financial records, including sales data and previous tax filings.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online or via mail.

Legal Considerations for the Brewery Brewery Public House Privilege Tax

Compliance with the Brewery Brewery Public House Privilege Tax is crucial for avoiding legal issues. Businesses must adhere to state regulations regarding tax payments and reporting. Failure to comply can result in penalties, interest on unpaid taxes, and potential legal action from state authorities.

Key Elements of the Brewery Brewery Public House Privilege Tax

Important aspects of the Brewery Brewery Public House Privilege Tax include:

- The tax rate, which may vary based on the volume of sales.

- Filing frequency, typically annual or quarterly.

- Specific exemptions or deductions that may apply to certain businesses.

Required Documents for the Brewery Brewery Public House Privilege Tax

When preparing to file the Brewery Brewery Public House Privilege Tax, businesses should have the following documents ready:

- Sales records for the reporting period.

- Previous tax returns, if applicable.

- Documentation of any exemptions claimed.

Quick guide on how to complete brewery brewery public house privilege tax state of oregon oregon

Complete Brewery Brewery public House Privilege Tax State Of Oregon Oregon effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without holdups. Handle Brewery Brewery public House Privilege Tax State Of Oregon Oregon on any device with airSlate SignNow’s Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign Brewery Brewery public House Privilege Tax State Of Oregon Oregon with ease

- Find Brewery Brewery public House Privilege Tax State Of Oregon Oregon and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Brewery Brewery public House Privilege Tax State Of Oregon Oregon and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the brewery brewery public house privilege tax state of oregon oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Brewery Brewery Public House Privilege Tax in the State of Oregon?

The Brewery Brewery Public House Privilege Tax in the State of Oregon is a tax imposed on breweries operating within the state. This tax is designed to support local infrastructure and services. Understanding this tax is crucial for brewery owners to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with managing Brewery Brewery Public House Privilege Tax documentation?

airSlate SignNow provides an efficient platform for managing all documentation related to the Brewery Brewery Public House Privilege Tax in the State of Oregon. With our eSigning capabilities, you can easily send, sign, and store tax-related documents securely. This streamlines your tax management process and ensures you stay organized.

-

What are the pricing options for airSlate SignNow for breweries in Oregon?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of breweries in Oregon. Our plans are designed to be cost-effective, ensuring that you can manage your Brewery Brewery Public House Privilege Tax documentation without breaking the bank. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for breweries dealing with tax documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These features are particularly beneficial for breweries managing the Brewery Brewery Public House Privilege Tax in the State of Oregon, as they simplify the process of document handling and ensure compliance.

-

Can airSlate SignNow integrate with other software used by breweries?

Yes, airSlate SignNow seamlessly integrates with various software solutions commonly used by breweries. This includes accounting software and tax management tools, which can help streamline the process of managing the Brewery Brewery Public House Privilege Tax in the State of Oregon. Integration enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for breweries in Oregon?

Using airSlate SignNow provides numerous benefits for breweries in Oregon, including improved efficiency in document management and enhanced compliance with the Brewery Brewery Public House Privilege Tax regulations. Our platform allows for quick eSigning and easy access to documents, saving you time and resources.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents related to the Brewery Brewery Public House Privilege Tax in the State of Oregon. We utilize advanced encryption and security protocols to protect your data and ensure that your documents are safe from unauthorized access.

Get more for Brewery Brewery public House Privilege Tax State Of Oregon Oregon

- Salvage receipt form

- Dpr pml 060 form

- The residents guide to the rls model ashp form

- Eh fp 301 high prior fsf permit appl2 12 pmd princegeorgescountymd form

- Rentenantrag formular

- Waiver of liability and hold harmless agreement template form

- Waiver of liability agreement template form

- Warehouse storage agreement template form

Find out other Brewery Brewery public House Privilege Tax State Of Oregon Oregon

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors