Sworn Statement and Proof of Loss PDF City of Lorain 2017-2026

Understanding the sworn statement in proof of loss

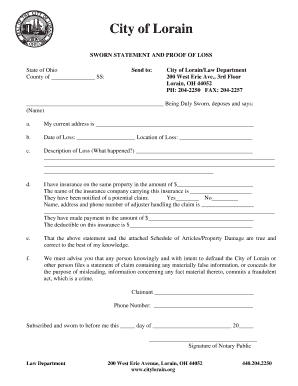

A sworn statement in proof of loss is a formal document used primarily in insurance claims to confirm the details of a loss. This document is typically required by insurance companies to process claims for property damage or loss. It serves as a declaration from the policyholder, affirming the accuracy of the information provided regarding the incident. The sworn statement often includes specifics such as the date of loss, the nature of the loss, and any relevant supporting documentation.

Steps to complete the sworn statement in proof of loss

Completing a sworn statement in proof of loss involves several key steps. First, gather all necessary information related to the loss, including dates, descriptions, and any evidence such as photographs or receipts. Next, fill out the form accurately, ensuring that all sections are completed. It is crucial to provide truthful and detailed information, as inaccuracies can lead to delays or denial of the claim. After completing the form, the policyholder must sign it in the presence of a notary public, affirming that the information is correct.

Key elements of the sworn statement in proof of loss

The sworn statement in proof of loss contains several essential elements. These include the policyholder's name and contact information, the insurance policy number, a detailed account of the loss, and the date it occurred. Additionally, the document should outline the estimated value of the loss and any supporting evidence provided. It is important that the statement is clear and concise to facilitate the claims process.

Legal use of the sworn statement in proof of loss

This document has significant legal implications. By signing the sworn statement, the policyholder is legally bound to the accuracy of the information provided. Misrepresentation or fraud can result in severe penalties, including denial of the claim or legal action by the insurance company. Therefore, it is vital to approach the completion of this document with honesty and diligence.

Obtaining the sworn statement in proof of loss

To obtain the sworn statement in proof of loss, individuals typically need to contact their insurance provider. Most insurance companies provide this form as part of their claims process. Additionally, some states may have specific templates or requirements for the sworn statement. It is advisable to check with the insurance company or a legal professional to ensure compliance with local regulations.

Examples of using the sworn statement in proof of loss

Examples of when a sworn statement in proof of loss might be used include incidents such as fire damage to a home, theft of personal property, or damage caused by severe weather. In each case, the policyholder would need to document the specifics of the loss, including any relevant details that support their claim. Providing a thorough sworn statement can significantly impact the outcome of the insurance claim process.

Quick guide on how to complete sworn statement and proof of loss pdf city of lorain

Finalize Sworn Statement And Proof Of Loss PDF City Of Lorain seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Sworn Statement And Proof Of Loss PDF City Of Lorain on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and electronically sign Sworn Statement And Proof Of Loss PDF City Of Lorain effortlessly

- Retrieve Sworn Statement And Proof Of Loss PDF City Of Lorain and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sworn Statement And Proof Of Loss PDF City Of Lorain to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sworn statement and proof of loss pdf city of lorain

Create this form in 5 minutes!

How to create an eSignature for the sworn statement and proof of loss pdf city of lorain

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sworn statement in proof of loss?

A sworn statement in proof of loss is a formal document that an insured party submits to an insurance company to claim compensation for a loss. This statement typically includes details about the incident, the extent of the loss, and any supporting evidence. Using airSlate SignNow, you can easily create and eSign this document to streamline your claims process.

-

How can airSlate SignNow help with sworn statements in proof of loss?

airSlate SignNow provides a user-friendly platform to create, send, and eSign sworn statements in proof of loss. Our solution simplifies the documentation process, ensuring that your claims are submitted quickly and accurately. With our templates and integrations, you can enhance your workflow and reduce processing time.

-

Is there a cost associated with using airSlate SignNow for sworn statements in proof of loss?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, allowing you to manage sworn statements in proof of loss without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing sworn statements in proof of loss?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing sworn statements in proof of loss. Additionally, our platform allows for easy collaboration and sharing, ensuring that all parties involved can access the necessary documents efficiently.

-

Can I integrate airSlate SignNow with other tools for sworn statements in proof of loss?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to seamlessly manage sworn statements in proof of loss alongside your existing tools, enhancing your overall workflow and productivity.

-

How secure is airSlate SignNow for handling sworn statements in proof of loss?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your sworn statements in proof of loss and other sensitive documents. You can trust that your information is safe and secure while using our services.

-

What are the benefits of using airSlate SignNow for sworn statements in proof of loss?

Using airSlate SignNow for sworn statements in proof of loss offers numerous benefits, including increased efficiency, reduced paperwork, and faster claim processing. Our platform simplifies the entire process, allowing you to focus on what matters most—getting your claims approved and compensated.

Get more for Sworn Statement And Proof Of Loss PDF City Of Lorain

- Notice to medical insurance provider of request for continuation coverage minnesota form

- Mn court order form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out minnesota form

- Minnesota judge form

- Amending caption form

- Minnesota change form

- Minnesota temporary custody form

- Service publication minnesota form

Find out other Sworn Statement And Proof Of Loss PDF City Of Lorain

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later