Form 709

What is the Form 709

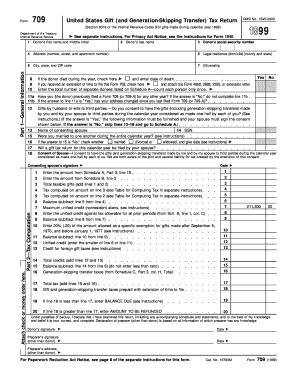

The IRS Form 709 is a United States federal tax form used to report gifts and generation-skipping transfers. This form is essential for individuals who exceed the annual gift tax exclusion limit, which is set by the IRS. It allows taxpayers to document the value of gifts given to others and to calculate any potential gift tax liability. Understanding the purpose of Form 709 is crucial for proper tax compliance and planning.

How to obtain the Form 709

To obtain the IRS Form 709, individuals can visit the official IRS website, where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy by contacting the IRS directly. It is advisable to ensure you are using the most current version of the form to avoid any issues during filing.

Steps to complete the Form 709

Completing the IRS Form 709 involves several key steps:

- Gather necessary information about the gifts made during the tax year.

- Determine the fair market value of each gift at the time it was given.

- Complete the form by providing details such as the recipient's information and the value of the gifts.

- Calculate any applicable gift tax using the instructions provided with the form.

- Review the completed form for accuracy before submission.

Legal use of the Form 709

The IRS Form 709 serves as a legal document that must be filed by individuals who meet specific criteria regarding gift giving. Proper completion and submission of this form ensure compliance with federal tax laws. Failure to file or incorrect reporting can lead to penalties, making it essential to understand the legal implications of Form 709.

Filing Deadlines / Important Dates

The deadline for filing IRS Form 709 is typically April fifteenth of the year following the tax year in which the gifts were made. If the taxpayer is granted an extension for their income tax return, this extension also applies to Form 709. It is important to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 709 can be submitted in various ways. Taxpayers have the option to file the form electronically using tax software that supports e-filing for gift tax returns. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are not typically available for this form, making electronic and mail submissions the primary methods for filing.

Quick guide on how to complete form 709 1667016

Effortlessly prepare Form 709 on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents quickly and effectively. Manage Form 709 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to amend and electronically sign Form 709 seamlessly

- Obtain Form 709 and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Form 709 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 1667016

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 709 and why do I need to print it?

The IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is required for individuals who have made gifts above the annual exclusion limit. Printing this form accurately is crucial for ensuring compliance with tax regulations. By using airSlate SignNow, you can easily edit, fill out, and eSign the IRS Form 709 before printing it.

-

How can airSlate SignNow help me with IRS Form 709 print?

airSlate SignNow streamlines the process of filling out and eSigning the IRS Form 709, making it simple to manage your forms digitally. Once you are done, you can conveniently print the form directly from the platform. This eliminates the need for cumbersome paperwork and ensures your forms are professionally completed.

-

Are there any costs associated with printing the IRS Form 709 using airSlate SignNow?

While airSlate SignNow offers various subscription plans, the ability to print the IRS Form 709 is included in all tiers. This means you can efficiently manage your documents without any additional fees for printing. It's a cost-effective solution for individuals and businesses alike.

-

What features does airSlate SignNow provide for working with IRS Form 709?

airSlate SignNow offers a range of features including document templates, easy editing, eSignature capabilities, and streamlined printing options for IRS Form 709. With user-friendly navigation, you can ensure your form is filled out correctly and signed in a secure environment. All of this makes the process quick and efficient.

-

Is there a way to integrate airSlate SignNow with other software for IRS Form 709 printing?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow. Whether you're using accounting software or customer relationship management (CRM) systems, you can easily incorporate IRS Form 709 printing into your existing processes. This integration saves time and increases productivity.

-

Can I store my completed IRS Form 709 documents using airSlate SignNow?

Absolutely! airSlate SignNow allows you to securely store all your completed IRS Form 709 documents in one place. This not only helps in keeping your records organized but also ensures that your important tax documents are safe and accessible whenever needed.

-

Does airSlate SignNow provide customer support for IRS Form 709 issues?

Yes, airSlate SignNow offers comprehensive customer support to assist you with any issues related to IRS Form 709 printing or any other features. Whether you need help navigating the platform or have questions about tax forms, our dedicated support team is available to provide guidance and solutions.

Get more for Form 709

- Texas trailer registration form

- Kent state university immunization form

- Ub92 form 41482953

- Ccs medical order form 76314272

- Qml pathology request form pdf

- Snap application pdf dss manuals mo gov form

- Social security sent me a form ssa 8240 authorization to

- Framework procurement agreement template form

Find out other Form 709

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer