R Form Print

What is the R Form Print

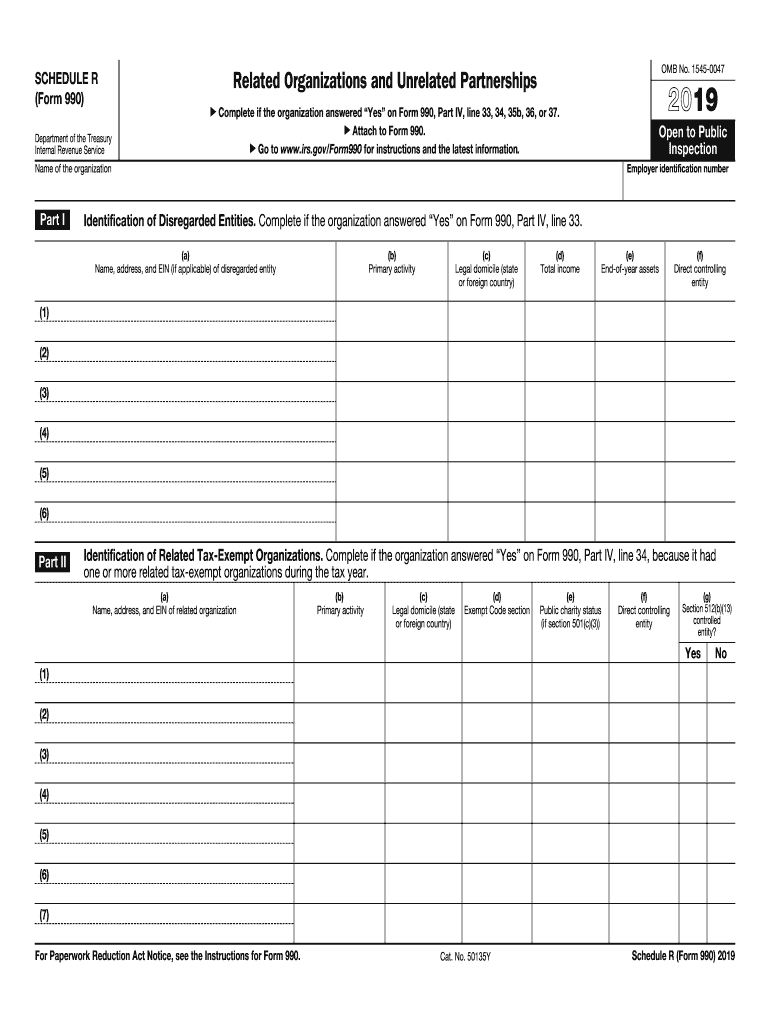

The R Form Print, specifically the 2019 990 R, is a tax form utilized by organizations to report their financial activities to the Internal Revenue Service (IRS). This form is essential for certain tax-exempt organizations, including those that are classified as unrelated business income entities. The 990 R form provides a comprehensive overview of an organization's revenue, expenses, and other financial details, ensuring transparency and compliance with federal regulations.

Steps to complete the R Form Print

Completing the 2019 990 R form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, fill out the form by entering your organization's financial data in the designated sections. Pay special attention to details such as revenue sources and expenses. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form electronically or via mail, adhering to the IRS guidelines for submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2019 990 R form. It is crucial to follow these guidelines to ensure compliance and avoid penalties. The form must be filed annually by the due date, which is typically the fifteenth day of the fifth month after the end of the organization's fiscal year. Additionally, organizations must ensure that all information reported is accurate and complete. Failure to comply with IRS guidelines may result in penalties or loss of tax-exempt status.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 990 R form are critical for organizations to maintain compliance. The standard due date is the fifteenth day of the fifth month following the end of the organization's fiscal year. For example, if the fiscal year ends on December thirty-first, the form is due by May fifteenth of the following year. Organizations may apply for an extension, but it is essential to file the extension request before the original deadline to avoid penalties.

Legal use of the R Form Print

The legal use of the 2019 990 R form is paramount for organizations seeking to maintain their tax-exempt status. This form serves as a declaration of compliance with IRS regulations, detailing financial activities and ensuring transparency. Properly completing and submitting the form not only fulfills legal obligations but also builds trust with stakeholders, including donors and the public. Organizations must ensure that all information is accurate and that the form is submitted on time to avoid legal repercussions.

Required Documents

To successfully complete the 2019 990 R form, organizations must gather several required documents. These typically include financial statements, such as profit and loss statements and balance sheets, as well as records of revenue and expenses. Additionally, previous years' tax returns may be necessary to provide context and continuity in reporting. Ensuring that all required documents are prepared in advance can streamline the completion process and help avoid errors.

Quick guide on how to complete 2019 schedule r form 990 internal revenue service

Prepare R Form Print effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and efficiently. Manage R Form Print on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign R Form Print with ease

- Find R Form Print and click on Get Form to begin.

- Utilize the tools we provide to fulfill your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device of your choice. Modify and eSign R Form Print and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule r form 990 internal revenue service

How to create an eSignature for your 2019 Schedule R Form 990 Internal Revenue Service in the online mode

How to make an eSignature for your 2019 Schedule R Form 990 Internal Revenue Service in Google Chrome

How to create an eSignature for putting it on the 2019 Schedule R Form 990 Internal Revenue Service in Gmail

How to generate an electronic signature for the 2019 Schedule R Form 990 Internal Revenue Service straight from your smart phone

How to create an eSignature for the 2019 Schedule R Form 990 Internal Revenue Service on iOS

How to generate an eSignature for the 2019 Schedule R Form 990 Internal Revenue Service on Android OS

People also ask

-

What is the 2019 990 r and how is it relevant to my business?

The 2019 990 r is a crucial document for nonprofits, providing financial transparency and compliance with IRS regulations. airSlate SignNow simplifies the signing process for the 2019 990 r, allowing your organization to manage, send, and eSign the document efficiently.

-

How can airSlate SignNow help me with the 2019 990 r process?

airSlate SignNow streamlines the 2019 990 r process by offering a user-friendly platform for sending and eSigning essential documents. The solution enhances collaboration and ensures timely submission, ultimately reducing delays during tax season.

-

What are the pricing options for airSlate SignNow related to the 2019 990 r?

airSlate SignNow offers competitive pricing plans designed to fit various organizational needs. By choosing the right plan, you can efficiently manage the 2019 990 r and other important documents without breaking your budget.

-

Does airSlate SignNow offer templates for the 2019 990 r?

Yes, airSlate SignNow provides customizable templates for the 2019 990 r, making it easy for your team to prepare necessary documents. This feature saves time and ensures that you have all the correct sections filled out and ready for eSignature.

-

Can I integrate airSlate SignNow with other software for handling the 2019 990 r?

Absolutely! airSlate SignNow offers integrations with various software solutions, enhancing your ability to manage the 2019 990 r seamlessly. This integration capability allows for improved workflow and data management.

-

What are the security features of airSlate SignNow for the 2019 990 r?

Security is a priority with airSlate SignNow, especially when handling sensitive documents like the 2019 990 r. The platform features advanced encryption, secure cloud storage, and audit trails to protect your information.

-

How does airSlate SignNow improve the signing experience for the 2019 990 r?

airSlate SignNow enhances the signing experience with features like automated reminders and a simple signing interface, making it easier for your team and stakeholders to eSign the 2019 990 r. This efficiency helps ensure your documents are completed on time.

Get more for R Form Print

Find out other R Form Print

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple