Denver Revised Municipal Code 20 69 Form

What is the Denver Revised Municipal Code 20 69 Form

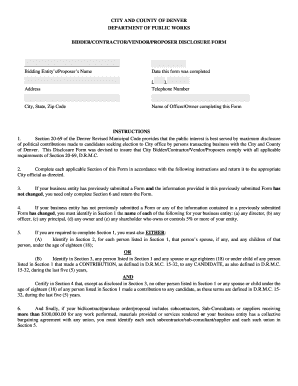

The Denver Revised Municipal Code 20 69 Form is a legal document used within the jurisdiction of Denver, Colorado. This form is designed to facilitate compliance with specific municipal regulations, particularly those related to zoning, land use, or business operations. It serves as an essential tool for individuals and businesses seeking to navigate local laws effectively.

How to use the Denver Revised Municipal Code 20 69 Form

Using the Denver Revised Municipal Code 20 69 Form involves several key steps. First, ensure that you have the most current version of the form, which can typically be obtained from the city’s official website or local government offices. Next, carefully read the instructions provided with the form to understand the requirements and necessary information. Complete the form by filling in all required fields accurately, as incomplete submissions may lead to delays or rejections.

Steps to complete the Denver Revised Municipal Code 20 69 Form

Completing the Denver Revised Municipal Code 20 69 Form requires attention to detail. Follow these steps:

- Gather necessary documents and information required for the form.

- Fill in your personal or business details, including name, address, and contact information.

- Provide specific information related to the purpose of the form, such as zoning requests or business licenses.

- Review the form for accuracy and completeness before submission.

Legal use of the Denver Revised Municipal Code 20 69 Form

The legal use of the Denver Revised Municipal Code 20 69 Form ensures compliance with local regulations. Submitting this form may be necessary for obtaining permits or licenses, and it may also be required for certain business activities. Understanding the legal implications of the form is crucial, as failure to comply with municipal codes can result in penalties or legal actions.

Key elements of the Denver Revised Municipal Code 20 69 Form

The key elements of the Denver Revised Municipal Code 20 69 Form include:

- Applicant Information: Details about the individual or business submitting the form.

- Purpose of Submission: A clear statement of why the form is being submitted, such as a request for a zoning change.

- Supporting Documentation: Any additional documents required to substantiate the request or application.

- Signature: The applicant's signature, affirming the accuracy of the information provided.

Who Issues the Form

The Denver Revised Municipal Code 20 69 Form is typically issued by the Denver city government, specifically through departments responsible for urban planning, zoning, or business licensing. These departments ensure that the form aligns with local regulations and provides the necessary framework for compliance.

Quick guide on how to complete denver revised municipal code 20 69 form

Complete Denver Revised Municipal Code 20 69 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Denver Revised Municipal Code 20 69 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Denver Revised Municipal Code 20 69 Form without hassle

- Locate Denver Revised Municipal Code 20 69 Form and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from your preferred device. Modify and eSign Denver Revised Municipal Code 20 69 Form, ensuring effective communication at any step of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the denver revised municipal code 20 69 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Denver Revised Municipal Code 20 69 Form?

The Denver Revised Municipal Code 20 69 Form is a legal document required for specific municipal processes in Denver. It ensures compliance with local regulations and facilitates efficient handling of municipal matters. Understanding this form is crucial for businesses operating within Denver.

-

How can airSlate SignNow help with the Denver Revised Municipal Code 20 69 Form?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign the Denver Revised Municipal Code 20 69 Form. Our solution streamlines the document management process, making it faster and more efficient for businesses to comply with municipal requirements.

-

What are the pricing options for using airSlate SignNow for the Denver Revised Municipal Code 20 69 Form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can manage the Denver Revised Municipal Code 20 69 Form without breaking the bank. Visit our pricing page for detailed information on available plans.

-

Are there any features specifically designed for the Denver Revised Municipal Code 20 69 Form?

Yes, airSlate SignNow includes features that enhance the handling of the Denver Revised Municipal Code 20 69 Form, such as customizable templates, automated workflows, and secure eSigning. These features help ensure that your documents are compliant and processed efficiently.

-

What benefits does airSlate SignNow offer for managing the Denver Revised Municipal Code 20 69 Form?

Using airSlate SignNow for the Denver Revised Municipal Code 20 69 Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick turnaround times, ensuring that your municipal processes are handled smoothly.

-

Can I integrate airSlate SignNow with other tools for the Denver Revised Municipal Code 20 69 Form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, allowing you to manage the Denver Revised Municipal Code 20 69 Form alongside your existing workflows. This integration capability enhances productivity and ensures a cohesive document management experience.

-

Is airSlate SignNow secure for handling the Denver Revised Municipal Code 20 69 Form?

Yes, airSlate SignNow prioritizes security and compliance when handling the Denver Revised Municipal Code 20 69 Form. Our platform employs advanced encryption and security protocols to protect your sensitive information throughout the document lifecycle.

Get more for Denver Revised Municipal Code 20 69 Form

- Trial notebook template 101298780 form

- Selecting the highest most appropriate alabama high school diploma pathway form

- Washington gas meter upgrade form

- 1099 hc bluecross blue shield ga form

- Preschool graduation program template pdf form

- Consumer disclosure for voluntary escrow account payments form

- Bcbsm wf 10584 group change form

- Id or medical record form

Find out other Denver Revised Municipal Code 20 69 Form

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form