8853 Irs Form

What is the 2019 IRS 8853 Form?

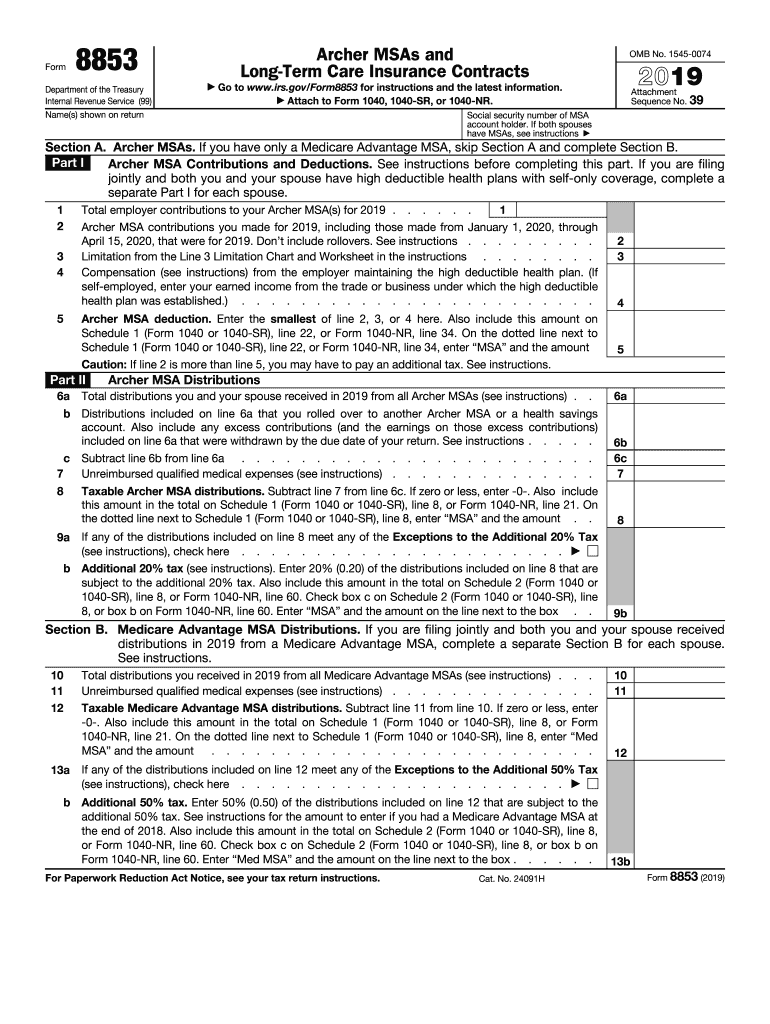

The 2019 IRS 8853 form is a tax document used by individuals to report contributions to and distributions from Archer Medical Savings Accounts (MSAs). This form is essential for taxpayers who have established MSAs, allowing them to claim deductions for contributions made during the tax year. The 8853 form provides the IRS with necessary information regarding the taxpayer's health savings accounts, ensuring compliance with tax regulations.

Steps to Complete the 2019 IRS 8853 Form

Completing the 2019 IRS 8853 form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including records of contributions and distributions related to your Archer MSA. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. You will also need to report the total contributions made to the account and any distributions taken during the year. Finally, review the form for accuracy before submitting it with your tax return.

Legal Use of the 2019 IRS 8853 Form

The legal use of the 2019 IRS 8853 form is governed by IRS regulations that outline the requirements for reporting MSAs. To ensure that your form is legally valid, it must be completed accurately and submitted by the tax filing deadline. The form must be signed and dated, and any necessary documentation supporting your claims should be attached. Compliance with these regulations helps avoid penalties and ensures that contributions and distributions are reported correctly.

Filing Deadlines for the 2019 IRS 8853 Form

The filing deadline for the 2019 IRS 8853 form aligns with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but it is important to ensure that the 8853 form is submitted along with your tax return to avoid any issues with the IRS.

Required Documents for the 2019 IRS 8853 Form

To complete the 2019 IRS 8853 form, you will need several documents. These include records of all contributions made to your Archer MSA, documentation of any distributions taken, and your previous tax returns if applicable. Having these documents ready will streamline the process of filling out the form and ensure that all information reported is accurate and complete.

Examples of Using the 2019 IRS 8853 Form

Examples of using the 2019 IRS 8853 form include reporting contributions made to an Archer MSA for medical expenses or claiming distributions that were used for qualified medical costs. For instance, if you contributed $3,000 to your MSA and withdrew $1,500 for eligible medical expenses, you would report these figures on the form. This allows you to benefit from tax deductions while ensuring compliance with IRS regulations.

Quick guide on how to complete 2015 instructions for form 8853 internal revenue service

Complete 8853 Irs seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, adjust, and eSign your documents efficiently without delays. Manage 8853 Irs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign 8853 Irs effortlessly

- Obtain 8853 Irs and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign 8853 Irs to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 instructions for form 8853 internal revenue service

How to generate an eSignature for your 2015 Instructions For Form 8853 Internal Revenue Service in the online mode

How to make an eSignature for the 2015 Instructions For Form 8853 Internal Revenue Service in Chrome

How to create an eSignature for putting it on the 2015 Instructions For Form 8853 Internal Revenue Service in Gmail

How to create an electronic signature for the 2015 Instructions For Form 8853 Internal Revenue Service right from your mobile device

How to create an eSignature for the 2015 Instructions For Form 8853 Internal Revenue Service on iOS devices

How to make an electronic signature for the 2015 Instructions For Form 8853 Internal Revenue Service on Android OS

People also ask

-

What is the 2019 8853 form used for?

The 2019 8853 form is used to report Health Savings Account (HSA) contributions and distributions. This form helps individuals who have an HSA to keep track of their contributions and withdrawals throughout the year for tax reporting purposes.

-

How can airSlate SignNow assist with the 2019 8853 form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 2019 8853 form. With our solution, users can streamline the filing process, ensuring documents are securely signed and delivered efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2019 8853 form?

Yes, there is a cost associated with using airSlate SignNow, but it is a cost-effective solution for handling documents like the 2019 8853 form. We offer various pricing plans to fit businesses of all sizes, making it accessible for everyone.

-

What features does airSlate SignNow offer for the 2019 8853 form?

airSlate SignNow offers several features for managing the 2019 8853 form, including eSignature, customizable templates, and document tracking. These features ensure you can easily fill out, sign, and send the form without hassle.

-

Can I integrate airSlate SignNow with my existing software for the 2019 8853 form?

Yes, airSlate SignNow offers integrations with various popular applications, allowing you to seamlessly incorporate the 2019 8853 form process into your existing workflows. You can connect with tools like CRMs, document management systems, and cloud storage solutions.

-

How secure is airSlate SignNow for handling the 2019 8853 form?

AirSlate SignNow prioritizes security and uses top-notch encryption to protect your documents, including the 2019 8853 form. Our platform complies with industry standards to ensure the confidentiality and integrity of your data throughout the signing process.

-

What benefits does airSlate SignNow provide when working with the 2019 8853 form?

Using airSlate SignNow for the 2019 8853 form provides numerous benefits, such as reducing paper usage and speeding up document processing. Our platform also enhances collaboration by allowing multiple signers to complete the form online in real time.

Get more for 8853 Irs

Find out other 8853 Irs

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy