1095 a Form

What is the 1095 A Form

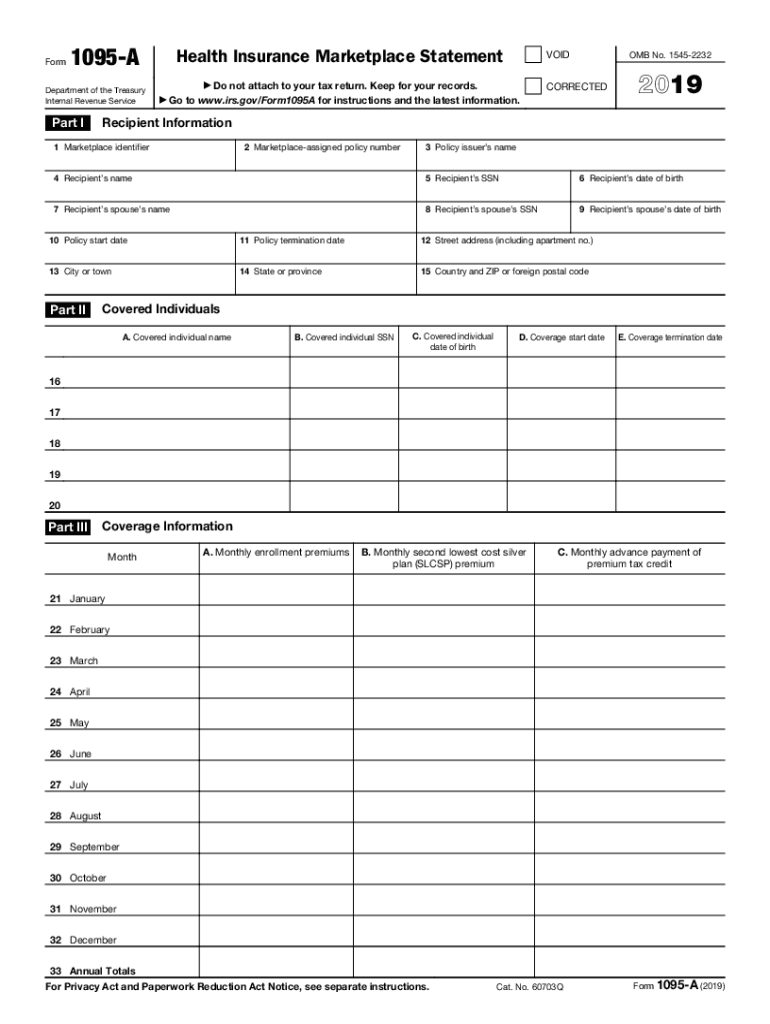

The 1095 A form is a crucial document for individuals who obtained health insurance through the Health Insurance Marketplace. This form provides essential information about the coverage you had during the year, including the months you were covered and the premium amounts. It is used to determine eligibility for premium tax credits and to report health coverage on your federal tax return. Understanding the 1095 A form is vital for ensuring compliance with the Affordable Care Act (ACA) and for accurately filing your taxes.

How to obtain the 1095 A Form

You can obtain your 2019 form 1095 A online through your Health Insurance Marketplace account. If you enrolled in a plan through the Marketplace, you should receive a copy of the form by mail. However, if you need an additional copy or did not receive it, you can log into your Marketplace account and download it directly. Ensure that your account information is up to date to facilitate a smooth retrieval process.

Steps to complete the 1095 A Form

Completing the 1095 A form involves several steps to ensure accuracy. First, gather your health insurance information, including the coverage start and end dates. Next, enter the required details, such as the names of all covered individuals and the monthly premium amounts. Review the form carefully for any errors before submission. If you are using the form to claim premium tax credits, make sure to include all necessary information to avoid delays or issues with your tax return.

Legal use of the 1095 A Form

The 1095 A form is legally binding and must be filled out accurately to comply with IRS regulations. It is essential for individuals who received premium tax credits or had Marketplace coverage to file this form with their tax returns. Failure to provide accurate information can lead to penalties or issues with tax compliance. It is advisable to retain a copy of the form for your records and to ensure that all information matches your tax filings.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing your federal tax return, including the 1095 A form, is typically April 15 of the following year. If you need additional time, you may file for an extension, but it is important to note that any taxes owed are still due by the original deadline. Keep track of any specific dates related to your Health Insurance Marketplace, as they may vary based on your state or specific circumstances.

Who Issues the Form

The 1095 A form is issued by the Health Insurance Marketplace from which you purchased your health insurance. If you enrolled in a plan through the federal Marketplace, the Centers for Medicare & Medicaid Services (CMS) is responsible for providing this form. If you used a state-based Marketplace, that state agency will issue your 1095 A form. It is important to ensure that the information on the form is accurate and reflects your coverage details for the tax year.

Quick guide on how to complete form 1095 a internal revenue service

Complete 1095 A Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Manage 1095 A Form on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign 1095 A Form effortlessly

- Find 1095 A Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature with the Sign feature, which takes mere moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Adjust and eSign 1095 A Form to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1095 a internal revenue service

How to generate an eSignature for your Form 1095 A Internal Revenue Service in the online mode

How to create an electronic signature for the Form 1095 A Internal Revenue Service in Google Chrome

How to make an eSignature for signing the Form 1095 A Internal Revenue Service in Gmail

How to make an electronic signature for the Form 1095 A Internal Revenue Service right from your smart phone

How to create an eSignature for the Form 1095 A Internal Revenue Service on iOS devices

How to generate an electronic signature for the Form 1095 A Internal Revenue Service on Android

People also ask

-

What is the 2019 form 1095 A, and why is it important?

The 2019 form 1095 A is a tax document that provides information about your health coverage. It's crucial for filing your tax return accurately, as it details the months you had coverage and helps determine your premium tax credits.

-

How can I complete the 2019 form 1095 A online?

You can easily complete the 2019 form 1095 A online using airSlate SignNow. Our platform simplifies the process, allowing you to fill out, sign, and send the form securely without the hassle of paper.

-

Is airSlate SignNow a cost-effective solution for signing the 2019 form 1095 A online?

Yes, airSlate SignNow offers a cost-effective solution for signing the 2019 form 1095 A online. Our pricing plans cater to businesses of all sizes, ensuring affordability without compromising on features.

-

What features does airSlate SignNow offer for the 2019 form 1095 A?

airSlate SignNow offers features such as customizable templates, electronic signatures, secure storage, and seamless document sharing, all tailored for the 2019 form 1095 A. These tools streamline the completion and filing process.

-

Can I integrate airSlate SignNow with other applications for the 2019 form 1095 A?

Absolutely! airSlate SignNow integrates with numerous applications to enhance your workflow for the 2019 form 1095 A. Connect with your favorite tools like Google Drive and Salesforce to manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for the 2019 form 1095 A?

Using airSlate SignNow for the 2019 form 1095 A offers numerous benefits, including reduced turnaround times, increased accuracy, and enhanced security of your sensitive information. Our platform ensures that you're compliant with all legal requirements.

-

How secure is my data when completing the 2019 form 1095 A online with airSlate SignNow?

Your data security is our top priority. When you complete the 2019 form 1095 A online with airSlate SignNow, your information is encrypted and stored securely, ensuring that only authorized users can access it.

Get more for 1095 A Form

- Financial crimes enforcement network the sar activity review trends tips ampamp form

- Chris fitch1 sarah hamilton2 paul basset3 and ryan davey1 form

- Tax corporation form

- Plate surrender application use to surrender nys license plates by mail form

- Pathfinder club membership application generic 3 form

- Non profit consult contract template form

- Non profit contract template form

- Non renewal contract template form

Find out other 1095 A Form

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself