K 1 Form

What is the K-1 Form?

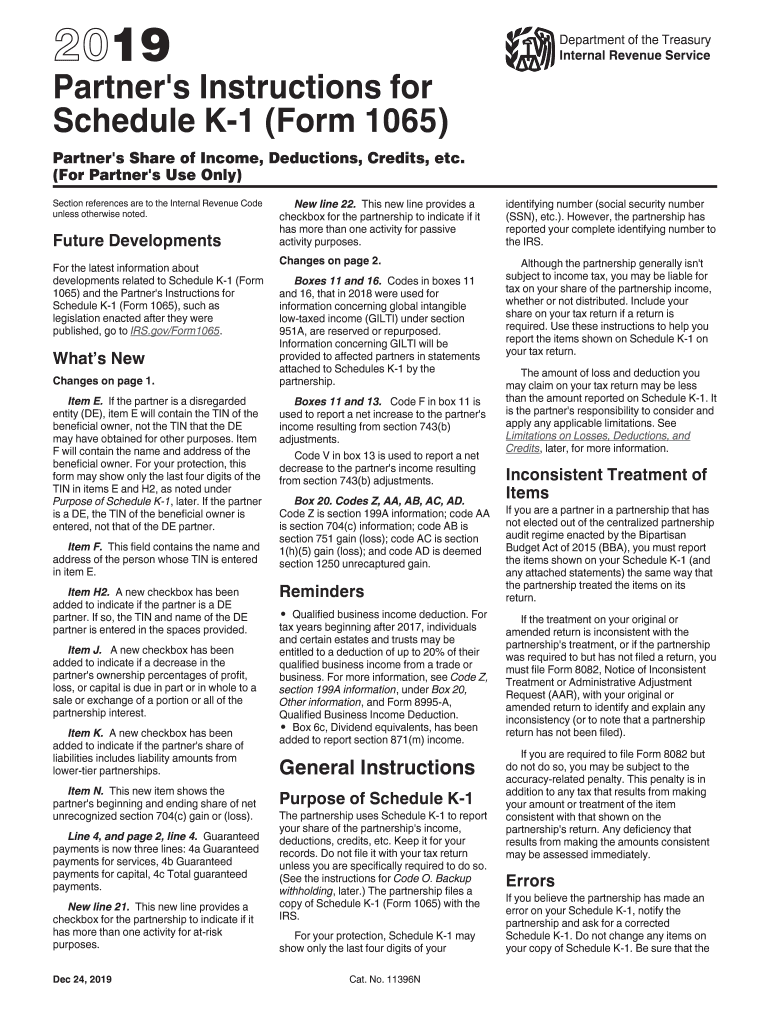

The K-1 form, specifically the 1065 K-1, is a tax document used to report income, deductions, and credits from partnerships and multi-member LLCs to the Internal Revenue Service (IRS). Each partner or member receives a K-1 that details their share of the entity's income, losses, and other tax-related items. This form is essential for individual partners to accurately report their income on their personal tax returns, ensuring compliance with IRS regulations.

How to Use the K-1 Form

Using the K-1 form involves several steps. First, partners must receive their K-1 from the partnership or LLC, which should be provided by the due date of the partnership's tax return. Once received, partners should carefully review the information, including income, deductions, and credits. This information is then transferred to the partner's individual tax return, typically on Schedule E. It is crucial to ensure that the details on the K-1 match the partner's records to avoid discrepancies with the IRS.

Steps to Complete the K-1 Form

Completing the K-1 form requires attention to detail. Here are the key steps:

- Gather necessary information, including the partnership's tax identification number and the partner's share of income and losses.

- Fill out the K-1 form accurately, ensuring that all fields are completed, including the partner's name, address, and tax identification number.

- Report the partner's share of income, deductions, and credits in the appropriate sections of the form.

- Provide a copy of the completed K-1 to each partner and retain a copy for the partnership's records.

IRS Guidelines

The IRS provides specific guidelines for the completion and filing of the K-1 form. It is important to refer to the IRS instructions for Form 1065 and K-1 for the most current requirements. These guidelines outline how to report various types of income, including capital gains, ordinary business income, and rental income. Additionally, they detail the deadlines for filing and the necessary attachments that must accompany the K-1 when submitted with the partnership's tax return.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 form are critical for compliance. Generally, partnerships must file Form 1065 by March 15 of the following tax year. K-1 forms should be provided to partners by the same date, allowing them sufficient time to report this income on their individual tax returns. If the partnership files for an extension, the deadline may be extended, but it is essential that partners receive their K-1 in a timely manner to avoid penalties.

Penalties for Non-Compliance

Failure to provide or accurately complete the K-1 form can result in significant penalties. The IRS may impose fines for late filing, and partners may face issues with their personal tax returns if the information is incorrect or missing. It is essential for partnerships to ensure that all K-1 forms are completed accurately and distributed on time to avoid these penalties, which can complicate tax situations for both the partnership and its partners.

Quick guide on how to complete 2019 partners instructions for schedule k 1 form 1065 partners instructions for schedule k 1 form 1065 partners share of income

Complete K 1 Form effortlessly on any device

Online document administration has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage K 1 Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

The easiest way to edit and eSign K 1 Form with minimal effort

- Retrieve K 1 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to apply your changes.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign K 1 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 partners instructions for schedule k 1 form 1065 partners instructions for schedule k 1 form 1065 partners share of income

How to make an eSignature for the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income online

How to make an eSignature for the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income in Chrome

How to generate an eSignature for putting it on the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income in Gmail

How to generate an eSignature for the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income from your smartphone

How to generate an electronic signature for the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income on iOS

How to make an electronic signature for the 2019 Partners Instructions For Schedule K 1 Form 1065 Partners Instructions For Schedule K 1 Form 1065 Partners Share Of Income on Android devices

People also ask

-

What are the key features of airSlate SignNow that help with 1065x instructions 2019?

AirSlate SignNow offers essential features that streamline the eSigning process for 1065x instructions 2019. With customizable templates and intuitive workflows, users can easily prepare, send, and sign documents. The platform also integrates seamlessly with various applications, enhancing productivity.

-

How does airSlate SignNow simplify the completion of 1065x instructions 2019?

AirSlate SignNow simplifies the completion of 1065x instructions 2019 by offering a user-friendly interface and step-by-step guidance through the eSigning process. Users can fill out forms, add electronic signatures, and manage documents in one central location. This efficiency saves time and reduces errors during submission.

-

What pricing plans does airSlate SignNow offer for users needing 1065x instructions 2019?

AirSlate SignNow offers flexible pricing plans tailored to businesses of all sizes looking to manage 1065x instructions 2019. Users can choose from individual, business, and enterprise plans, each with varying levels of features and support. This ensures you find a plan that fits your budget and document signing needs.

-

Can I use airSlate SignNow for team collaboration on 1065x instructions 2019?

Yes, airSlate SignNow supports team collaboration for 1065x instructions 2019, enabling multiple users to work on documents simultaneously. Team members can leave comments, track changes, and update forms in real-time, making it an ideal solution for collaborative projects. This feature enhances transparency and communication among team members.

-

Does airSlate SignNow integrate with other software for managing 1065x instructions 2019?

Absolutely! AirSlate SignNow integrates with various applications, including Google Drive, Dropbox, and Microsoft Office. This allows users to import and export documents easily while maintaining the integrity of their 1065x instructions 2019. Such integrations streamline your workflow and enhance productivity.

-

How secure is my data when using airSlate SignNow for 1065x instructions 2019?

Data security is a top priority for airSlate SignNow when handling 1065x instructions 2019. The platform employs advanced encryption methods, ensuring that your signed documents and personal information remain confidential and protected. Additionally, airSlate SignNow complies with industry standards and regulations to safeguard your data.

-

What customer support options are available for airSlate SignNow users needing assistance with 1065x instructions 2019?

AirSlate SignNow offers comprehensive customer support for users working on 1065x instructions 2019. Support options include live chat, email, and an extensive knowledge base with articles and tutorials. Whether you have technical questions or need assistance with features, help is readily available to ensure a smooth user experience.

Get more for K 1 Form

- Texas form st

- Vermont form report

- Blank police reportpdffillercom form

- Illinois sr1050 2009 form

- Actors equity deputy election form

- Connecticut uniform police accident report

- Form 5118 wont let me complete my state return and i cant edit

- Mi 2210 michigan underpaymetn of estimated income tax mi 2210 mi 2210 michigan underpaymetn of estimated income tax mi 2210 form

Find out other K 1 Form

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement