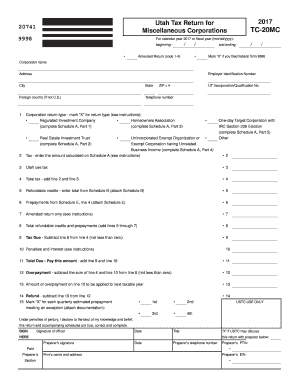

Utah Tc 20mc Form 2017

What is the Utah Tc 20mc Form

The Utah Tc 20mc Form is a specific document used in the state of Utah for tax-related purposes. This form is primarily utilized by individuals and businesses to report certain financial information to the state tax authority. It is essential for ensuring compliance with state tax regulations and for accurately calculating tax liabilities. The form may include sections for income reporting, deductions, and credits, tailored to meet the requirements set forth by Utah tax laws.

How to Obtain the Utah Tc 20mc Form

To obtain the Utah Tc 20mc Form, individuals can visit the official website of the Utah State Tax Commission. The form is typically available for download in PDF format, allowing users to print and complete it manually. Additionally, individuals may request a physical copy by contacting the tax office directly or visiting a local tax office. It is important to ensure that the most current version of the form is used to comply with any recent updates or changes in tax law.

Steps to Complete the Utah Tc 20mc Form

Completing the Utah Tc 20mc Form involves several key steps:

- Gather all necessary financial documents, including income statements and receipts for deductions.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report income in the designated sections, ensuring accuracy to avoid discrepancies.

- Include any applicable deductions or credits as outlined in the instructions provided with the form.

- Review the completed form for errors or omissions before submission.

Legal Use of the Utah Tc 20mc Form

The Utah Tc 20mc Form is legally binding and must be filled out accurately to reflect the taxpayer's financial situation. Failing to provide truthful information can result in penalties or legal repercussions. It is crucial for users to understand the legal implications of submitting this form, as it serves as an official record with the state tax authority. Compliance with state tax laws ensures that individuals and businesses avoid unnecessary audits or fines.

Filing Deadlines and Important Dates

Filing deadlines for the Utah Tc 20mc Form are critical to avoid penalties. Typically, the form must be submitted by the state tax filing deadline, which is often aligned with federal tax deadlines. It is advisable for taxpayers to mark their calendars with these important dates to ensure timely filing. Late submissions may incur additional fees or interest on unpaid taxes.

Required Documents

When filling out the Utah Tc 20mc Form, certain documents are required to substantiate the information provided. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Any prior year tax returns for reference

Having these documents ready can streamline the completion process and enhance accuracy.

Quick guide on how to complete utah tc 20mc form

Complete Utah Tc 20mc Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Utah Tc 20mc Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Utah Tc 20mc Form effortlessly

- Obtain Utah Tc 20mc Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any desired device. Edit and electronically sign Utah Tc 20mc Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct utah tc 20mc form

Create this form in 5 minutes!

How to create an eSignature for the utah tc 20mc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where can I get Utah tax forms?

Get Utah Forms Downloadable PDF versions of Utah tax forms are available at tax.utah.gov/forms. Many of these forms can be completed on your computer, then printed.

-

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

-

What is the threshold for form 8886?

Losses that must be reported on Forms 8886 and 8918 For individuals, at least $2 million in a single tax year or $4 million in any combination of tax years. For corporations (excluding S corporations), at least $10 million in any single tax year or $20 million in any combination of tax years.

-

What is Form 8886 Utah?

Federal Form 8886. Identity Verification. Innocent or Injured Spouse. Name, Address, SSN, and Residency. State Tax Refund Included on Federal Return.

-

Why am I getting a letter from the Utah state tax commission?

General Information. If a taxpayer does not file a return, files it late, or if the tax due is underpaid, the Tax Commission will send the taxpayer a billing notice approximately thirty days after the due date. The amount due on the billing notice will include any penalty and interest calculated to the notice due date.

-

Where do I file my Utah TC 20S?

A copy of the IRS letter of authorization, “Notice of Acceptance as an S Corporation,” must be at- tached to the S Corporation Franchise or Income Tax Return, TC-20S, when filing for the first time. and Tax Commission Master File Maintenance 210 N 1950 W Salt Lake City, UT 84134.

-

What is the purpose of form 8886?

Purpose of Form Use Form 8886 to disclose information for each reportable transaction in which you participated. See Participation in a Reportable Transaction, later, to determine if you participated in a reportable transaction. For more information on the disclosure rules, see Regulations section 1.6011-4.

-

What are the 5 categories of reportable transactions?

There are five categories of reportable transactions; confidential transactions, transactions with contractual protection, loss transactions, transactions of interest and listed transactions. See the brief descriptions of each type of transaction below.

Get more for Utah Tc 20mc Form

- Precious metals overhaul protection form

- Form 7a application for the reinstatement of an heathrow airport

- Howard county rental application form

- Singular of fill form

- Hiv serology test requisition form

- Grading request form linn county oregon co linn or

- Request form for birthday and anniversary message from the

- Garage lease agreement template form

Find out other Utah Tc 20mc Form

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later