940 Form

What is the 940 Form

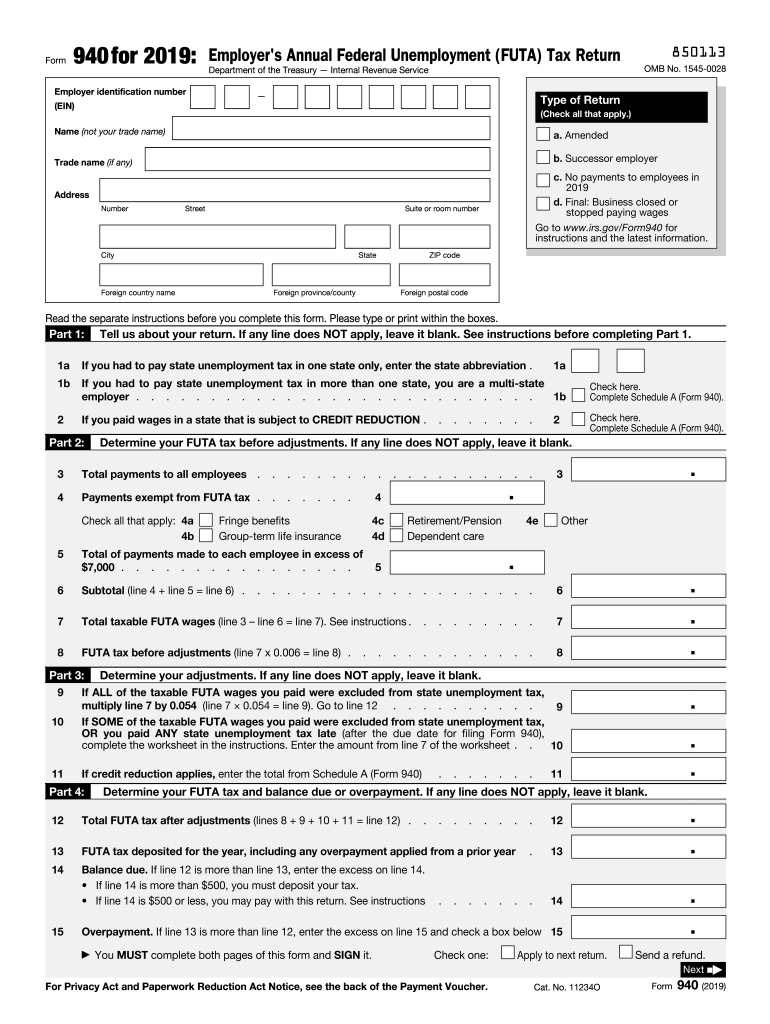

The 940 form, officially known as the IRS Form 940, is a federal tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form is essential for businesses that pay unemployment taxes, ensuring compliance with federal regulations. The 940 form calculates the amount of unemployment tax owed based on the wages paid to employees and is submitted annually to the Internal Revenue Service (IRS).

How to use the 940 Form

Using the 940 form involves several steps to ensure accurate reporting of unemployment taxes. Employers must first gather necessary information, including total wages paid and any adjustments for state unemployment taxes. After completing the form, it should be filed with the IRS by the designated deadline. It is important to keep a copy for your records, as this form serves as a crucial document for tax compliance.

Steps to complete the 940 Form

Completing the 940 form requires careful attention to detail. Here are the steps to follow:

- Gather information: Collect data on employee wages and any state unemployment tax credits.

- Fill out the form: Input the required information, including total wages and any adjustments.

- Calculate tax owed: Use the provided calculations to determine the FUTA tax liability.

- Review for accuracy: Double-check all entries to avoid errors.

- File the form: Submit the completed form to the IRS by the deadline.

Filing Deadlines / Important Dates

The filing deadline for the 940 form is typically January 31 of the year following the tax year being reported. If you are required to make a payment, it is due by the same date. Employers should be aware of these dates to avoid penalties and ensure compliance with federal tax regulations.

Legal use of the 940 Form

The 940 form is legally required for employers who meet certain criteria regarding employee wages and unemployment tax obligations. Proper use of this form ensures that businesses comply with federal laws governing unemployment taxes. Failure to file or inaccuracies in the form can result in penalties and interest charges, making it crucial for employers to understand their responsibilities.

Key elements of the 940 Form

Several key elements must be included in the 940 form to ensure completeness and compliance. These include:

- Employer identification information: Name, address, and Employer Identification Number (EIN).

- Wage information: Total wages paid to employees during the year.

- Tax calculations: Amount of FUTA tax owed and any credits claimed.

- Signature: The form must be signed by an authorized representative of the business.

Quick guide on how to complete 2019 form 940 internal revenue service

Easily prepare 940 Form on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the suitable form and securely save it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and electronically sign your documents quickly and efficiently. Manage 940 Form from any gadget with airSlate SignNow applications available for Android or iOS, and enhance any document-related task today.

The easiest way to alter and eSign 940 Form effortlessly

- Find 940 Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form—via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you choose. Edit and eSign 940 Form to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 940 internal revenue service

How to create an electronic signature for the 2019 Form 940 Internal Revenue Service online

How to create an eSignature for the 2019 Form 940 Internal Revenue Service in Chrome

How to generate an eSignature for signing the 2019 Form 940 Internal Revenue Service in Gmail

How to generate an eSignature for the 2019 Form 940 Internal Revenue Service straight from your smart phone

How to generate an electronic signature for the 2019 Form 940 Internal Revenue Service on iOS

How to generate an eSignature for the 2019 Form 940 Internal Revenue Service on Android devices

People also ask

-

What is the 2019 940 form fillable and why do I need it?

The 2019 940 form fillable is an IRS form used for annual FUTA tax returns. It allows employers to report their federal unemployment tax obligations. Using a fillable version streamlines the process and minimizes errors, making tax season much easier.

-

How do I get a 2019 940 form fillable?

You can easily access a 2019 940 form fillable through airSlate SignNow. Simply visit our site, and you'll find the downloadable PDF format which can be filled out electronically, allowing for efficient completion and submission.

-

Is there a cost associated with using the 2019 940 form fillable on airSlate SignNow?

Using the 2019 940 form fillable on airSlate SignNow is part of our subscription model. We offer affordable pricing plans tailored to businesses of all sizes, ensuring you have access to necessary tax forms without breaking the budget.

-

What features does the 2019 940 form fillable offer?

The 2019 940 form fillable includes interactive fields that simplify data entry, error checking to help prevent mistakes, and the ability to save progress. Our platform also allows you to eSign directly, making the process efficient.

-

Can I integrate the 2019 940 form fillable with other software?

Yes, airSlate SignNow allows for seamless integration with various accounting and payroll software, enabling you to efficiently manage and submit your 2019 940 form fillable alongside other financial documents.

-

How secure is my data when I use the 2019 940 form fillable on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use the 2019 940 form fillable, your data is encrypted and stored in a secure environment, ensuring that sensitive tax information is protected throughout the process.

-

What are the benefits of using an online 2019 940 form fillable?

Using an online 2019 940 form fillable saves time and reduces stress during tax season. You can fill it out at your own pace, eliminate the hassle of paper forms, and easily access it from any device to ensure you have all necessary submissions completed accurately.

Get more for 940 Form

- Software requirements management form

- The bias variance dilemma machine learning at berkeley form

- Page 1 of 2 cuti khas special leave 2 0 ipsis form

- Shopping cartelca good gifts form

- Graphic design logo contract template form

- Graphic design retainer contract template form

- Graphic design project contract template form

- Graphic design service contract template form

Find out other 940 Form

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple