the ATO Make the Determination on Whether You Are 2024-2026

Understanding The ATO Determination Process

The ATO determination process is essential for establishing whether an individual or entity meets specific criteria under Australian tax law. This process involves assessing various factors, including income, residency status, and business activities. Understanding how the ATO makes these determinations can help taxpayers ensure compliance and avoid potential penalties.

Typically, the ATO evaluates documentation submitted by taxpayers, which may include tax returns, financial statements, and other relevant records. The determination can impact tax obligations significantly, influencing everything from tax rates to eligibility for deductions.

Steps to Complete The ATO Determination

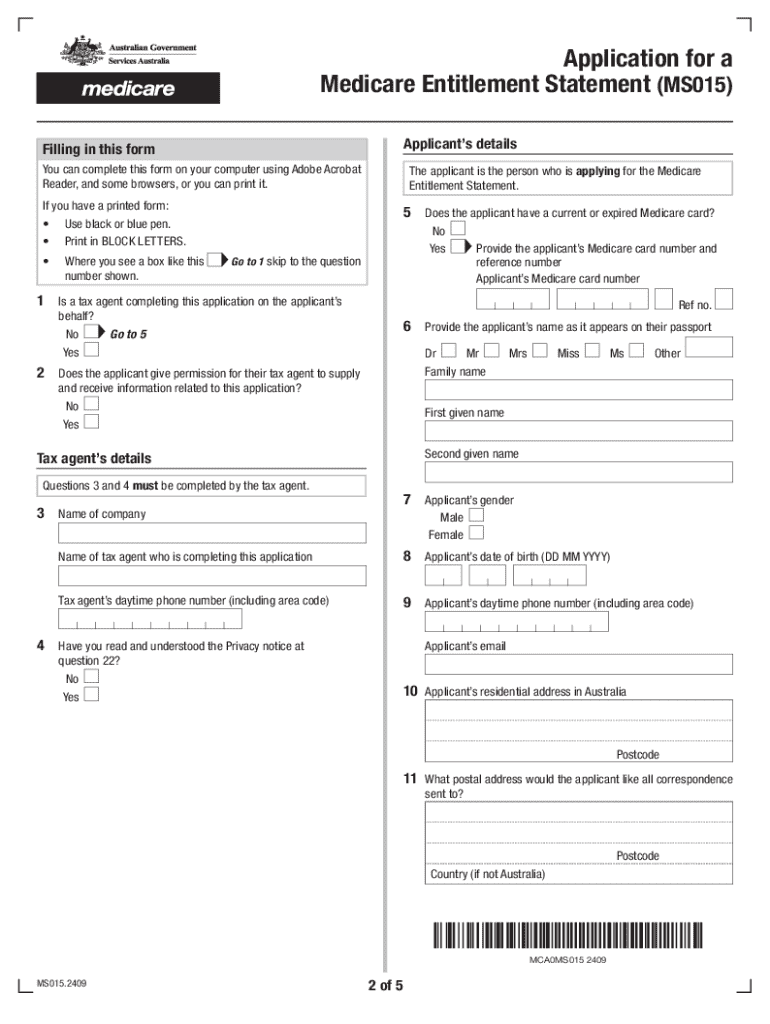

Completing the ATO determination involves several key steps. First, gather all necessary documentation, including income statements and any applicable forms. Next, ensure that you accurately fill out the required forms, providing complete and truthful information. Once completed, submit the forms to the ATO through the designated channels, which may include online submission or mailing physical copies.

After submission, it's vital to monitor the status of your determination. The ATO may contact you for additional information or clarification, so being responsive can expedite the process. Finally, once a determination is made, review the outcome carefully to understand your tax obligations.

Eligibility Criteria for The ATO Determination

Eligibility for the ATO determination depends on various factors, such as residency status, income levels, and the nature of your business activities. Generally, individuals must be Australian residents for tax purposes to qualify for certain benefits and deductions. Additionally, businesses must comply with specific regulations to be considered for favorable tax treatment.

It's important to review the eligibility criteria thoroughly to ensure that you meet all requirements before submitting your documentation. This can help prevent delays in the determination process and reduce the risk of non-compliance penalties.

Required Documents for The ATO Determination

To facilitate the ATO determination, specific documents must be prepared and submitted. These typically include:

- Tax returns for the relevant financial years

- Income statements or pay slips

- Financial statements for businesses

- Any supporting documents that validate claims made in the forms

Having these documents organized and readily available can streamline the determination process and help ensure a favorable outcome.

IRS Guidelines Related to The ATO Determination

While the ATO operates under Australian tax law, understanding IRS guidelines can be beneficial for U.S. taxpayers with international ties. The IRS provides guidance on how foreign income is treated, which can affect your tax obligations in both countries. For instance, if you are a U.S. citizen residing in Australia, you may need to navigate both ATO and IRS requirements.

Staying informed about IRS regulations can help you avoid double taxation and ensure compliance with both tax authorities.

Penalties for Non-Compliance with ATO Determinations

Failing to comply with ATO determinations can lead to significant penalties. These may include fines, interest on unpaid taxes, and even legal action in severe cases. Understanding the implications of non-compliance is crucial for all taxpayers.

To mitigate risks, it is advisable to adhere strictly to the ATO's requirements and timelines. Regular consultations with tax professionals can also provide guidance to maintain compliance and avoid potential penalties.

Handy tips for filling out The ATO Make The Determination On Whether You Are online

Quick steps to complete and e-sign The ATO Make The Determination On Whether You Are online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Gain access to a GDPR and HIPAA compliant service for optimum simpleness. Use signNow to e-sign and send The ATO Make The Determination On Whether You Are for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct the ato make the determination on whether you are

Create this form in 5 minutes!

How to create an eSignature for the the ato make the determination on whether you are

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of airSlate SignNow in helping businesses with ATO determinations?

airSlate SignNow provides a streamlined platform for businesses to manage their documentation needs, which is crucial when The ATO Make The Determination On Whether You Are compliant with regulations. By using our eSigning solution, businesses can ensure that all necessary documents are signed and stored securely, facilitating easier audits and compliance checks.

-

How does airSlate SignNow ensure compliance with ATO requirements?

Our platform is designed with compliance in mind, ensuring that all documents signed through airSlate SignNow meet the standards set by The ATO Make The Determination On Whether You Are. We utilize advanced security features and audit trails to maintain the integrity of your documents, making it easier for businesses to adhere to ATO regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small startup or a large enterprise, our pricing is designed to provide value while ensuring that you can effectively manage your documentation needs as The ATO Make The Determination On Whether You Are.

-

What features does airSlate SignNow offer to enhance document management?

Our platform includes features such as customizable templates, automated workflows, and real-time tracking, all of which are essential for businesses needing to comply with The ATO Make The Determination On Whether You Are. These tools help streamline the signing process and improve overall efficiency.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, enhancing your existing workflows. This integration capability is particularly beneficial for businesses looking to ensure that The ATO Make The Determination On Whether You Are is met without disrupting their current processes.

-

What benefits can businesses expect from using airSlate SignNow?

By using airSlate SignNow, businesses can expect increased efficiency, reduced turnaround times for document signing, and enhanced compliance with regulations. These benefits are crucial for organizations that need to ensure The ATO Make The Determination On Whether You Are is consistently met.

-

Is airSlate SignNow user-friendly for all team members?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for all team members to navigate and utilize the platform. This ease of use is essential for ensuring that everyone can contribute to meeting the requirements of The ATO Make The Determination On Whether You Are.

Get more for The ATO Make The Determination On Whether You Are

- Clearwater inspection pdf the city of south beloit southbeloit form

- Wolfs 109a vendor form sao state wy

- Aflac hc0019 form

- Ms form 70 698

- Form 760es estimated income tax payment vouchers for

- Encroachment between neighbors agreement template form

- End of tenancy agreement template form

- End of tenancyfrom landlord agreement template form

Find out other The ATO Make The Determination On Whether You Are

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter