Irs Tax Payment Form

What is the IRS Tax Payment Form?

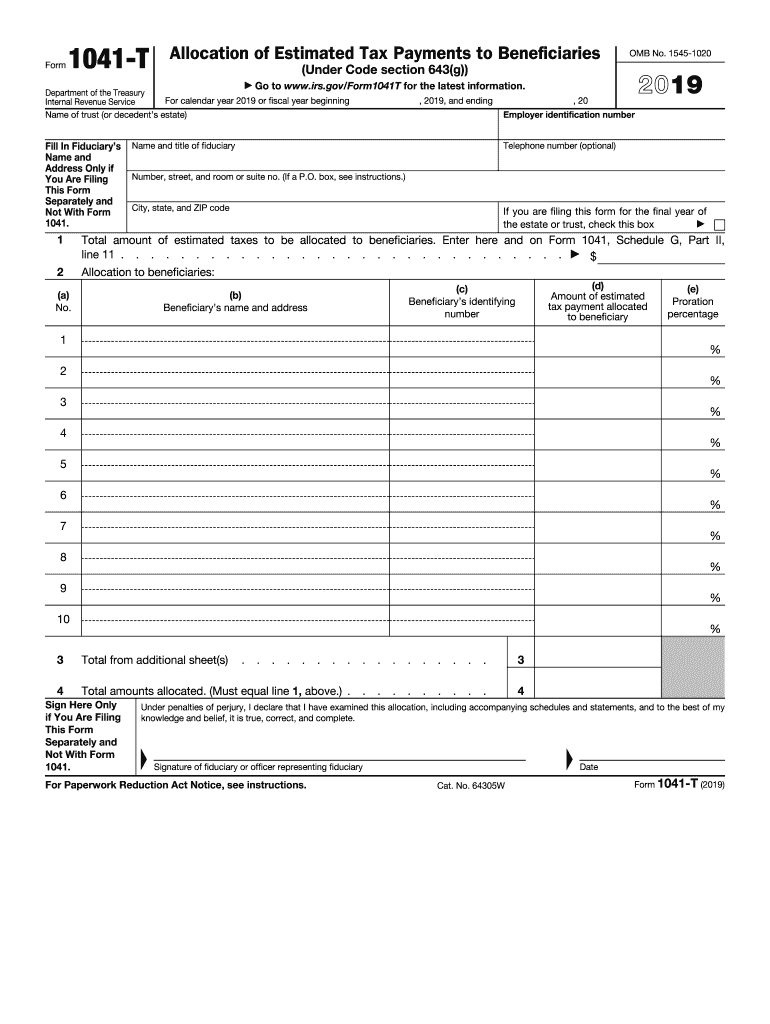

The IRS Tax Payment Form is a crucial document used by taxpayers to report and pay their federal income tax obligations. Specifically, the 1041 allocation relates to the income tax return for estates and trusts. This form is essential for fiduciaries who manage estates or trusts, ensuring that the income generated is reported accurately to the IRS. Understanding this form is vital for compliance with tax laws and for the proper management of estate or trust finances.

Steps to Complete the IRS Tax Payment Form

Completing the IRS Tax Payment Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents related to the estate or trust, including income statements and expenses. Next, fill out the 1041 estimated tax form, ensuring that all income sources are reported correctly. Calculate the total tax liability based on the income reported. Finally, review the form for any errors before submitting it to the IRS, either electronically or via mail.

Legal Use of the IRS Tax Payment Form

The legal use of the IRS Tax Payment Form is governed by federal tax laws. It is essential that the form is filled out accurately to avoid penalties and ensure that the estate or trust complies with all legal obligations. The 1041 beneficiaries form must be signed by the fiduciary, and it is recommended to use a reliable eSignature solution to maintain the form's legal standing. Compliance with the IRS guidelines ensures that the estate or trust operates within the law.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Tax Payment Form are critical for compliance. Generally, the 1041 estimated tax payments form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts, this typically means April 15 for calendar year filers. It is important to stay informed about any changes to these deadlines, as they can impact the filing process and potential penalties for late submissions.

Form Submission Methods

There are several methods for submitting the IRS Tax Payment Form. Taxpayers can choose to file online using approved e-filing software, which often simplifies the process and reduces errors. Alternatively, forms can be mailed directly to the IRS, ensuring that they are sent to the correct address based on the taxpayer's location. In-person submissions are also possible at designated IRS offices, providing another avenue for compliance.

Examples of Using the IRS Tax Payment Form

Using the IRS Tax Payment Form can vary based on individual circumstances. For instance, a fiduciary managing a trust might use the 1041 t tax form to report income generated from investments held within the trust. Another example includes an estate that has rental properties, where the fiduciary must report rental income and associated expenses. Understanding these examples helps clarify how the form applies to different financial situations.

Quick guide on how to complete 1041 t allocation of estimated tax payments to beneficiaries

Complete Irs Tax Payment Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without interruptions. Manage Irs Tax Payment Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Irs Tax Payment Form with ease

- Find Irs Tax Payment Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to deliver your form: through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Tax Payment Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1041 t allocation of estimated tax payments to beneficiaries

How to make an electronic signature for the 1041 T Allocation Of Estimated Tax Payments To Beneficiaries online

How to create an eSignature for your 1041 T Allocation Of Estimated Tax Payments To Beneficiaries in Chrome

How to make an eSignature for signing the 1041 T Allocation Of Estimated Tax Payments To Beneficiaries in Gmail

How to generate an electronic signature for the 1041 T Allocation Of Estimated Tax Payments To Beneficiaries from your smart phone

How to generate an eSignature for the 1041 T Allocation Of Estimated Tax Payments To Beneficiaries on iOS

How to make an electronic signature for the 1041 T Allocation Of Estimated Tax Payments To Beneficiaries on Android

People also ask

-

What is 1041 allocation in the context of airSlate SignNow?

The 1041 allocation refers to the distribution of income, deductions, and credits among beneficiaries of an estate or trust. With airSlate SignNow, users can streamline the process of managing 1041 allocations by electronically signing necessary documents, ensuring that everything is accurate and timely.

-

How can airSlate SignNow simplify the 1041 allocation process?

airSlate SignNow simplifies the 1041 allocation process by enabling users to create, send, and eSign required documents with ease. This reduces the chances of errors and speeds up the time it takes to finalize the 1041 allocations, making the entire process more efficient.

-

Is there a cost associated with using airSlate SignNow for 1041 allocation?

Yes, airSlate SignNow offers various pricing packages based on user needs. These packages provide access to features that can assist in managing 1041 allocations effectively, making it a cost-effective solution for businesses handling complex documentation.

-

What features does airSlate SignNow offer for managing 1041 allocation documents?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSignature capabilities. These tools make it easier to prepare and manage documents related to 1041 allocations, ensuring that all parties can collaborate efficiently.

-

Can I integrate airSlate SignNow with other software for 1041 allocation?

Yes, airSlate SignNow offers various integrations with accounting, tax software, and other business applications. This allows for a seamless workflow when handling 1041 allocations and ensures that all necessary data is easily accessible.

-

What are the benefits of using airSlate SignNow for 1041 allocation?

The primary benefits of using airSlate SignNow for 1041 allocations include enhanced efficiency, reduced paperwork, and improved accuracy. By utilizing eSignatures and digital document management, firms can ensure compliance and streamline the allocation process.

-

How secure is airSlate SignNow for handling 1041 allocation documentation?

airSlate SignNow prioritizes security with features such as AES-256 bit encryption, secure cloud storage, and compliance with industry standards. This provides peace of mind for users managing sensitive information related to 1041 allocations.

Get more for Irs Tax Payment Form

Find out other Irs Tax Payment Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors