8804 C Form

What is the 8804 C?

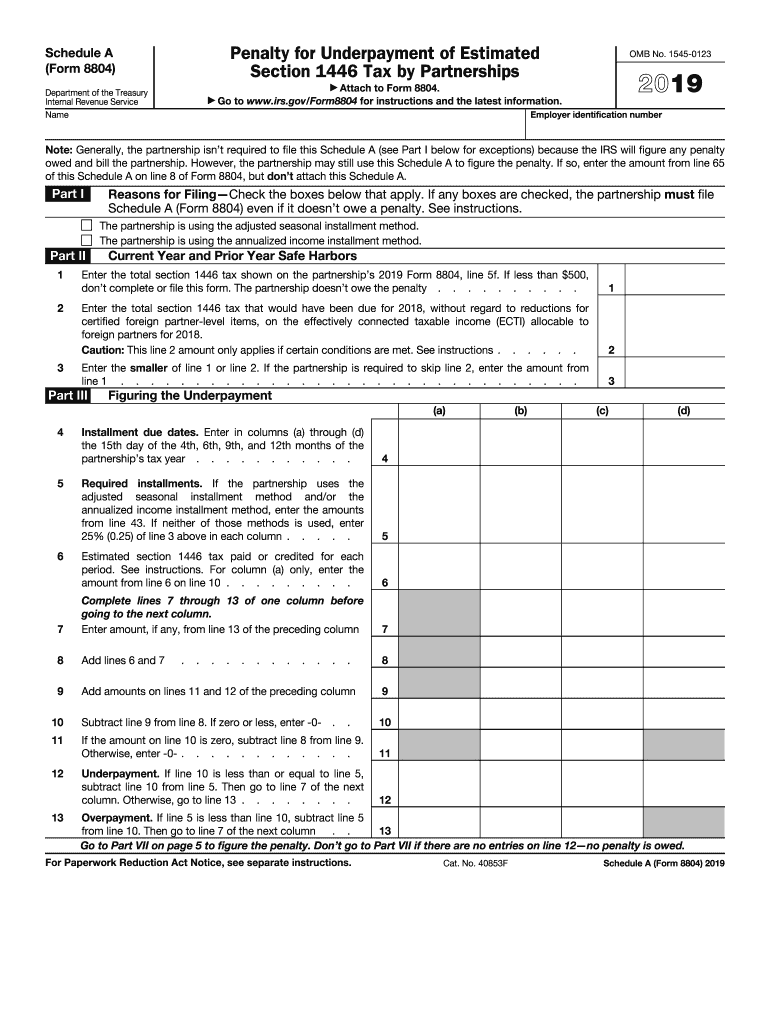

The 8804 C is a specific form used in the United States for reporting tax information related to foreign partners in partnerships. This form is part of the broader IRS requirements for tax compliance, particularly concerning withholding taxes on effectively connected income. The 8804 C provides essential details about the partnership's income and the amounts withheld on behalf of foreign partners, ensuring that the IRS receives accurate information about tax obligations.

Steps to Complete the 8804 C

Completing the 8804 C involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the partnership and its foreign partners, including their names, addresses, and taxpayer identification numbers. Next, calculate the total effectively connected income and the corresponding withholding amounts for each foreign partner. Carefully fill out each section of the form, ensuring that all figures are accurate and reflect the partnership's financial activities. Finally, review the completed form for any errors before submission.

Legal Use of the 8804 C

The legal use of the 8804 C is crucial for ensuring that partnerships comply with federal tax laws. This form must be filed accurately and on time to avoid penalties. It serves as a declaration of the partnership's withholding obligations and provides the IRS with necessary information regarding foreign partner income. Proper use of the form protects both the partnership and its foreign partners from potential legal issues associated with tax non-compliance.

IRS Guidelines

IRS guidelines for the 8804 C outline the requirements for completing and submitting the form. These guidelines specify who must file the form, the deadlines for submission, and the information required. Partnerships must adhere to these guidelines to ensure that they meet their tax obligations. Failure to comply with IRS regulations can lead to penalties, interest, and additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 8804 C are critical for partnerships to avoid penalties. Generally, the form must be filed by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically falls on April 15. It is essential for partnerships to keep track of these dates and ensure timely submission to maintain compliance with IRS regulations.

Required Documents

To complete the 8804 C, partnerships must gather several required documents. These include the partnership's tax identification number, details of foreign partners, and documentation of effectively connected income. Additionally, any previous tax filings related to withholding may be necessary for reference. Having all relevant documents on hand streamlines the completion process and helps ensure accuracy in reporting.

Quick guide on how to complete 2017 schedule a form 8804

Complete 2017 schedule a form 8804 seamlessly on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to acquire the necessary forms and securely archive them online. airSlate SignNow provides all the essential tools to create, alter, and electronically sign your documents swiftly without any delays. Handle 8804 safe harbor on any device through airSlate SignNow’s Android or iOS applications and enhance your document-oriented processes today.

How to alter and electronically sign 2015 8804 effortlessly

- Obtain 8804 instructions and click on Get Form to commence.

- Employ the functionalities we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with features specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign 8804 c 2018 and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 2015 form 8804

Create this form in 5 minutes!

How to create an eSignature for the form 8804 c 2017

How to generate an electronic signature for the Proposed Collection Comment Request For Forms 8804 8804 online

How to create an eSignature for your Proposed Collection Comment Request For Forms 8804 8804 in Google Chrome

How to make an eSignature for signing the Proposed Collection Comment Request For Forms 8804 8804 in Gmail

How to make an electronic signature for the Proposed Collection Comment Request For Forms 8804 8804 right from your mobile device

How to create an eSignature for the Proposed Collection Comment Request For Forms 8804 8804 on iOS devices

How to make an eSignature for the Proposed Collection Comment Request For Forms 8804 8804 on Android

People also ask 2017 form 8804

-

What is form 8804 c and how does it work?

Form 8804 c is a critical document used by partnerships to report their U.S. income tax liabilities. Using airSlate SignNow, you can easily fill out, sign, and e-file your form 8804 c in a secure environment. Our platform streamlines the entire process, ensuring accuracy and compliance with tax regulations.

-

How can airSlate SignNow streamline my form 8804 c submission?

AirSlate SignNow provides an intuitive interface that simplifies the completion and submission of form 8804 c. You can complete the form digitally, ensuring all information is accurate before eSigning. This not only saves time but also reduces the chance of errors compared to traditional paper forms.

-

What are the pricing options for using airSlate SignNow to manage form 8804 c?

AirSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you're a small partnership or a larger firm, you can choose a plan that fits your budget while ensuring easy access to essential features for managing form 8804 c. Check our website for the latest pricing details and to find a plan that's right for you.

-

Is airSlate SignNow secure for handling sensitive documents like form 8804 c?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption and secure cloud storage to safeguard sensitive information related to your form 8804 c. You can confidently eSign and manage your documents without worrying about unauthorized access.

-

Can I track the status of my form 8804 c after submission?

Absolutely! AirSlate SignNow offers tracking features that allow you to monitor the status of your submitted form 8804 c. You will receive notifications regarding any updates or required actions, ensuring that you stay informed throughout the process.

-

Does airSlate SignNow integrate with other accounting software for managing form 8804 c?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software. This allows users to import and export data related to form 8804 c effortlessly, enhancing efficiency in managing your tax documentation. Check our integration options to see the compatible platforms.

-

What are the benefits of using airSlate SignNow for form 8804 c?

Using airSlate SignNow to manage form 8804 c offers numerous benefits, including a user-friendly interface, enhanced security, and integrations with other tools. Our platform reduces the complexity and effort involved in completing tax forms, helping you focus on your business while ensuring compliance.

Get more for form 8804 extension

- Rachel e proaction physical therapy form

- Reset form attachment 11 michigan department of treasury 4573 rev

- Writing center tutor application process albright form

- Going green can save you green archive sba form

- Prussian blue drug products submitting a new drug application fda form

- Seconded by alderman schwandt northtonawanda form

- Clt onsite workshop application form

- Salespersons sponsorship form 2 9 1 trec texas

Find out other form 8804 schedule a

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe