1042 Sform Fillable Print Template 2018

What is the 1042 Sform Fillable Print Template

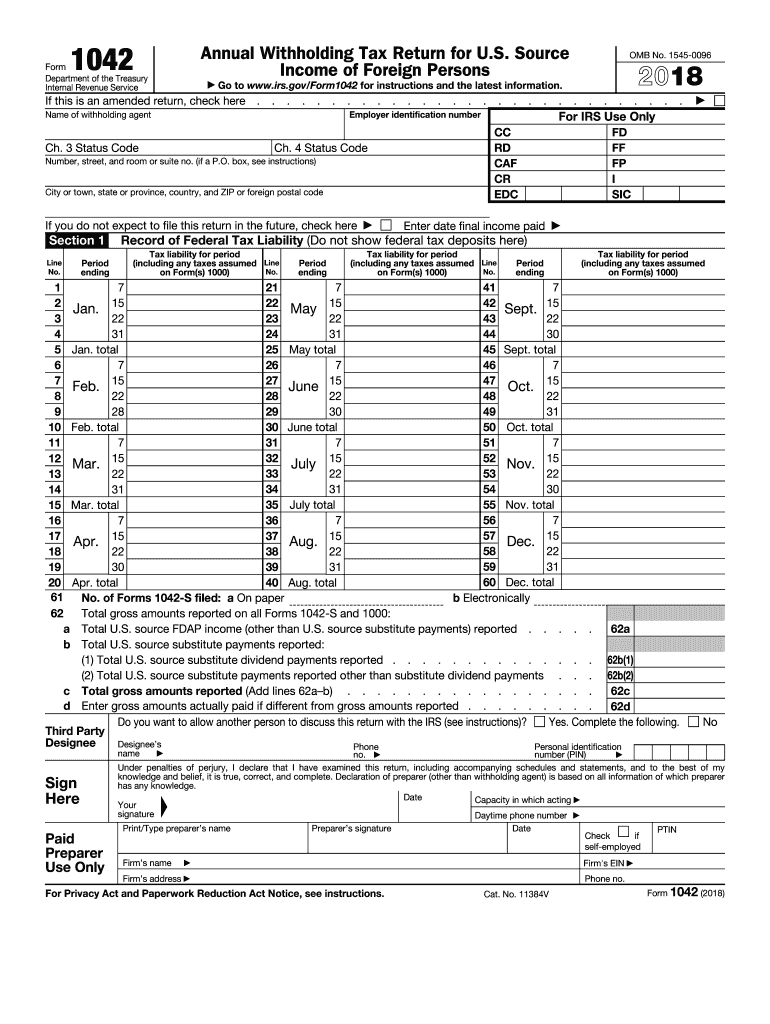

The 1042 Sform Fillable Print Template is a tax document used by foreign individuals and entities to report income that is subject to withholding in the United States. This form is essential for non-resident aliens receiving income such as dividends, interest, or royalties. The fillable format allows users to enter their information directly into the form electronically, ensuring accuracy and ease of completion. It is important to use the most current version of this form to comply with IRS regulations.

How to use the 1042 Sform Fillable Print Template

Using the 1042 Sform Fillable Print Template involves several straightforward steps. First, download the fillable template from a reliable source. Next, open the document using a compatible PDF reader that supports form filling. Enter all required information, including your name, address, and taxpayer identification number. After filling out the form, review it for accuracy. Once confirmed, print the document for submission or save it as a PDF for electronic filing, depending on the submission method allowed by the IRS.

Steps to complete the 1042 Sform Fillable Print Template

Completing the 1042 Sform Fillable Print Template requires careful attention to detail. Follow these steps:

- Download the latest version of the form.

- Open the form in a compatible PDF editor.

- Fill in your personal information in the designated fields.

- Provide details about the income being reported.

- Include any necessary attachments or additional documentation as specified.

- Review the completed form for any errors or omissions.

- Print or save the form as needed for submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1042 Sform. It is crucial to adhere to these guidelines to avoid penalties. Ensure that all information is accurate and complete before submission. The IRS also outlines the deadlines for filing this form, which typically coincide with the end of the tax year. Familiarizing yourself with these guidelines can help ensure compliance and facilitate a smoother filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 1042 Sform are important to note to avoid late penalties. Generally, the form must be submitted by March fifteenth of the year following the tax year in question. If you are submitting the form electronically, it is advisable to file as early as possible to ensure compliance and to allow time for any necessary corrections. Keeping track of these dates is essential for timely filing and to avoid complications with the IRS.

Required Documents

When completing the 1042 Sform, certain documents may be required to support your claims. This may include proof of income, tax identification numbers, and any relevant treaties that may affect withholding rates. Ensure that you have all necessary documentation ready to accompany your form. This will help streamline the filing process and reduce the likelihood of delays or queries from the IRS.

Quick guide on how to complete form 1042 2018

Discover the easiest method to complete and sign your 1042 Sform Fillable Print Template

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to complete and sign your 1042 Sform Fillable Print Template and similar forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork swiftly and in compliance with formal standards - comprehensive PDF editing, management, safeguarding, signing, and sharing tools all available at your fingertips within a user-friendly interface.

Only a few steps are needed to complete and sign your 1042 Sform Fillable Print Template:

- Upload the editable template to the editor using the Get Form button.

- Identify the information you need to provide in your 1042 Sform Fillable Print Template.

- Navigate through the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize important sections or Conceal areas that are no longer relevant.

- Click on Sign to create a legally valid electronic signature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed 1042 Sform Fillable Print Template in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our solution also allows flexible file sharing. There’s no need to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 1042 2018

FAQs

-

What is the difference between IRS W-8BEN and W-8BEN-E forms?

Sure, I can address tax issues here. You would use the W-8 Ben for an individual situation. And, you would use the W-8 Ben E for a company situation.Though, the actual completion of the form center on how the US international tax provision taxes the foreign person or company on the income. So, we first apply the tax law based on the fact situation at hand. So, the form completion centers on tax law and treaty law.Then, and if the person or company home country has a specific tax treaty with the US, we would then apply the exact treaty provision for mitigating (reducing) the withholding required.Here, we need to understand how treaties work and apply the most recent treaty or possibly and updated protocol or competent authority position between the US and the home country when we complete the treaty section of the W8-Ben or Ben-E. The above represents the procedure I have used when dealing with this situation. As with all events dealing with the US tax law completing this form correctly and fully provides for the best outcome allowed by tax law and treaty law.I have completed the above based on the fact situation. If the income type or facts change above, the tax results may change for sure. www.rst.tax

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the form 1042 2018

How to create an eSignature for the Form 1042 2018 online

How to make an eSignature for the Form 1042 2018 in Google Chrome

How to make an electronic signature for signing the Form 1042 2018 in Gmail

How to make an eSignature for the Form 1042 2018 from your smart phone

How to make an electronic signature for the Form 1042 2018 on iOS devices

How to create an electronic signature for the Form 1042 2018 on Android devices

People also ask

-

What is the 1042 Sform Fillable Print Template?

The 1042 Sform Fillable Print Template is a standardized document used for reporting income paid to foreign persons. This template allows users to fill out the necessary information digitally and print it for submission. Utilizing the 1042 Sform Fillable Print Template simplifies compliance with IRS requirements, making it essential for businesses that engage with international clients.

-

How can I fill out the 1042 Sform Fillable Print Template using airSlate SignNow?

Filling out the 1042 Sform Fillable Print Template with airSlate SignNow is straightforward. Users can upload the template to the platform, use our intuitive editor to fill in the required fields, and save their progress. This process ensures that your document is both accurate and compliant with IRS standards.

-

Is the 1042 Sform Fillable Print Template free to use?

The 1042 Sform Fillable Print Template itself is available for free; however, using airSlate SignNow to edit or eSign this template requires a subscription. Our pricing plans are designed to be cost-effective while providing a range of features that facilitate document management, making it a worthwhile investment for businesses.

-

What features does airSlate SignNow offer for the 1042 Sform Fillable Print Template?

AirSlate SignNow offers several features for the 1042 Sform Fillable Print Template, including electronic signature capabilities, document sharing, and real-time collaboration. Users can also track document status and receive notifications when their form is signed. These features enhance efficiency and accuracy in managing important tax documents.

-

Can I integrate the 1042 Sform Fillable Print Template with other tools?

Yes, airSlate SignNow allows you to integrate the 1042 Sform Fillable Print Template with various tools and applications. Our platform supports integrations with popular business software such as CRMs, accounting software, and cloud storage services, enabling seamless document management workflows and improved productivity.

-

What are the benefits of using the airSlate SignNow platform for the 1042 Sform Fillable Print Template?

Using airSlate SignNow for the 1042 Sform Fillable Print Template offers numerous benefits, including enhanced security for sensitive information and faster processing times. The platform's user-friendly interface makes it easy for anyone to create, edit, and sign documents. Additionally, our customer support team is available to assist with any inquiries you may have.

-

How secure is the 1042 Sform Fillable Print Template when using airSlate SignNow?

The 1042 Sform Fillable Print Template is highly secure when managed through airSlate SignNow. We implement advanced encryption protocols to protect your data during transmission and storage. Our platform also complies with industry standards to ensure that your sensitive information remains confidential and secure.

Get more for 1042 Sform Fillable Print Template

Find out other 1042 Sform Fillable Print Template

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors