Form 706 Instructions

What is the Form 706 Instructions

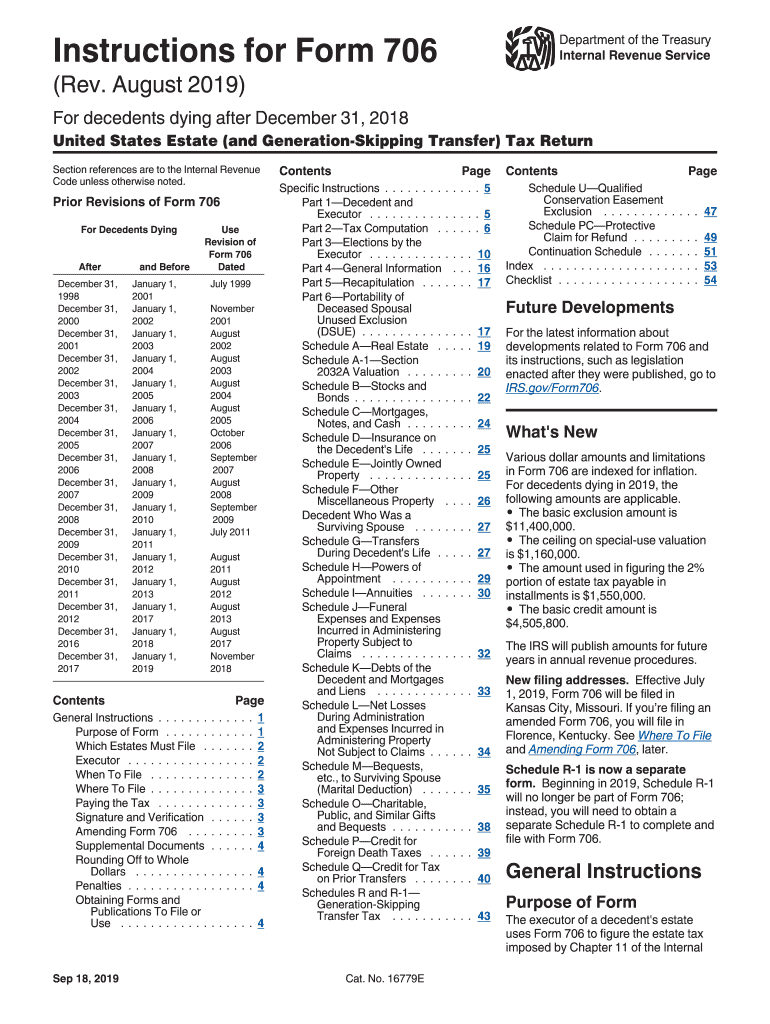

The Form 706 Instructions are a comprehensive guide provided by the IRS for completing Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return. This form is required for reporting the estate tax obligations of a deceased individual whose estate exceeds the applicable exemption amount. The instructions detail the necessary steps to accurately report the value of the estate, deductions, and any applicable credits. Understanding these instructions is crucial for ensuring compliance with federal estate tax laws.

Steps to complete the Form 706 Instructions

Completing the Form 706 involves several key steps that must be followed carefully to ensure accuracy and compliance. First, gather all necessary documentation related to the deceased's assets, liabilities, and prior gifts. Next, fill out the form by providing detailed information about the estate, including the fair market value of all assets at the time of death. It is essential to include any deductions for debts, funeral expenses, and charitable contributions. After completing the form, review it thoroughly for any errors before signing and dating it. Finally, submit the form to the IRS by the specified deadline to avoid penalties.

Legal use of the Form 706 Instructions

The legal use of the Form 706 Instructions is essential for ensuring that the estate tax return is valid and meets all regulatory requirements. The instructions outline the legal framework governing estate taxation, including relevant laws and regulations that must be adhered to. Using the form as directed helps prevent issues with the IRS, such as audits or penalties for non-compliance. It is important to understand the legal implications of the information provided on the form, as inaccuracies can lead to significant financial consequences.

