Ct 1 Form

What is the CT-1 Railroad Form?

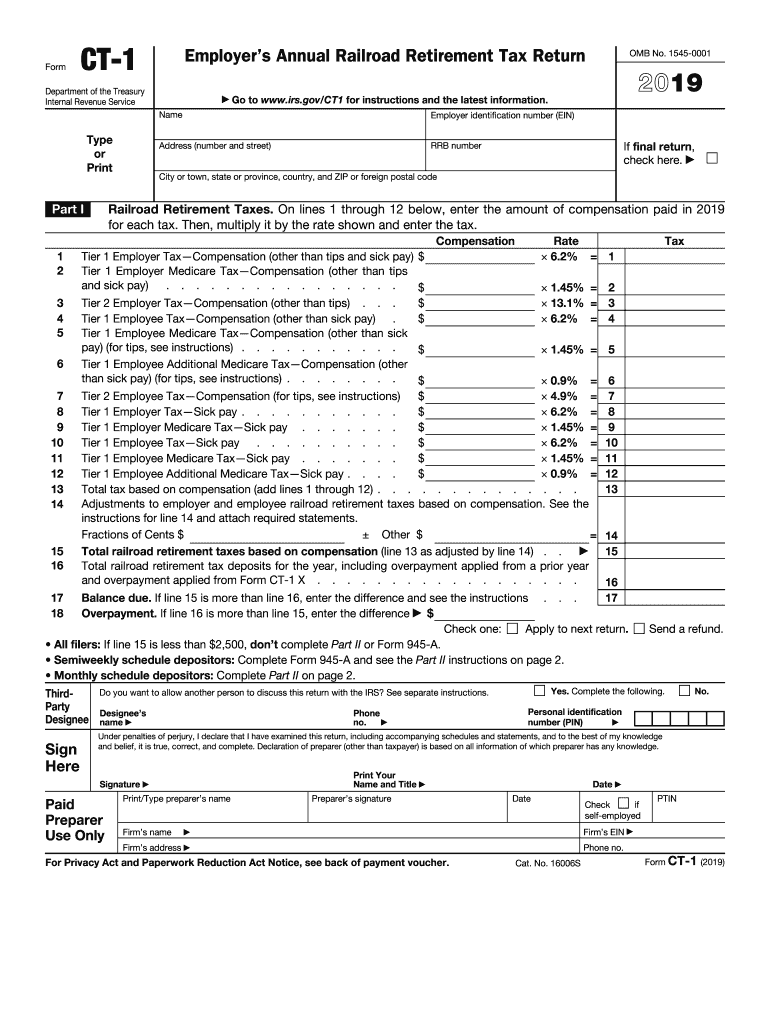

The CT-1 Railroad Form, also known as the CT-1 annual, is a crucial document used by employers in the railroad industry to report retirement plan contributions and employee benefits. This form is necessary for compliance with the Internal Revenue Service (IRS) regulations, ensuring that all retirement benefits are accurately reported and managed. The CT-1 form captures essential information about the employer's contributions to retirement plans for employees, which is vital for tax purposes and employee benefit management.

Steps to Complete the CT-1 Form

Completing the CT-1 form involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary information, including employer identification details and employee data.

- Fill out the form sections, providing accurate figures for contributions and benefits.

- Review the form for any errors or omissions before submission.

- Ensure that all required signatures are obtained to validate the form.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the CT-1 Form

The CT-1 form serves a legal purpose in documenting retirement contributions and ensuring compliance with federal regulations. It is essential for employers to understand that failure to file the CT-1 correctly can lead to penalties. The form must be filled out in accordance with IRS guidelines, which stipulate how contributions should be reported and the necessary documentation to support those contributions. Legal compliance not only protects the employer but also ensures that employees receive the benefits they are entitled to under the law.

IRS Guidelines for the CT-1 Form

The IRS provides specific guidelines for completing and submitting the CT-1 form. Employers must adhere to these guidelines to ensure their submissions are accepted. Key points include:

- Filing deadlines must be strictly observed to avoid late fees.

- Accurate reporting of all contributions and benefits is mandatory.

- Employers should keep copies of submitted forms for their records.

Filing Deadlines for the CT-1 Form

Timely filing of the CT-1 form is essential for compliance. The IRS typically sets annual deadlines for submission, which employers must follow. Missing these deadlines can result in penalties and interest on any unpaid contributions. Employers should mark their calendars for these important dates to ensure they remain compliant with federal regulations.

Required Documents for the CT-1 Form

When preparing to complete the CT-1 form, employers should gather all necessary documentation. This includes:

- Employee records detailing contributions to retirement plans.

- Employer identification information, including tax identification numbers.

- Any relevant financial statements that support the reported figures.

Form Submission Methods for the CT-1

The CT-1 form can be submitted through various methods, depending on the preferences of the employer and the requirements of the IRS. Common submission methods include:

- Online submission through the IRS e-filing system.

- Mailing a paper version of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete 2019 form ct 1 employers annual railroad retirement tax return

Effortlessly prepare Ct 1 on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documentation, as you can access the desired form and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, edit, and eSign your documents without delays. Handle Ct 1 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Ct 1 with ease

- Find Ct 1 and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a standard handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct 1 and ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form ct 1 employers annual railroad retirement tax return

How to create an electronic signature for your 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return online

How to generate an eSignature for the 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return in Chrome

How to make an eSignature for signing the 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return in Gmail

How to make an electronic signature for the 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return right from your smartphone

How to create an electronic signature for the 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return on iOS

How to make an electronic signature for the 2019 Form Ct 1 Employers Annual Railroad Retirement Tax Return on Android OS

People also ask

-

What is the ct1 railroad form and why is it important?

The ct1 railroad form is a document required by the railroad industry to facilitate various transactions and regulatory compliance. It is essential for businesses operating within this sector to ensure accurate and timely submission of the ct1 railroad form to avoid potential fines and delays.

-

How does airSlate SignNow simplify the process of completing the ct1 railroad form?

airSlate SignNow simplifies the completion of the ct1 railroad form by providing an intuitive electronic signature platform. Users can easily fill out, sign, and send the ct1 railroad form without needing to print or scan, which streamlines the entire process.

-

What are the pricing plans for using airSlate SignNow to manage the ct1 railroad form?

airSlate SignNow offers various pricing plans designed to accommodate different business needs, whether you're a small business or a large enterprise. Each plan includes features that support the completion and management of the ct1 railroad form, ensuring you find an option that fits your budget.

-

Can I integrate airSlate SignNow with other tools for managing the ct1 railroad form?

Yes, airSlate SignNow integrates seamlessly with a variety of tools and platforms, enhancing your workflow when managing the ct1 railroad form. Popular integrations include Google Drive, Dropbox, and other productivity applications, allowing for a more cohesive document management strategy.

-

What security features does airSlate SignNow provide for the ct1 railroad form?

airSlate SignNow prioritizes security with features such as encryption and multi-factor authentication to safeguard your documents, including the ct1 railroad form. These measures ensure that sensitive information remains protected throughout the signing process.

-

Is it possible to track the status of the ct1 railroad form sent via airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking of your documents, including the ct1 railroad form, allowing you to see when they have been viewed, signed, and completed. This feature enhances accountability and helps streamline document management.

-

Are there templates available for the ct1 railroad form in airSlate SignNow?

Yes, airSlate SignNow offers customizable templates for the ct1 railroad form which can save you time and effort. By using these templates, you can standardize information and ensure compliance with industry requirements while making the signing process smoother.

Get more for Ct 1

Find out other Ct 1

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online