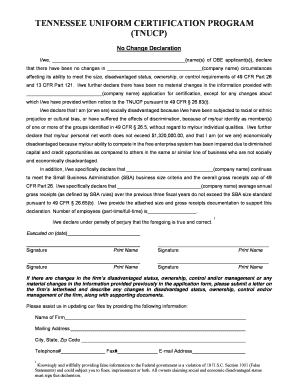

TNUCP No Change Declaration Form

What is the TNUCP No Change Declaration

The TNUCP No Change Declaration is a formal document used primarily in the context of tax compliance and reporting. It serves as a declaration that there have been no changes in circumstances that would affect a taxpayer's filing status or obligations. This form is essential for individuals and businesses who need to confirm that their previously submitted information remains accurate and unchanged for a specific tax period.

How to use the TNUCP No Change Declaration

Using the TNUCP No Change Declaration involves completing the form with accurate information regarding your current tax status. Taxpayers must ensure that all details reflect their ongoing eligibility for the tax benefits or statuses claimed in previous filings. This declaration can be submitted alongside other tax documents or as a standalone form, depending on the requirements set by the tax authority.

Steps to complete the TNUCP No Change Declaration

Completing the TNUCP No Change Declaration requires a few straightforward steps:

- Gather all relevant tax documents from previous filings.

- Review the information to confirm that there have been no changes in your personal or business circumstances.

- Fill out the declaration form accurately, ensuring that all sections are completed.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form according to the guidelines provided by the tax authority, either online, by mail, or in person.

Legal use of the TNUCP No Change Declaration

The TNUCP No Change Declaration is legally binding, meaning that providing false information can lead to penalties or legal repercussions. It is crucial for taxpayers to understand that this declaration must be used in accordance with IRS guidelines and state regulations. By ensuring accuracy and compliance, individuals and businesses can protect themselves from potential disputes or audits.

Required Documents

When completing the TNUCP No Change Declaration, certain documents may be required to support your claims. These typically include:

- Previous tax returns or filings that demonstrate your tax status.

- Any correspondence from the IRS or state tax authorities related to your tax filings.

- Documentation of any tax benefits or statuses claimed in prior years.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the TNUCP No Change Declaration. These deadlines may vary based on individual circumstances and the specific tax year. Generally, taxpayers should aim to submit the declaration by the same deadlines applicable to their tax returns to avoid penalties or complications.

Quick guide on how to complete tnucp no change declaration

Easily prepare TNUCP No Change Declaration on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and safely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without any delays. Administer TNUCP No Change Declaration on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign TNUCP No Change Declaration effortlessly

- Obtain TNUCP No Change Declaration and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign TNUCP No Change Declaration and enhance communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tnucp no change declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TNUCP No Change Declaration?

The TNUCP No Change Declaration is a document that confirms there have been no changes to the information previously submitted. This declaration is essential for maintaining compliance and ensuring that all parties are aware of the current status of the information provided.

-

How can airSlate SignNow help with the TNUCP No Change Declaration?

airSlate SignNow simplifies the process of creating and signing the TNUCP No Change Declaration. With our user-friendly platform, you can easily generate, send, and eSign this important document, ensuring a smooth and efficient workflow.

-

Is there a cost associated with using airSlate SignNow for the TNUCP No Change Declaration?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the TNUCP No Change Declaration and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the TNUCP No Change Declaration?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the TNUCP No Change Declaration. These tools help streamline the process and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for the TNUCP No Change Declaration?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the TNUCP No Change Declaration alongside your existing workflows. This flexibility enhances productivity and ensures that all your tools work together smoothly.

-

What are the benefits of using airSlate SignNow for the TNUCP No Change Declaration?

Using airSlate SignNow for the TNUCP No Change Declaration provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed quickly and securely, saving you time and resources.

-

How secure is the TNUCP No Change Declaration when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform for the TNUCP No Change Declaration, your documents are protected with advanced encryption and secure storage, ensuring that sensitive information remains confidential and safe.

Get more for TNUCP No Change Declaration

- The ato make the determination on whether you are form

- Ship fire drill scenario sample form

- Car of sale contract template form

- Dss mailing address north carolina department of health form

- Apply for food amp nutrition services without an account form

- Form 2940 request for an administrative reviewtexas

- Speech and hearing provider name change application form

- Form ow 8 es oklahomafill out and use this pdf

Find out other TNUCP No Change Declaration

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template