Filing Deadlines / Important Dates

Filing deadlines for Form 706 are crucial to avoid penalties. Generally, the form must be filed within nine months after the date of the decedent's death. However, an extension of up to six months may be requested using Form 4768. It is important to note that interest will accrue on any unpaid estate tax from the original due date of the return, so timely filing is essential. Keeping track of these dates ensures compliance with IRS regulations and helps manage the estate's financial obligations effectively.

Required Documents

To complete Form 706 accurately, several documents are required. These include a copy of the decedent's death certificate, a detailed inventory of all assets, and documentation of liabilities. Additionally, any prior gift tax returns may need to be included to account for lifetime gifts that exceed the annual exclusion amount. Gathering these documents in advance can streamline the process of completing the form and ensure that all necessary information is reported accurately.

Form Submission Methods (Online / Mail / In-Person)

Form 706 can be submitted to the IRS through various methods. While the form is primarily filed by mail, it is important to check for any updates regarding electronic filing options, as the IRS occasionally expands its digital services. When submitting by mail, ensure that the form is sent to the correct address specified in the instructions. For those who prefer in-person submission, visiting a local IRS office may be an option, though appointments may be necessary.

Quick guide on how to complete instructions for form 706 rev august 2019 instructions for form 706 united states estate and generation skipping transfer tax

Effortlessly Prepare Form 706 Instructions on Any Device

Managing documents online has gained traction among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly and efficiently. Handle Form 706 Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The Easiest Method to Edit and eSign Form 706 Instructions Without Difficulty

- Obtain Form 706 Instructions and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Form 706 Instructions to ensure exceptional communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 706 rev august 2019 instructions for form 706 united states estate and generation skipping transfer tax

How to make an eSignature for the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax in the online mode

How to generate an electronic signature for the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax in Chrome

How to create an electronic signature for putting it on the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax in Gmail

How to create an electronic signature for the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax from your mobile device

How to make an electronic signature for the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax on iOS

How to generate an eSignature for the Instructions For Form 706 Rev August 2019 Instructions For Form 706 United States Estate And Generation Skipping Transfer Tax on Android OS

People also ask

-

What is Form 706 2019?

Form 706 2019 is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is utilized to report the estate tax owed on the transfer of the decedent's estate. Understanding Form 706 2019 is crucial for estates exceeding the exemption limit to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 706 2019?

airSlate SignNow provides an efficient platform to complete and eSign Form 706 2019. Our user-friendly interface enables you to fill out the form electronically, ensuring accuracy and compliance while streamlining your filing process. You can easily send the completed form to other parties or save it for your records.

-

What are the pricing options for using airSlate SignNow for Form 706 2019?

airSlate SignNow offers a range of pricing plans to fit different needs when working with Form 706 2019. Our plans include options for individuals and businesses, featuring features tailored to optimize your document management. You can choose a plan that best suits your budget and requirements for handling legal documents.

-

Are there additional features to simplify filing Form 706 2019?

Yes, airSlate SignNow includes various features designed to simplify the filing of Form 706 2019. Features such as templates, automated reminders, and collaboration tools help ensure that all necessary documents are completed accurately and submitted on time. This enhances your overall efficiency in managing estate tax documents.

-

Can I integrate airSlate SignNow with other software for Form 706 2019?

Absolutely! airSlate SignNow offers integration capabilities with popular software and applications to facilitate the handling of Form 706 2019. This means you can connect your existing tools for improved document management and streamlining workflows related to estate planning and taxation.

-

How does eSigning enhance the process of submitting Form 706 2019?

eSigning through airSlate SignNow enhances the process of submitting Form 706 2019 by ensuring signatures are collected securely and efficiently. This not only speeds up the process but also maintains the legal validity of the document. With eSigning, you can ensure all parties are in agreement before the submission.

-

What are the benefits of using airSlate SignNow for legal documents like Form 706 2019?

Using airSlate SignNow for legal documents such as Form 706 2019 offers many benefits, including reduced processing time and enhanced document security. Our platform guarantees data protection while allowing for easy access and sharing of files among stakeholders. These advantages make it an ideal solution for managing signNow legal documents.

Get more for Form 706 Instructions

Find out other Form 706 Instructions

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast