TC 20MC, Utah Tax Return for Misc Corporations Forms & Publications 2023-2026

Understanding the TC 20MC

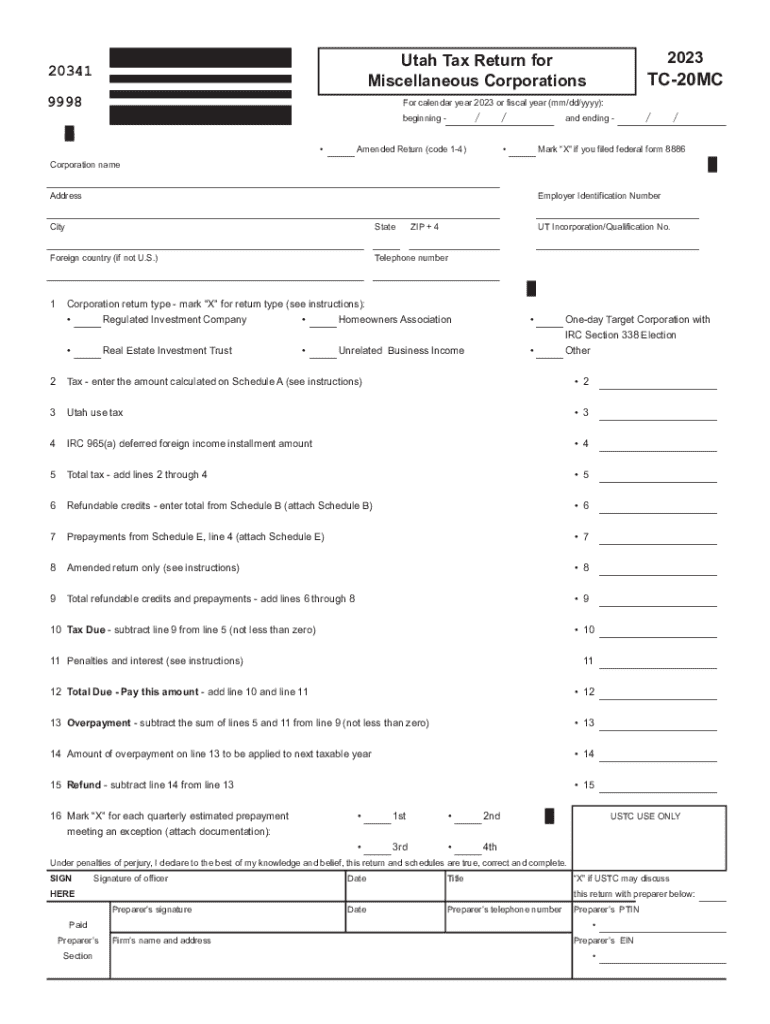

The TC 20MC is the Utah Tax Return for Miscellaneous Corporations, designed to facilitate the reporting of income and expenses for various business entities operating within the state. This form is essential for corporations that do not fall under the traditional categories of taxation, such as C corporations or S corporations. It allows these entities to comply with state tax obligations while ensuring accurate reporting to the Utah State Tax Commission.

Steps to Complete the TC 20MC

Completing the TC 20MC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, fill out the form with accurate information regarding your business operations, including total income, expenses, and any applicable tax credits. After completing the form, review all entries for accuracy before submission. It is crucial to ensure that all calculations are correct to avoid potential penalties.

Filing Deadlines and Important Dates

Timely submission of the TC 20MC is vital to avoid penalties. The filing deadline for the TC 20MC typically aligns with the federal tax return deadline, which is usually April fifteenth. However, if you are unable to file by this date, you may request an extension. It is important to note that extensions only extend the filing date, not the payment date for any taxes owed. Therefore, any estimated taxes should be paid by the original deadline to avoid interest and penalties.

Required Documents for TC 20MC

To successfully complete the TC 20MC, several documents are required. These include financial statements that detail your business's income and expenses, previous tax returns, and any supporting documentation for deductions claimed. Additionally, if your corporation has made any estimated tax payments, documentation of these payments should also be included. Having these documents organized will streamline the filing process and help ensure compliance with state regulations.

Legal Use of the TC 20MC

The TC 20MC serves a specific legal purpose within the framework of Utah tax law. It is legally required for miscellaneous corporations to report their income and expenses accurately. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is crucial for maintaining compliance and avoiding potential legal issues with the Utah State Tax Commission.

Obtaining the TC 20MC

The TC 20MC can be obtained through the Utah State Tax Commission's website or by contacting their office directly. It is available in both digital and paper formats, allowing businesses to choose the method that best suits their needs. For those who prefer a digital approach, the form can be filled out online and submitted electronically, which can expedite the filing process and reduce the likelihood of errors.

Examples of Using the TC 20MC

Various scenarios illustrate the application of the TC 20MC. For instance, a small consulting firm that does not qualify as a C corporation may use this form to report its income and expenses. Similarly, a nonprofit organization that engages in business activities may also need to file the TC 20MC to comply with state tax laws. These examples highlight the form's versatility and importance for different types of business entities operating in Utah.

Quick guide on how to complete tc 20mc utah tax return for misc corporations forms ampamp publications

Streamline TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without hold-ups. Manage TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications with ease

- Locate TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or inaccuracies that necessitate printing new copies of documents. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and eSign TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 20mc utah tax return for misc corporations forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the tc 20mc utah tax return for misc corporations forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tc20mc and how does it relate to airSlate SignNow?

The tc20mc is a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing tc20mc, businesses can improve efficiency and reduce turnaround times.

-

How much does airSlate SignNow cost with the tc20mc feature?

Pricing for airSlate SignNow varies based on the plan selected, but the tc20mc feature is included in all tiers. This ensures that businesses of all sizes can access powerful eSigning tools without breaking the bank. For detailed pricing, visit our website or contact our sales team.

-

What are the key features of tc20mc in airSlate SignNow?

The tc20mc feature includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. These features are designed to enhance user experience and ensure that documents are signed quickly and securely. With tc20mc, you can also integrate with various applications for seamless workflow management.

-

What benefits does tc20mc offer for businesses?

By implementing the tc20mc feature, businesses can signNowly reduce the time spent on document processing. This leads to faster decision-making and improved productivity. Additionally, tc20mc enhances security, ensuring that sensitive information is protected throughout the signing process.

-

Can I integrate tc20mc with other software applications?

Yes, tc20mc is designed to integrate seamlessly with a variety of software applications, including CRM and project management tools. This integration allows for a more cohesive workflow, enabling users to manage documents and signatures from one central platform. Check our integration options for more details.

-

Is tc20mc suitable for small businesses?

Absolutely! The tc20mc feature within airSlate SignNow is tailored to meet the needs of small businesses by providing an affordable and user-friendly eSigning solution. Small businesses can leverage tc20mc to enhance their document workflows without the need for extensive resources or technical expertise.

-

How secure is the tc20mc feature in airSlate SignNow?

The tc20mc feature prioritizes security, employing advanced encryption and authentication methods to protect your documents. airSlate SignNow complies with industry standards to ensure that all eSignatures are legally binding and secure. You can trust tc20mc to keep your sensitive information safe.

Get more for TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications

Find out other TC 20MC, Utah Tax Return For Misc Corporations Forms & Publications

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile