Schedule a 2018

What is the Schedule A

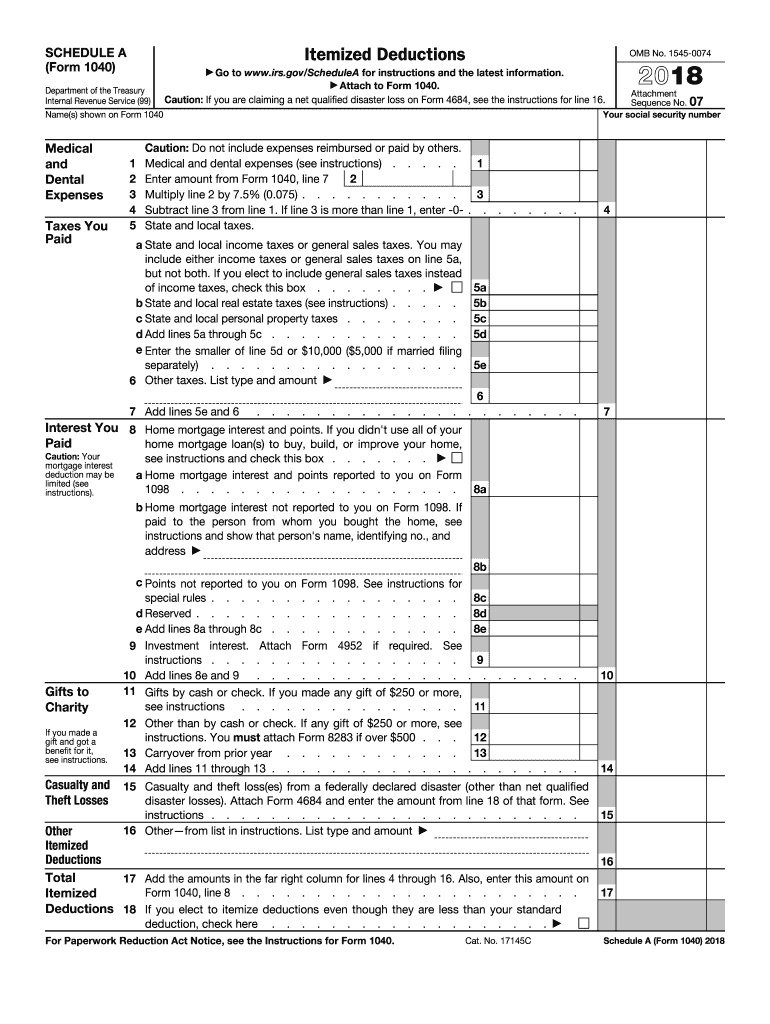

The Schedule A is a form used by taxpayers in the United States to report itemized deductions on their federal income tax return. This form is part of the IRS Form 1040 and allows individuals to detail various expenses that can reduce their taxable income. Common deductions reported on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions. By itemizing deductions, taxpayers may lower their overall tax liability compared to taking the standard deduction, depending on their individual financial situations.

How to use the Schedule A

Using Schedule A involves several steps. Taxpayers must first determine if itemizing deductions is beneficial for their financial situation. If the total of the itemized deductions exceeds the standard deduction, it is advantageous to use Schedule A. Next, gather all necessary documentation to support each deduction claimed. This includes receipts, bank statements, and any relevant tax documents. Once all information is compiled, complete the form by entering the amounts in the appropriate sections, ensuring accuracy to avoid discrepancies with the IRS.

Steps to complete the Schedule A

Completing Schedule A requires careful attention to detail. Follow these steps for accurate completion:

- Gather all documentation related to potential deductions.

- Begin with the medical expenses section, entering qualifying expenses that exceed a specific percentage of your adjusted gross income.

- Proceed to the state and local taxes section, where you can deduct either state income tax or sales tax, along with property taxes.

- Fill out the mortgage interest section, including any points paid on your mortgage.

- List charitable contributions made during the tax year, ensuring you have receipts for donations.

- Review the completed form for accuracy before submitting it with your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for using Schedule A, which include eligibility requirements for each type of deduction. Taxpayers must ensure that the expenses claimed are legitimate and properly documented. Additionally, the IRS updates the form and its instructions periodically, so it is essential to use the correct version for the tax year being filed. Familiarizing oneself with the IRS guidelines can help prevent errors and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A coincide with the general tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes to deadlines due to special circumstances, such as natural disasters or legislative changes. It is advisable to file as early as possible to avoid last-minute issues.

Required Documents

To complete Schedule A accurately, taxpayers need to gather several key documents, including:

- Receipts for medical expenses.

- Documentation of state and local taxes paid.

- Mortgage statements showing interest paid.

- Records of charitable contributions, including receipts and acknowledgment letters.

- Any other relevant financial documents that support deductions claimed on the form.

Legal use of the Schedule A

The Schedule A must be completed in accordance with IRS regulations to ensure its legal validity. Taxpayers are responsible for accurately reporting their deductions and maintaining proper documentation to support their claims. Misreporting or failing to provide adequate documentation can lead to penalties or audits. It is crucial to understand the legal implications of itemizing deductions and to ensure compliance with all IRS guidelines.

Quick guide on how to complete schedule a 2018 form

Discover the simplest method to complete and endorse your Schedule A

Are you still spending valuable time crafting your official papers on physical documents instead of doing it digitally? airSlate SignNow offers a superior approach to finalize and endorse your Schedule A and comparable forms for public services. Our intelligent electronic signature platform equips you with all necessary tools to manage documents swiftly and in line with official regulations - powerful PDF editing, organizing, protecting, signing, and sharing functionalities are all available in a user-friendly interface.

Only a few steps are needed to complete and endorse your Schedule A:

- Insert the editable template into the editor using the Get Form button.

- Review what details are necessary to include in your Schedule A.

- Navigate through the fields utilizing the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the forms with your data.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Block out sections that are no longer relevant.

- Press Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date beside your signature and conclude your task by clicking the Done button.

Store your completed Schedule A in the Documents folder within your profile, download it, or send it to your chosen cloud storage. Our platform also offers adaptable form sharing. There’s no necessity to print out your documents when sending to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct schedule a 2018 form

FAQs

-

How can I get tax relief in California if someone did the Facebook scam with me? I lost my $6000 in January 2018

I dont think it is possible.Consult with the Professional tax advisor.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

How do I fill out the GATE application form?

The GATE 2018 application form opened on August 31, a day earlier than the scheduled date (September 1). Before you start filling the application form, it is important that you go through all the guidelines mentioned for filling it.For instance, you must ensure that you meet the eligibility criteria of the entrance exam. Also, ensure that you only enter correct details, or else you application may be rejected.How to fill the GATE Application FormThe application process includes the following steps:RegistrationLogging-in to access the application formFilling in the GATE application formIn this step, you have to enter personal details, communication details, and also upload all relevant documents. After you are done with entering all essential details, you have to finally pay the application fee, through online mode.4. Logging-in to access the application formFinally submit the completed application form, and get a printout for future reference.The full details to fill the form can be found here: How to fill GATE 2018 Application FormRegards.

-

What's your GATE 2018 result and are you satisfied with it?

I am 2016 pass out from a private college in Mechanical engineering.During campus placements I got placed in TCS, but I didn’t join and opted for coaching from made easy Bhopal. I appeared for GATE 2017 as my first attempt and just cleared the cutoffs by TWO marks.My first attempt was mostly consumed mostly by the fear and some imaginary notion that my preparation is not up to the mark.Braced myself for the second attempt. ( But only doubt I had was “ Will I be able to make that big jump from 30’s to 80’s)Planned everything well this time: Collected all the standard books, studied from them, solved numerals, prepared short notes, formula sheets, took made easy (fully completed) and exergic (half completed) test series. I was constantly under 500 rank in full length test series of made easy. Exergic was a bit too hard to score.In short I did everything I could do.3rd Feb, 2018: Appeared for the morning session. Paper was very much moderate level compared to last year. Attempted 60 questions. ( My best attempt during test series was 55). I was hoping 75+ marks even after normalization.16th March, 2018: My world came crashing down. 63 marks AIR 5099. I was shattered beyond limits. I checked the answers and I found that I had lost 21 marks in silly mistakes. SIMPLE STRAIGHT CALCULATIONS. 16 marks NAT type out of range and rest MCQ. I never felt so hopeless in my entire life as I am feeling now. I am 26 and I have only few psus left I guess to apply even if I attempt gate again.I don’t know what to do and yes I am deeply UNSATISFIED.Suggestion and feedback's from people who has passed this phase in the past. Please!

-

While filling out the NEET application, I choose Telangana since I was studying here, but I belong to AP. Is there any chance to correct it, if so how?

HiCandidates will be permitted to make the correction in their data submitted in NEET 2018 application form. NEET application form correction will be allowed in the following data only:Identification Identity Candidates’ Name Date of Birth Gender Category Disability Status State Codes of Eligibility Medium of Question Paper Parents NameFor availing the correction facility, candidates will visit the official website during the schedule fixed for the correction facility. Correction in any other data is not allowed as this will not affect the candidature and the merit. Further, candidates are requested to be very careful while making corrections as no second opportunity will be made available for corrections.Correction in Application Form : 12.03.2018 (Monday) to 16.03.2018 (Friday)Correction ProcessVisit the Official Site of NEET.Visit “Candidates Login” link.Enter your registration number and password.Click on the link for correction.Now, correct your filled details in the application form.Candidates are advised to correct the mistakes carefully as no second-time correction opportunity will be provided further.Hope this suffice.All the best.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the schedule a 2018 form

How to create an eSignature for your Schedule A 2018 Form in the online mode

How to generate an electronic signature for your Schedule A 2018 Form in Chrome

How to generate an electronic signature for putting it on the Schedule A 2018 Form in Gmail

How to generate an electronic signature for the Schedule A 2018 Form straight from your smart phone

How to generate an electronic signature for the Schedule A 2018 Form on iOS devices

How to make an eSignature for the Schedule A 2018 Form on Android devices

People also ask

-

What is the process to Schedule A document using airSlate SignNow?

Scheduling a document with airSlate SignNow is simple and straightforward. You can upload your document, specify the recipients, and set a date for when you want them to sign. This ensures that your important documents are signed in a timely manner, making the entire process efficient.

-

How much does it cost to Schedule A document with airSlate SignNow?

The pricing for using airSlate SignNow to Schedule A document varies based on the plan you choose. We offer flexible pricing tiers to accommodate businesses of all sizes, ensuring that you can effectively manage your document signing needs without breaking the bank.

-

What features does airSlate SignNow offer for Scheduling A documents?

airSlate SignNow includes a variety of features designed to enhance the document signing experience. When you Schedule A document, you benefit from customizable templates, reminders for signers, and real-time tracking of document status, which all contribute to a streamlined workflow.

-

Can I integrate airSlate SignNow with other applications to Schedule A documents?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to Schedule A documents directly from platforms you already use. Whether it’s CRM systems, cloud storage solutions, or project management tools, our integrations enhance your productivity and simplify the document management process.

-

What are the benefits of using airSlate SignNow to Schedule A documents?

Using airSlate SignNow to Schedule A documents provides signNow benefits such as increased efficiency and reduced turnaround times. The ease of scheduling ensures that your documents are signed when needed, improving compliance and enhancing collaboration among teams.

-

Is it secure to Schedule A document with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents scheduled for signing are protected with advanced encryption and compliance with global security standards. You can confidently Schedule A document knowing that sensitive information is safeguarded.

-

Can I customize the signing experience when I Schedule A document?

Yes, airSlate SignNow allows you to customize the signing experience for each document you Schedule A. You can add fields, specify signing order, and personalize messages to enhance communication with signers, making the process more user-friendly.

Get more for Schedule A

Find out other Schedule A

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document