Oklahoma State Tax Form

What is the Oklahoma State Tax Form

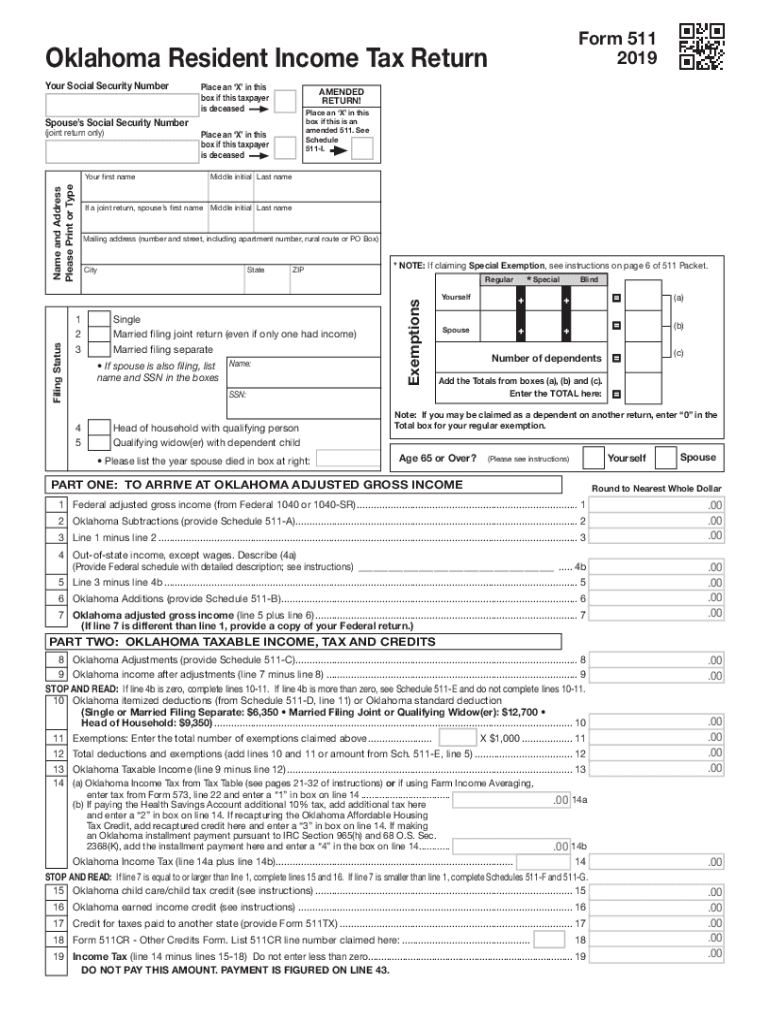

The 2019 Oklahoma Tax Form 511 is a document used by residents of Oklahoma to report their state income tax. This form is essential for individuals who earn income within the state and need to calculate their tax liability. It serves as a means to determine how much tax is owed or the refund due based on the income earned during the tax year.

How to use the Oklahoma State Tax Form

To effectively use the 2019 Oklahoma Tax Form 511, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income, deductions, and credits. After filling out the form, it can be submitted electronically or mailed to the appropriate state tax authority.

Steps to complete the Oklahoma State Tax Form

Completing the 2019 Oklahoma Tax Form 511 involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income and any deductions you qualify for.

- Calculate your total tax liability using the provided tax tables.

- Sign and date the form before submitting it.

Legal use of the Oklahoma State Tax Form

The 2019 Oklahoma Tax Form 511 is legally binding when completed accurately and submitted according to state regulations. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be signed by the taxpayer to validate its authenticity.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file the Oklahoma Tax Form 511 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should stay informed about any changes to filing deadlines to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Oklahoma Tax Form 511 can be submitted through various methods:

- Electronically via the Oklahoma Tax Commission's online portal.

- By mailing a printed copy of the completed form to the designated address.

- In-person submission at local tax offices, if available.

Required Documents

When completing the 2019 Oklahoma Tax Form 511, taxpayers should have the following documents ready:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions or credits claimed.

- Previous year’s tax return for reference.

Quick guide on how to complete 2019 oklahoma resident individual income tax forms and

Easily Prepare Oklahoma State Tax Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents rapidly without delays. Manage Oklahoma State Tax Form on any device with airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

The Simplest Method to Modify and eSign Oklahoma State Tax Form Effortlessly

- Locate Oklahoma State Tax Form and click Get Form to initiate the process.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you wish to submit your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Oklahoma State Tax Form ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 oklahoma resident individual income tax forms and

How to create an eSignature for your 2019 Oklahoma Resident Individual Income Tax Forms And online

How to make an electronic signature for your 2019 Oklahoma Resident Individual Income Tax Forms And in Chrome

How to create an eSignature for putting it on the 2019 Oklahoma Resident Individual Income Tax Forms And in Gmail

How to create an electronic signature for the 2019 Oklahoma Resident Individual Income Tax Forms And straight from your mobile device

How to make an eSignature for the 2019 Oklahoma Resident Individual Income Tax Forms And on iOS devices

How to make an electronic signature for the 2019 Oklahoma Resident Individual Income Tax Forms And on Android OS

People also ask

-

What is a printable Oklahoma tax form 511?

The printable Oklahoma tax form 511 is the state's individual income tax return form that residents use to report their annual income. This form is essential for calculating tax liabilities and is designed to be easily printable for convenience. Ensuring accuracy when filling out the printable Oklahoma tax form 511 can help you avoid penalties and ensure a timely refund.

-

How can I access the printable Oklahoma tax form 511?

You can access the printable Oklahoma tax form 511 through the official Oklahoma Tax Commission website or various tax preparation software that includes state forms. Additionally, airSlate SignNow provides easy access to the printable version, allowing you to fill out and sign the form digitally. Simple navigation ensures you find the correct document quickly.

-

Are there any fees associated with eSigning the printable Oklahoma tax form 511 using airSlate SignNow?

Using airSlate SignNow to eSign your printable Oklahoma tax form 511 is affordable and typically incurs a small fee, depending on the specific plan you choose. However, the platform is designed to provide a cost-effective solution for all your document signing needs. Investing in this service can streamline your tax filing process signNowly.

-

What are the benefits of using airSlate SignNow for the printable Oklahoma tax form 511?

One of the key benefits of using airSlate SignNow for your printable Oklahoma tax form 511 is the ease of tracking the document's status and maintaining a digital record. The platform offers fast and secure eSignature integration, which can save you time and enhance your filing accuracy. Additionally, it eliminates the need for printing and mailing the form, making it a greener option.

-

Can I save my progress when filling out the printable Oklahoma tax form 511 with airSlate SignNow?

Yes, when using airSlate SignNow, you can save your progress while filling out the printable Oklahoma tax form 511. This feature allows you to return to the document at your convenience without losing any information. It also ensures that you can take the necessary time to review your entries before final submission.

-

Is the printable Oklahoma tax form 511 compatible with mobile devices?

Absolutely! The printable Oklahoma tax form 511 is designed to be compatible with mobile devices using airSlate SignNow. This allows you to fill out, sign, and even submit the form from your smartphone or tablet, providing flexibility and accessibility on the go.

-

What integrations does airSlate SignNow offer for managing the printable Oklahoma tax form 511?

airSlate SignNow offers integrations with various cloud storage services and productivity tools, making it easier to manage your printable Oklahoma tax form 511 seamlessly. Popular integrations include Google Drive, Dropbox, and Microsoft Office, allowing you to access your documents from anywhere. This connectivity enhances collaboration and document management efficiency.

Get more for Oklahoma State Tax Form

Find out other Oklahoma State Tax Form

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast